Imperial Oil’s Performance: Strengths and Challenges Ahead

Imperial Oil Limited (IMO) is a pivotal entity in Canada’s energy landscape, recognized for its extensive work in the exploration, production, and marketing of crude oil and natural gas. A subsidiary of Exxon Mobil Corporation (XOM), IMO not only possesses a strong presence within Canada but also plays a significant role on the global stage. The company’s wide-ranging operations encompass upstream exploration, downstream refining, and a growing chemicals division, illustrating its comprehensive involvement in the energy sector.

Operating from Calgary, this integrated oil and gas company significantly contributes to Canada’s economic growth and North America’s energy framework. Given its substantial size and influence, investors closely monitor IMO’s developments within the sector.

However, this prominent position carries both opportunities and risks. While the company enjoys several strengths, potential challenges could impact its performance in the future.

This article will explore the key drivers behind the strength of IMO Stock and identify the potential risks that investors should take into account before making investment decisions.

What is Supporting the IMO Stock?

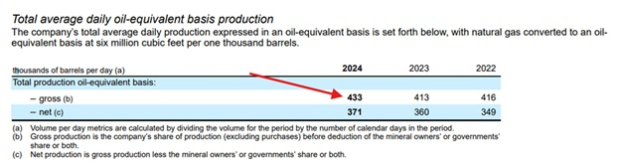

Record-Breaking Production Bolsters Revenue Stability: In its latest report, IMO announced its highest fourth-quarter production in 30 years, averaging 460,000 barrels per day. This achievement contributed to a record full-year production of 433,000 barrels per day, which ensures consistent revenue streams.

Image Source: Imperial Oil Limited

Additionally, the strong operational performance at Kearl, which produced an all-time annual high of 281,000 barrels per day, enhances the company’s long-term stability. These increased production levels allow IMO to take advantage of favorable crude pricing while mitigating inflationary cost pressures.

Dividend Growth Reflects Financial Health Confidence: A notable development is IMO’s 20% increase in its quarterly dividend to 72 Canadian cents per share, marking the largest nominal increase in the company’s history. This decision reflects management’s confidence in its ability to generate cash flow and achieve long-term profitability. Over the past three years, IMO has returned C$16 billion to shareholders, positioning itself as a shareholder-friendly energy stock. With a solid balance sheet and low debt levels, the company is well-equipped to maintain and potentially grow its dividends, even in fluctuating market conditions.

High-Quality Asset Base With Low Decline Rates: IMO’s oil sands operations in Kearl and Cold Lake exhibit exceptionally low natural decline rates when compared to conventional oil fields. Unlike shale production that requires continuous drilling to sustain output, IMO’s assets can maintain high production levels with minimal reinvestment. This characteristic ensures long-term revenue stability and lowers capital expenditure needs, making the company an attractive option for investors seeking consistent cash flow in the energy sector.

Vertical Integration Ensures Operational Stability: By operating throughout the entire oil value chain—from upstream production to refining and fuel distribution—IMO reduces its reliance on external suppliers. This vertical integration helps shield the company from sudden price shocks affecting various segments of the oil market. Should crude prices decline, strong refining margins can still benefit IMO; conversely, if refining margins weaken, upstream earnings provide a necessary buffer. This approach makes IMO a lower-risk investment compared to companies focused solely on exploration or refining.

Potential for Reserve Expansion Through Technology: The company is actively investing in advanced recovery techniques, such as solvent-assisted SAGD at Cold Lake, which have already delivered higher-than-anticipated production levels. These technological advancements have the potential to unlock additional reserves and extend the lifespan of existing fields, increasing the company’s resource base without necessitating large-scale new developments. If successful, these innovations could enhance IMO’s cost structure and long-term production capabilities.

Risks Facing the IMO Stock

Declining Net Income Raises Concerns About Growth: In the fourth quarter of 2024, IMO reported a net income of C$1.2 billion, down from C$1.4 billion in the previous year. Although production increased, lower commodity prices and refining margins negatively impacted overall profitability. A slight decline in full-year revenues further underscores the difficulty of sustaining earnings growth in a volatile oil market. If oil prices remain depressed or refining margins continue to erode, IMO’s ability to achieve earnings growth could be compromised, making it a less attractive investment option.

