MarketAxess Holdings Inc. Thrives Despite Rising Expenses

MarketAxess Holdings Inc. (MKTX) is currently benefitting from increasing commissions, strategic acquisitions, and partnerships, along with a solid financial foundation that supports growth and shareholder returns.

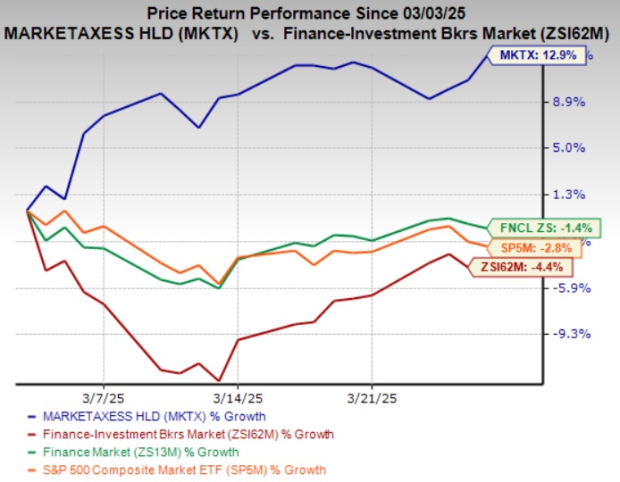

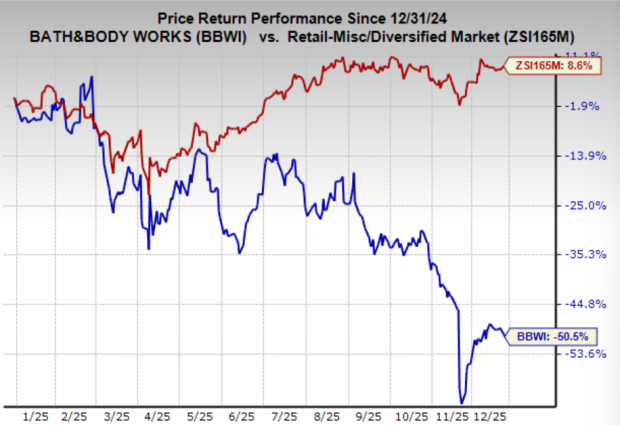

Current Zacks Rank and Stock Performance

MarketAxess holds a Zacks Rank #3 (Hold) at this time.

Over the last month, the stock has risen by 12.9%, contrasting with the industry average, which has declined by 4.4%. During the same period, the Zacks Finance sector and the S&P 500 index saw decreases of 1.4% and 2.8%, respectively.

Image Source: Zacks Investment Research

Strong Growth Projection for MarketAxess

The Zacks Consensus Estimate for MarketAxess’ earnings in 2025 stands at $7.70 per share, reflecting a year-over-year increase of 5.8%. For revenue, the estimate is $876.3 million, indicating a 7.2% rise from the previous year.

Looking ahead to 2026, the earnings consensus estimate increases to $8.63 per share, a 12.1% gain from 2025. Projected revenues for that year are estimated at $969 million, representing a 10.6% improvement from 2025.

Earnings Surprise History

MKTX has surpassed earnings expectations in each of the past four quarters, with an average surprise of 2.93%.

MarketAxess Shows Strong Return on Equity

The return on equity for MKTX is 20.2%, significantly above the industry average of 12%. This figure highlights the company’s efficiency in utilizing shareholder funds.

Favorable Trends Supporting MarketAxess

The company benefits from rising trading volumes, which are enhancing its commission-based revenues. MarketAxess has demonstrated consistent growth for over a decade, affirming its strong foothold in the market. In 2024, the average daily trading volume reached $37.1 billion, a notable 19% increase year-over-year.

As a prominent electronic trading platform operator, MarketAxess holds a significant market share across diverse products, including U.S. High Grade and High Yield bonds, Eurobonds, Emerging Markets, and Municipal Bonds.

