Nvidia (NASDAQ: NVDA) has been on a meteoric rise since the inception of 2023, far surpassing the growth of its counterpart, AMD (NASDAQ: AMD). While AMD has seen a commendable 140% surge, Nvidia has soared approximately 700%, establishing a firm dominion. This dominance has generated a wave of speculation among investors about the potential of AMD to outshine Nvidia in the future. However, such comparisons require a deeper analysis beyond mere stock price performance.

Amid this close competition, I unabashedly advocate for Nvidia as the superior investment choice over AMD, steering clear from the allure of superficial benchmarks.

The Business Prowess of Nvidia: A Strategic Focus on Graphics Processing

While both companies are key players in the computer hardware domain, Nvidia’s strategic focus on producing top-notch graphics processing units (GPUs) sets it apart from AMD. Although AMD dabbles in GPUs too, their offerings pale in comparison to Nvidia’s sophisticated and software-rich GPUs. In a direct GPU comparison, Nvidia undeniably reigns supreme, asserting its technological prowess.

However, AMD’s business canvas extends far beyond GPUs, encompassing a diverse product portfolio. From client CPUs to gaming console components and customized embedded processors, AMD has its fingers in various tech pies. Despite treading similar paths with different divisions, Nvidia’s colossal data center segment casts a shadow so vast that it renders other divisions inconsequential in the scheme of business evaluation.

With a narrower business focus, Nvidia’s data center segment boasts a staggering $26.3 billion in revenue, outshining its counterparts and positioning itself as a prime player in the AI infrastructure expansion, primed to capitalize on the burgeoning AI trend.

The Puzzling Premium: AMD’s Pricier Stock in the Shadow of Nvidia’s Supremacy

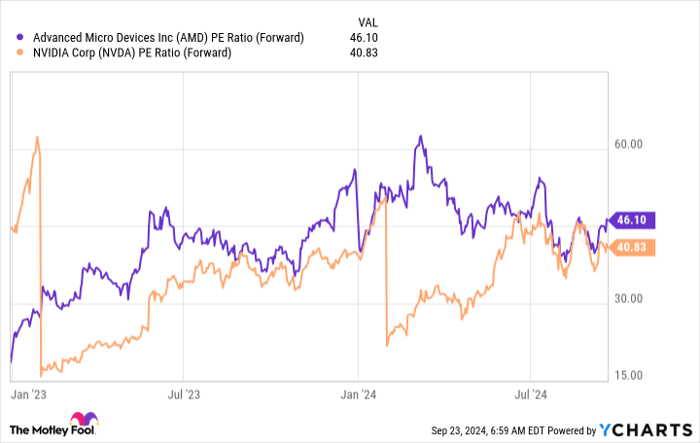

Conventionally, in a competitive landscape, the victor often commands a premium valuation over its peers. However, the narrative takes a different turn with AMD and Nvidia. Despite Nvidia’s stellar performance, AMD sports a higher forward price-to-earnings (P/E) ratio, a puzzling contrast. Opting for the stock that delivers superior performance at a lower price point stands as the logical investment move albeit a curious anomaly.

Nvidia unequivocally emerges as the unrivaled choice over AMD in the current investment climate. With its prominent stake in one of the most significant industry trends akin to the internet revolution, investing in Nvidia offers a strategic advantage. While AMD may not be a bad investment option given the right price, Nvidia shines as the beacon of promise.

Is Nvidia Stock Worth the $1,000 Investment?

Before diving into Nvidia stock, contemplate this:

The Motley Fool Stock Advisor team recently pinpointed the 10 best stocks for investors to ride, with Nvidia conspicuously absent from the list. These elite stocks are poised to yield colossal returns in the foreseeable future.

Imagine back to the time Nvidia made its debut on this prestigious list on April 15, 2005… If you had invested $1,000 based on our guidance, your returns would swell to $740,704!*

Stock Advisor offers a roadmap to investment success, equipping investors with portfolio-building insights, regular analyst updates, and bimonthly stock recommendations. Since 2002, the Stock Advisor service has outstripped the S&P 500 returns by a staggering fourfold*.

Explore the 10 stocks »

*Stock Advisor returns as of September 23, 2024

Keithen Drury holds no stake in any of the mentioned stocks. The Motley Fool endorses and recommends Advanced Micro Devices and Nvidia. The Motley Fool adheres to a transparent disclosure policy.

The insights and opinions articulated herein represent the author’s perspective and do not necessarily align with those of Nasdaq, Inc.