SoFi Technologies Sees Remarkable Growth as 2024 Ends Strong

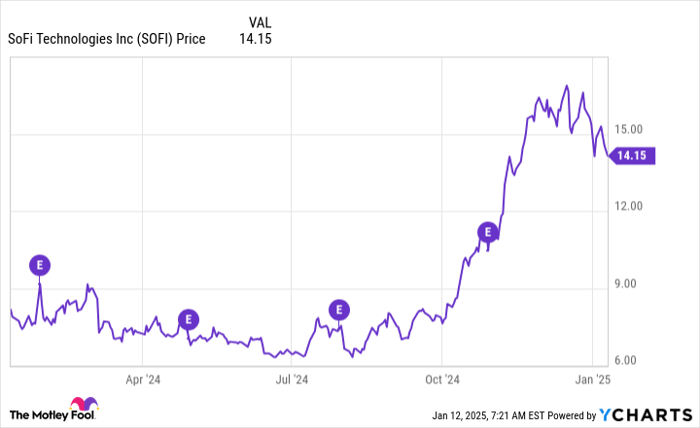

SoFi Technologies (NASDAQ: SOFI) closed 2024 with a nearly 55% growth in its stock price for the year. This comes after a phenomenal year in 2023, when the stock increased by 116%. Although it faced a decline throughout the first nine months of 2024, the fintech firm gradually demonstrated its profitability, welcomed millions of new members, and expanded its non-lending services. Moreover, its lending business, a point of concern for investors, improved more than anticipated by company management as the year came to a close.

For those thinking of investing in SoFi, it may be wise to consider making a move before January 27.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

What Makes SoFi a Leading Fintech Stock?

SoFi stands out as an exemplary fintech stock. Its user-friendly mobile app provides customers with a comprehensive toolkit for financial services, including banking, lending, credit cards, and investment management. This all-in-one approach allows users to supervise every aspect of their finances without hassle.

Originally focused on student lending, SoFi has expanded its services using what it calls a financial services productivity loop strategy. This involves attracting customers with one service, then offering them additional, higher-value products. Apart from lending, SoFi has two other major segments: financial services and a tech platform known as Galileo, acquired in 2020. Management aims to make this tech platform comparable to Amazon Web Services for the financial industry.

The strategy appears effective, as user engagement with SoFi’s platform remains high while the non-lending sectors are growing quicker than lending. In Q3, revenue from non-lending services climbed by 64% year over year, rising from 39% to 49% of the total revenue. Overall revenue also grew by 30% year over year, with the addition of 756,000 new members. Revenue per product soared from $53 last year to $81 this year.

Furthermore, the financial performance of the non-lending segments is improving considerably. Last year, when SoFi reported its first quarterly net profit during Q3 2023, it mainly came from lending. A year later, all segments showed year-over-year growth, with financial services profits surging.

| Metric | Q3 2023 | Q3 2024 |

|---|---|---|

| Lending segment contribution profit | $204 million | $239 million |

| Financial Services segment contribution profit | $3.3 million | $100 million |

| Technology Platform segment contribution profit | $32 million | $33 million |

Data source: SoFi quarterly reports.

Although lending remains the key driver of total gross profits, there’s a positive outlook for this sector as well, especially with benchmark interest rates decreasing. SoFi’s management anticipates an uptick in lending revenue for the full year.

The Anticipation for January 27

SoFi is set to announce its Q4 2024 earnings on January 27. Historically, the management has a pattern of underpromising and overdelivering. If this continues, investors may see significant stock price increases following the earnings report.

Potential investors should keep in mind that SoFi stock often spikes on good news, only to decline in subsequent days. The company’s quarterly reports can be dense, revealing both impressive growth in users and revenues as well as complex concerns related to lending—like originations and defaults—which are worth examining closely. After a favorable third-quarter report last year, the stock maintained its upward momentum.

SOFI data by YCharts

Since the Federal Reserve began lowering interest rates in September, SoFi’s stock has gained significant traction and has started to pull back as the next earnings report approaches. This could offer a prime opportunity to invest. However, potential investors should focus on long-term growth rather than short-term fluctuations.

Is Investing $1,000 in SoFi Technologies a Good Idea Right Now?

Before making an investment in SoFi Technologies, here’s something to consider:

The Motley Fool Stock Advisor analyst team identified what they believe are the 10 best stocks for investors to buy right now, and notably, SoFi Technologies was not included. The selected stocks have the potential for substantial returns in the coming years.

Reflect on when Nvidia made this list on April 15, 2005… If you had invested $1,000 at the time, it would be worth $832,928 today!*

Stock Advisor provides investors an accessible guide to success, offering portfolio-building advice and regular analyst updates, along with new stock picks each month. The Stock Advisor service has more than quadrupled the return of the S&P 500 since its inception in 2002.*

See the 10 stocks »

*Stock Advisor returns as of January 13, 2025

John Mackey, former CEO of Whole Foods Market, which is an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Jennifer Saibil holds positions in SoFi Technologies. The Motley Fool has positions in and recommends Amazon. For additional information, refer to the Motley Fool disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.