South Atlantic Bancshares (SABK) Might Be Ready for a Comeback

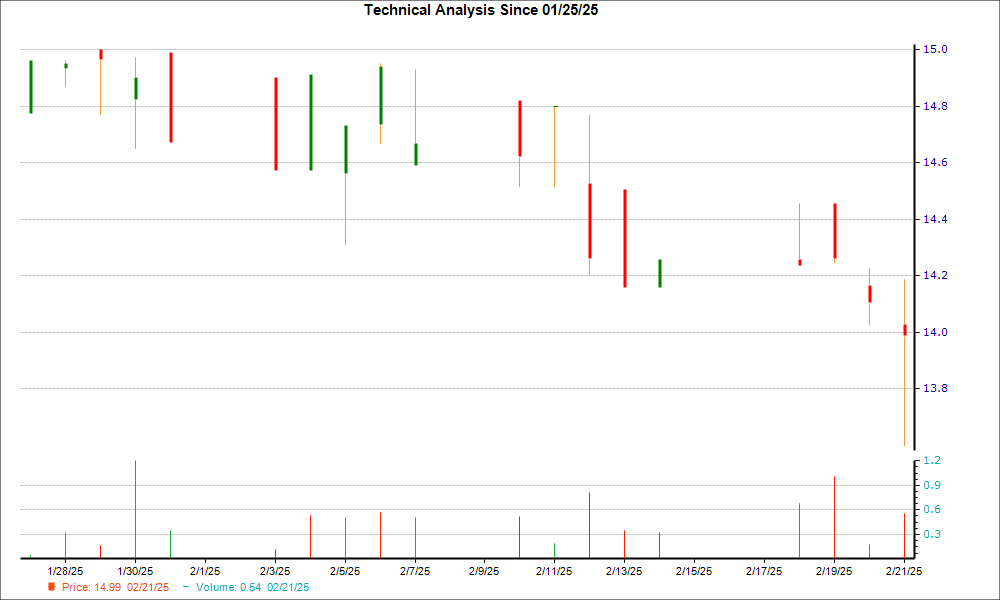

The stock has dipped 6.5% in recent weeks, but a hammer chart pattern suggests a potential turnaround. Analysts are becoming increasingly optimistic about SABK’s future earnings, a strong sign for investors.

Understanding the Hammer Chart Pattern

The hammer chart pattern is a well-known tool in candlestick charting. It features a small candle body formed by a minor difference between the opening and closing prices, and a long lower wick that indicates a significant drop from the day’s low. The lower wick should be at least twice the length of the candle body, creating a hammer-like appearance.

Typically, during a downtrend, a stock opens lower than the prior day’s close, continuing its decline to set a new low. However, if buyers step in, the stock may recover slightly, closing near or above the opening price. When this pattern emerges at the lower end of a downtrend, it signals that sellers may be losing their grip on the stock’s price.

Hammer candles can appear across different timeframes, making them useful for both short-term and long-term investors.

Despite its effectiveness, the hammer chart pattern has limitations. Its strength hinges on its position in the overall trend, so it should be combined with other bullish indicators for better accuracy.

Key Factors Driving Potential Growth for SABK

Recently, earnings estimates for South Atlantic Bancshares have shown an upward trend, which is generally a bullish sign. The consensus EPS estimate for this year has risen by 7.2% over the past month, indicating that analysts expect improved earnings compared to prior forecasts.

Additionally, SABK holds a Zacks Rank #1 (Strong Buy), placing it in the top 5% of over 4,000 ranked stocks based on earnings estimate trends and EPS surprises. Stocks with this ranking typically outperform the market, highlighting SABK’s strong investment potential.

The Zacks Rank serves as an effective timing tool, often pinpointing when a company’s outlook is turning positive, further suggesting a potential trend reversal for SABK.

Get Access to Zacks’ Stock Insights for Just $1

We mean it.

Some years ago, we surprised our members by offering 30-day access to all stock picks for just $1, with no further commitment required.

Many took advantage of this opportunity, while others hesitated, thinking there might be a catch. Our goal is to help you explore our portfolio services, such as Surprise Trader, Stocks Under $10, Technology Innovators, and more—each having recorded significant gains in 2024.

Download our free report on the 7 Best Stocks for the Next 30 Days

Free Stock Analysis Report on South Atlantic Bancshares, Inc. (SABK)

This article originally published on Zacks Investment Research (zacks.com).

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.