Evaluating Bitcoin: A Viable Alternative to Real Estate Investment

Investors are currently assessing their options in the ever-changing economic climate. With Bitcoin gaining traction as a potential alternative to traditional investments like real estate, the digital asset showcases a unique combination of limited supply and significant growth prospects.

Real Estate: The Myth of Stability

Traditionally viewed as a secure means of preserving wealth, real estate is not devoid of risks. Factors such as interest rate increases, government actions, and economic slumps can all impact the housing market. Furthermore, investing in property often comes with hefty maintenance expenses, taxes, and liquidity issues.

In contrast, Bitcoin does not involve maintenance costs or any physical limitations. Its characteristics include high portability and protection against local economic disturbances, making it an attractive option for those looking to diversify.

Bitcoin’s Emergence as a Digital Store of Value

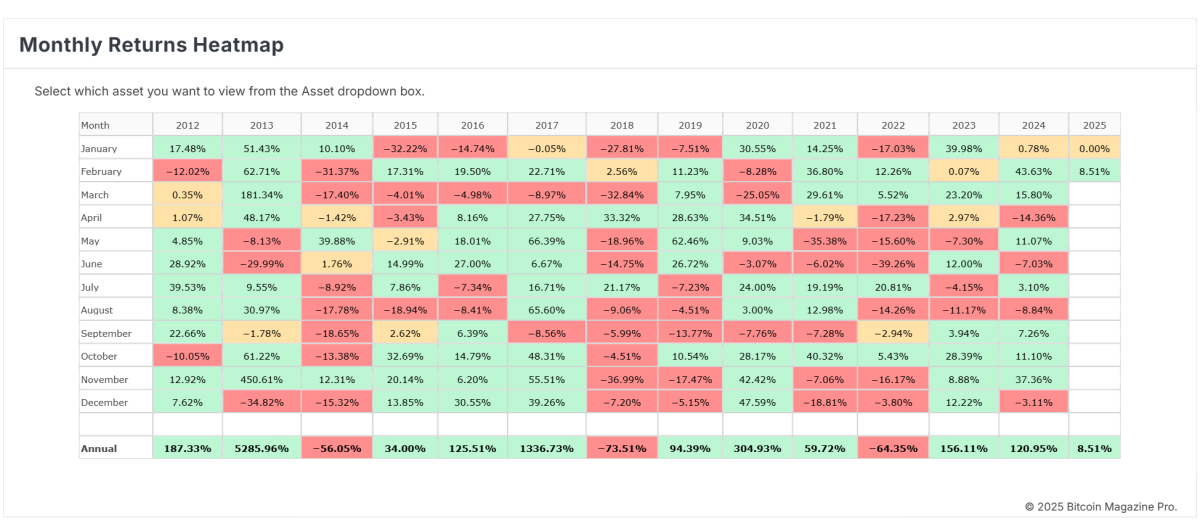

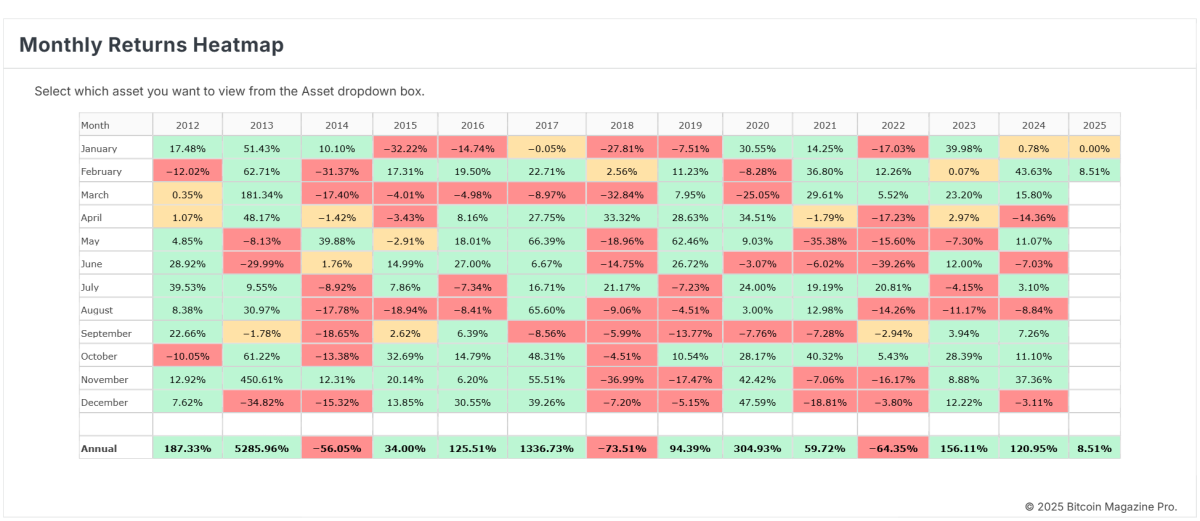

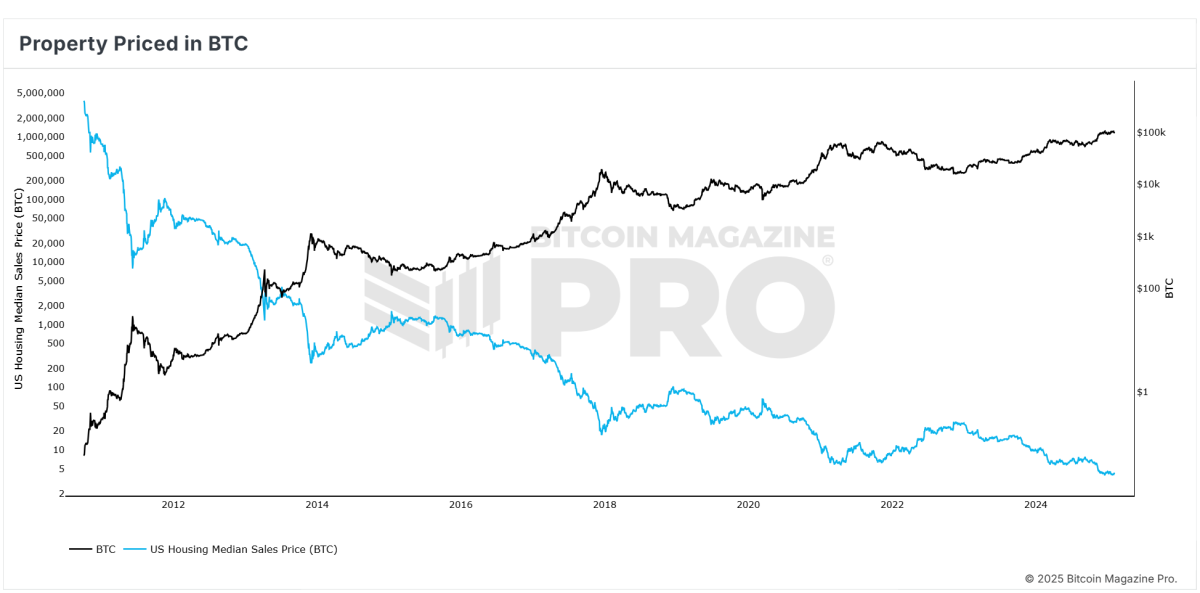

