“`html

NVIDIA Corporation (NVDA) reported a remarkable fiscal Q3 2026, with revenues reaching $57 billion, a 62% year-over-year increase and 22% rise from the previous quarter. Data center segment revenues were $51.2 billion, up 66% year-over-year and 25% from the last quarter. Net income surged to $31.91 billion, up from $19.31 billion in the same period last year.

NVIDIA anticipates revenues of approximately $65 billion for the fiscal Q4 2026, reflecting ongoing confidence in AI hardware dominance and its software platform, CUDA. The company has also returned $37 billion to shareholders since the start of fiscal 2026 through share buybacks and dividends.

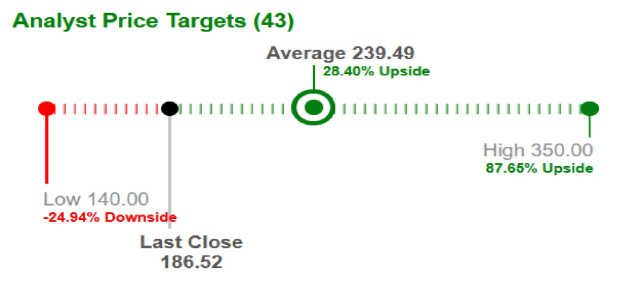

Brokers project an average short-term price target of $239.49 for NVDA, indicating a potential 28.4% increase from the latest closing price of $186.52. The highest target is $350, which suggests an upside of 87.7%.

“`