Strategic acquisitions and partnerships are key for MarketAxess as they aim to enhance their offerings, enter new markets, and innovate. The Open Trading marketplace they operate provides pricing advantages to clients, lowers transaction costs, and minimizes market risk. The company is focused on advancing electronification in fixed-income sectors that currently remain manual.

Globally, MarketAxess services over 1,000 active clients in Europe, Asia, and Latin America through regulated trading venues. Their investment in international client relationships is anticipated to maintain robust revenue growth in these markets.

With a strong financial standing, MarketAxess supports its growth initiatives through ample liquidity and substantial operating cash flows. The net cash generated from operations in 2024 reached $385.2 million, marking a 15.4% year-over-year increase. This financial strength allows the company to reinvest into the business while also executing share repurchases and paying dividends.

Rising Expenses Pose a Concern

Despite these strengths, MarketAxess faces rising expenses that may impact profit margins. The total expenses have climbed consistently in recent years. In 2024, these expenses rose by 9% year-over-year, and projections indicate they will continue to rise, with estimates for 2025 totaling between $505 million and $525 million.

Other Stocks Worth Considering

Other well-ranked stocks in the Finance sector include Enterprise Financial Services Corp (EFSC), Intercorp Financial Services Inc. (IFS), and First Business Financial Services, Inc. (FBIZ). Currently, Enterprise Financial carries a Zacks Rank #1 (Strong Buy), while Intercorp Financial and First Business Financial have Zacks Rank #2 (Buy). You can view the complete list of today’s Zacks #1 Rank stocks here.

Enterprise Financial Services has beaten earnings estimates in three of the last four quarters, with an average surprise of 9.11%. The Zacks consensus estimate for EFSC’s earnings in 2025 shows a 1% increase, while the revenue forecast represents growth of 2.9% compared to the prior year. EFSC’s earnings estimate has risen by 8.1% over the last two months.

Intercorp Financial’s earnings have surpassed estimates three out of the last four quarters, with a surprise average of 2.76%. The Zacks consensus for IFS’s earnings indicates a 39.6% improvement in 2025, while the revenue forecast reflects an 8.2% increase year-over-year. IFS’s earnings consensus has improved by 1% in the last two months.

First Business Financial exceeded earnings estimates three times in the last four quarters, with an average surprise of 5.20%. The Zacks consensus estimate for FBIZ’s 2025 earnings shows an 11% improvement, while revenues are projected to rise by 8.7% from the previous year. The earnings consensus for FBIZ has adjusted up by 0.6% in the past 30 days.

In the past month, Intercorp Financial has gained 2.9%. However, Enterprise Financial and First Business Financial saw declines of 8.9% and 9.4%, respectively, during the same period.

Zacks’ Research Chief Highlights Strong Stock Potential

Zacks’ team of analysts has identified five stocks with a high potential for returns exceeding 100% in the near future. Among these, Research Director Sheraz Mian emphasizes one particular stock that is likely to show the most significant growth.

This top selection stands out as one of the most innovative financial firms, boasting a rapidly expanding customer base of over 50 million and offering a range of advanced solutions. This stock positions itself well for substantial gains. While not every recommendation may succeed, this stock could surpass past Zacks’ high-performing selections, such as Nano-X Imaging, which increased by +129.6% within just over nine months.

Top Stock Recommendations for Short-Term Investors

Free: See Our Top Stock And 4 Runners Up

If you’re looking for the latest investment insights, Zacks Investment Research offers a timely report on the “7 Best Stocks for the Next 30 Days.” Accessing this report is free and could help you spot emerging opportunities in the market.

Individual Stock Analyses

Investors may find value in detailed analyses provided for specific companies. The following stock analysis reports are available at no cost:

- First Business Financial Services, Inc. (FBIZ)

- MarketAxess Holdings Inc. (MKTX)

- Enterprise Financial Services Corporation (EFSC)

- Intercorp Financial Services Inc. (IFS)

For a more comprehensive understanding of these companies, you can explore the available stock analysis reports that provide insights into their financial health and market potential.

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.