Nvidia Dominates Data Center Market, But AMD Offers Value

There’s no denying that graphics processing unit (GPU) leader Nvidia is significantly outpacing its rival, Advanced Micro Devices (NASDAQ: AMD), in the data center sector. Nevertheless, investors might find potential in companies that aren’t market leaders but are trading at attractive discounts.

The adage “a rising tide lifts all boats” rings true, especially concerning Nvidia and AMD. Large data center operators tend to diversify their GPU suppliers to avoid dependency on a single provider. Nvidia recently forecast substantial growth in data center infrastructure spending, a trend that could positively affect both companies. However, the pivotal question is whether AMD provides sufficient value to justify investing in its shares compared to Nvidia.

Start Your Mornings Smarter! Wake up with Breakfast News in your inbox every market day. Sign Up For Free »

Nvidia Expects Major Growth in Data Center Investments

Nvidia remains dedicated primarily to graphics processing units and the software that supports them. On the other hand, AMD’s chip offerings are more diverse, including GPUs that compete with Nvidia’s, as well as embedded processors and CPUs for personal computers. For the moment, we’ll focus on Nvidia’s prediction regarding the data center market, sidestepping AMD’s broader business portfolio.

During its GTC A1 conference last month, Nvidia’s CEO, Jensen Huang, projected that data center infrastructure spending could reach an annual total of $1 trillion by 2028. Although Nvidia is unlikely to capture the entire sum, generating about 25% of it in revenue isn’t unrealistic based on its current market share. What, then, can be said about AMD?

In 2024, AMD reported approximately $12.6 billion in data center revenue. In contrast, Nvidia achieved a staggering $115 billion in data center revenue for its fiscal 2025 (which ended January 26), making AMD’s business roughly one-tenth the size of Nvidia’s. Given this context, it wouldn’t be surprising for AMD’s annual data center revenue to reach near the $25 billion mark over the next four years.

The implications are significant. Currently, AMD’s total 12-month trailing revenue is $25.8 billion. This suggests substantial potential growth for AMD in the coming years, despite not accounting for any gains from its other divisions—client (personal computer chips), gaming (console and gaming PC GPUs), and embedded processors. Although these segments may not grow at the same rate as data center sales, they are likely to contribute additional support to AMD’s financial performance.

AMD Valuation Reflects Market-Average Price

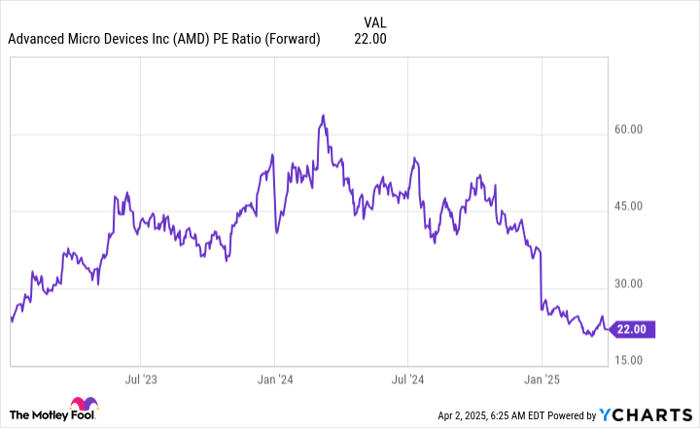

AMD’s earnings over the past year were influenced by notable one-time charges, making the trailing price-to-earnings (P/E) ratio less meaningful for valuation at present. Instead, it’s more appropriate to consider the forward P/E ratio.

AMD PE Ratio (Forward) data by YCharts.

Currently trading at 22 times its forward earnings, AMD is more affordable than it has been in several quarters. This valuation is effectively in line with the S&P 500, which has a forward P/E of about 21. Should AMD benefit proportionately from the expected growth in the data center market, it could provide market-beating returns.

Meanwhile, it’s essential to note AMD’s operational performance. For instance, in the fourth quarter, its data center division achieved the second-best operating margins among its categories.

| Division | Q4 Operating Margin |

|---|---|

| Data Center | 27.7% |

| Client | 12.7% |

| Gaming | 11.2% |

| Embedded | 40% |

Data source: AMD.

If AMD’s revenue from the data center continues to outpace growth in other divisions (excluding embedded), its operating margin is expected to improve, enhancing profits faster than revenues.

Should this scenario unfold, the combination of growth and improving margins could turn AMD’s stock into a valuable asset, making its current price an appealing entry point. However, Huang’s projections extend to 2028, requiring investors to maintain patience through potential short-term market fluctuations.

Seize This Second Chance for a Potentially Profitable Opportunity

Do you ever feel you missed the chance to invest in successful stocks? This could be the moment you’ve been waiting for.

Our expert analysis team occasionally offers a strong “Double Down” recommendation, highlighting stocks they believe are on the verge of considerable increases. If you’re concerned that you missed your opportunity, now might be the ideal time to invest.

- Nvidia: if you invested $1,000 when we doubled down in 2009, you’d have $286,347!*

- Apple: if you invested $1,000 when we doubled down in 2008, you’d have $42,448!*

- Netflix: if you invested $1,000 when we doubled down in 2004, you’d have $504,518!*

We are currently issuing “Double Down” alerts for three promising companies, and opportunities like this do not arise often.

Continue »

*Stock Advisor returns as of April 1, 2025

Keithen Drury holds positions in Nvidia. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.