Refining Margins Under Pressure from Lower Demand: While IMO’s refining segment offers some stability, margins weakened in the fourth quarter due to increased market supply. The decline in synthetic crude oil realizations, which fell C$6.27 per barrel, reveals a narrowing Synthetic/WTI spread. Furthermore, petroleum product sales fell to 458,000 barrels per day, down from 476,000 barrels per day year-over-year. Continued weakness in demand for refined products or tighter crack spreads could pressure IMO’s downstream earnings and overall profitability.

Dependence on Volatile Oil Prices Introduces Uncertainty: IMO’s profitability is heavily dependent on crude oil prices, which are subject to geopolitical issues, OPEC+ production decisions, and global economic conditions. A decline in oil prices could significantly affect the company’s earnings and cash flow, adding a layer of risk for investors. Although IMO has strong cost controls in place, it remains susceptible to broader market forces; a sustained drop in crude prices could negatively impact the Stock’s performance.

Slow Growth Compared to U.S. Shale Producers: While dependable, IMO’s oil sands production lacks the rapid growth potential typical of U.S. shale basins. Shale producers can quickly scale up production in response to rising oil prices, while oil sands projects require extended lead times and substantial upfront investment. This distinction makes IMO’s growth trajectory less dynamic compared to its American counterparts.

Imperial Oil Faces Valuation Concerns Amid Record Production

Investor Sentiment Affected by U.S. Shale Growth: The appeal of Imperial Oil Limited (IMO) may be diminishing for growth-focused investors who typically seek faster returns. Continued expansion of U.S. shale production could hinder IMO’s ability to attract investor capital, leading to a reassessment of its market position.

Analysis of Valuation Metrics

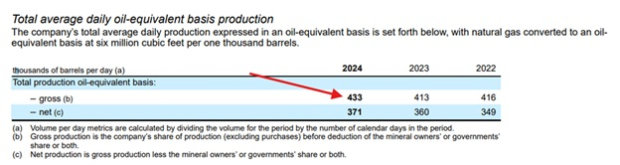

Concerns Over Valuation: Currently, IMO’s EV/EBITDA ratio stands at 5.81, which is significantly higher than the integrated Canadian Oil and Gas sector average of 3.65. This substantial premium raises concerns about potential overvaluation. When compared to peers like Suncor Energy (SU) and Canadian Natural Resources Limited (CNQ), IMO’s higher valuation could create challenges if future earnings fall short of expectations, potentially leading to a considerable price correction.

EV/EBITDA Ratio: A Year in Review

Image Source: Zacks Investment Research

Outlook for Imperial Oil Stock

Despite its recent record-breaking production levels, which enhance revenue stability, IMO faces challenges. The Kearl oil sands site has been a key contributor to its performance. Recently, Imperial Oil raised its dividend by 20%, showcasing confidence in its financial health. The company also benefits from low-decline oil sands assets and vertical integration, which provide a cushion against market volatility.

However, there are notable risks to account for, including a decline in net income and weakening refining margins in the latest quarter. The company’s slower growth trajectory relative to U.S. shale competitors and its current premium valuation over peers warrant caution. Considering these factors, while IMO demonstrates potential, investors are advised to wait for a more favorable entry point, rather than purchasing this Zacks Rank #3 (Hold) stock immediately.

Explore Zacks’ Top Stock Picks for 2025

Zacks Investment Research recently released its top 10 stocks for 2025, curated by Director of Research Sheraz Mian. This portfolio has shown remarkable success, achieving a gain of +2,112.6% since its inception in 2012, significantly outperforming the S&P 500’s +475.6%. Don’t miss the opportunity to review these high-potential stocks chosen from over 4,400 companies covered by Zacks Rank. You can see the new top 10 stocks now.

For up-to-date recommendations, download Zacks’ report on the 7 Best Stocks for the Next 30 Days available today. Click to access this free report.

Exxon Mobil Corporation (XOM): Free Stock Analysis report

Suncor Energy Inc. (SU): Free Stock Analysis report

Imperial Oil Limited (IMO): Free Stock Analysis report

Canadian Natural Resources Limited (CNQ): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.