Nvidia Faces Turbulence Amid AI Competition: A Closer Look

OpenAI launched ChatGPT on Nov. 30, 2022, marking a pivotal moment in the artificial intelligence (AI) revolution. Since then, Nvidia (NASDAQ: NVDA) has seen unprecedented growth, unlike any other competitor.

From November 30, 2022, to January 24, 2025, Nvidia’s stock skyrocketed by 743%, adding nearly $3 trillion to the company’s market value. This impressive surge sparked a frenzy among investors eager to capitalize on Nvidia’s success.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to consider purchasing today. Learn More »

However, in such dramatic scenarios, investors sometimes overlook potential risks, believing the stock will only rise. Yet, seasoned investors recognize that market dynamics can shift unexpectedly.

Recently, a Chinese start-up named DeepSeek emerged, claiming to have developed a platform rivaling ChatGPT at a significantly lower cost. This announcement sent shockwaves through the investment community, and Nvidia’s stock subsequently plummeted. The previous optimism surrounding Nvidia began to fade as panic-selling ensued among investors.

In this analysis, I will explore just how significantly DeepSeek has influenced Nvidia and argue that the market overreacted. I believe Nvidia could well become Wall Street’s first $4 trillion company.

Assessing DeepSeek’s Impact on Nvidia

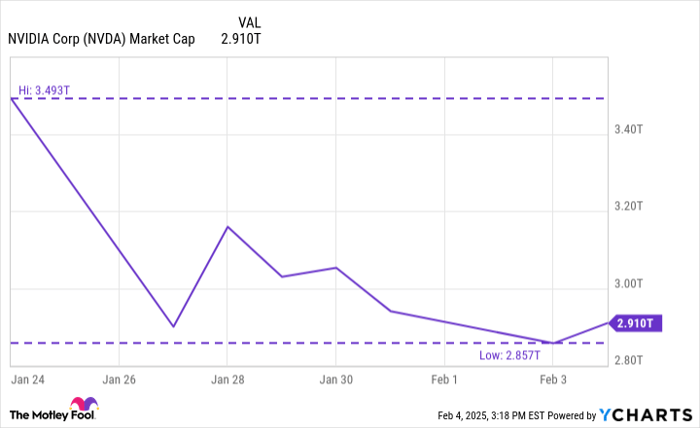

Before DeepSeek’s entrance, Nvidia held a market capitalization of $3.5 trillion. As of February 4, that value has declined by approximately $600 billion.

NVDA Market Cap data by YCharts

This decline is notable, particularly since the full impact of DeepSeek on Nvidia’s business trajectory remains unclear. Nvidia has not yet disclosed its earnings for Q4 2024, with the report expected on February 26.

Which Companies Challenge Nvidia?

The top three most valuable companies globally, measured by market cap, include Apple, Microsoft, and Nvidia. Among these, one company appears more likely to reach a $4 trillion valuation first.

As mentioned in a previous article, Apple’s stock potential primarily depends on a successful launch of the iPhone 16 and robust adoption of its new AI tool, Apple Intelligence. However, I maintain skepticism regarding whether Apple Intelligence will significantly impact investor enthusiasm.

Microsoft presents more potential for growth relative to Apple, though I have questions about its stock trajectory. A significant portion of Microsoft’s bullish outlook centers on its cloud computing service, Azure, which competes aggressively with Amazon Web Services (AWS) and Google Cloud Platform (GCP).

Although all three cloud giants are heavily investing in AI services, the fierce competition cannot be overlooked. Azure is strong, yet demand forecasts can be unpredictable.

This unpredictability makes it difficult to align investor expectations consistently. Consequently, I view Microsoft stock as somewhat vulnerable, with potential sharp shifts based on Azure’s performance and AI investments.

Image source: Getty Images.

Why Nvidia Could Be the First $4 Trillion Stock

While many details about DeepSeek’s training methodologies and dollar figures remain uncertain, we must consider whether Nvidia is genuinely at risk. If companies can train AI models more cost-effectively, where will AI infrastructure spending head?

According to Jevons paradox, spending might actually increase. This principle suggests that technological efficiencies can lower prices but also lead to greater overall spending as products become more accessible.

Thus, even if AI development costs decline, it doesn’t mean demand for Nvidia’s services will dwindle—in fact, it may rise. I align myself with this perspective and speculate that Nvidia’s demand might enter a new growth phase due to DeepSeek.

For Nvidia to achieve a $4 trillion valuation, its shares would need a 38% increase from presently recorded levels (as of February 4). If the earnings report later this month meets investor expectations, we might see the stock rebound to previous heights. In this scenario, only a 14% rise would be necessary for a $4 trillion valuation.

Should Nvidia’s management demonstrate sustained demand for its processors, a resurgence in the stock seems plausible. I believe DeepSeek may ultimately provide a net positive effect for Nvidia, positioning the stock for possible new highs.

Seize This Opportunity Before It’s Too Late

Have you ever felt like you missed the chance to invest in the most rewarding stocks? If so, take note.

There are rare occasions when our team of experts issues a “Double Down” stock recommendation, indicating a company poised for significant growth. If you’re worried you’ve already lost your opportunity, now may be the ideal time to act. The data is compelling:

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $336,677!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $43,109!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $546,804!*

Currently, we’re issuing “Double Down” alerts for three outstanding companies, and there may not be another opportunity like this soon.

Learn more »

*Stock Advisor returns as of February 3, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Amazon, Apple, Microsoft, and Nvidia. The Motley Fool has positions in and recommends Amazon, Apple, Microsoft, and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.