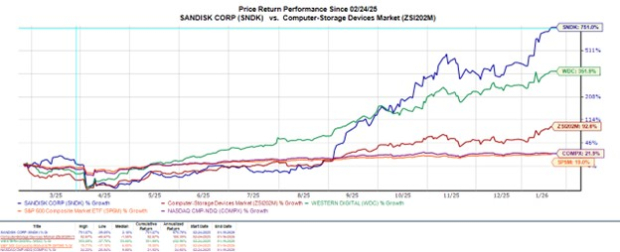

Sandisk Corporation (SNDK) has seen its stock surge by 70% to over $400 per share within just 11 trading days this year, driven by a scarcity in the NAND memory chip market crucial for AI infrastructure—leading to rising demand and prices. The company, which became independent following its spin-off from Western Digital in February 2025, has experienced an increase of more than 700% since then, reflecting the growing reliance on high-performance flash storage in data centers and AI applications.

Financial estimates for Sandisk indicate sales are expected to rise by 42% in fiscal 2026 to $10.45 billion and by another 26% to $13.15 billion in fiscal 2027. Annual earnings per share are projected to soar 350% this year and an additional 93% next year, from $13.46 to $25.94. Despite this impressive growth, Sandisk is still trading at a reasonable forward earnings multiple of 30X, aligning closely with industry benchmarks.