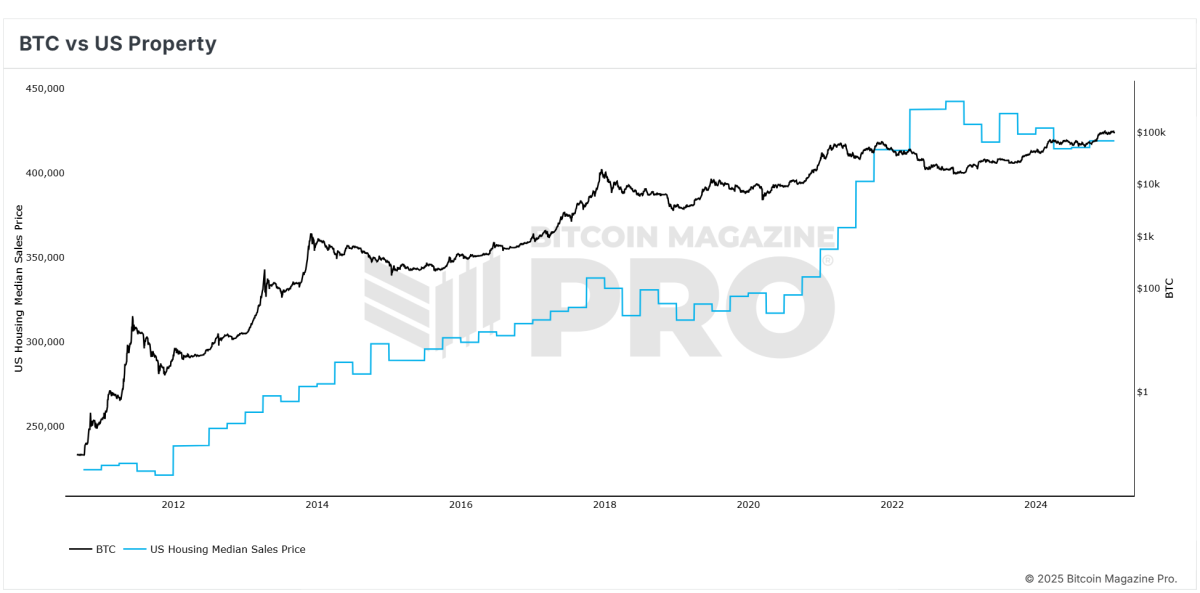

With a capped supply of 21 million coins, Bitcoin is being likened to “digital gold” for the modern age. Over the last ten years, this cryptocurrency has outperformed several asset classes, yielding significant returns even amidst market volatility.

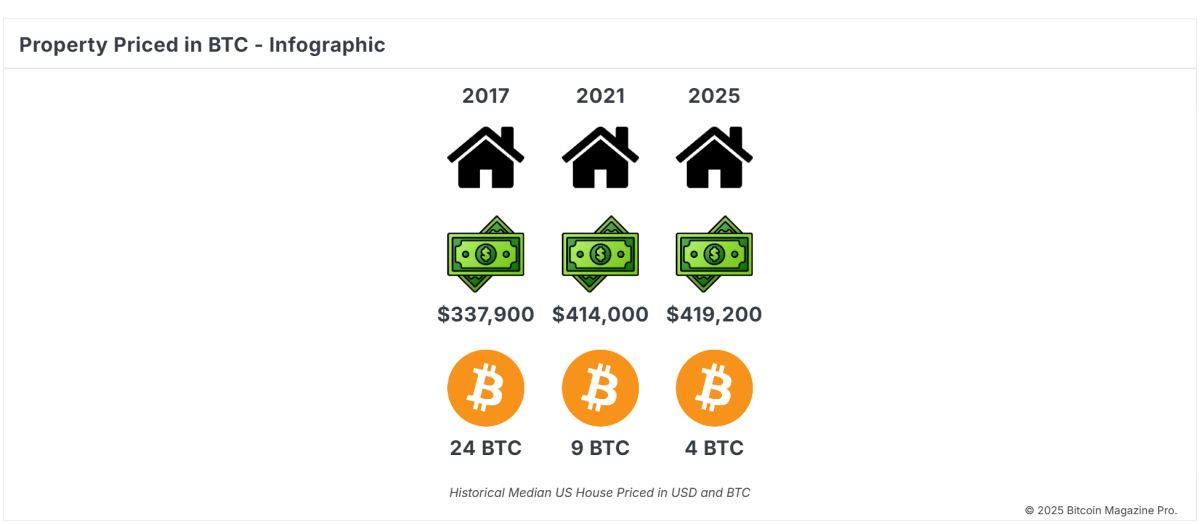

Real estate appreciation is frequently affected by inflation and governmental policies, which can erode value. Bitcoin manages this differently, operating on a deflationary model that ensures its scarcity and helps retain purchasing power.

Superior Liquidity and Access

Investing in real estate typically involves long-drawn transactions, substantial fees, and numerous regulatory challenges. Selling a property can extend over months, immobilizing capital. On the contrary, Bitcoin trading offers instant liquidity with 24/7 availability on global platforms, enabling investors to easily shift their wealth across borders.

The analysis clearly indicates Bitcoin’s capacity to preserve and enhance wealth more effectively than traditional property investments.

Protecting Against Inflation

While real estate typically reacts to inflation, it often fails to significantly exceed those trends. Bitcoin serves as a safeguard against fiat currency depreciation, showcasing resilience even during inflationary times. Given that central banks are increasing money supply, Bitcoin’s limited availability protects its value from monetary erosion.

Modern Investment Flexibility

Flexibility and unrestricted access are key priorities for today’s investors. Unlike localized and illiquid real estate assets, Bitcoin enables decentralized ownership without traditional financial dependencies, appealing to young, tech-oriented individuals seeking autonomy.

A Future-Forward Asset

Bitcoin represents not just a speculative opportunity but a financial shift. Investors who embrace Bitcoin stand to gain significant advantages as its adoption broadens. As awareness around Bitcoin grows, its applicable value as a solid, deflationary asset in our economy becomes increasingly evident.

Final Thoughts

Though real estate has been a staple in investment strategies, Bitcoin emerges as a revolutionary contender aligned with the evolving demands of a global economy. For those looking to safeguard their wealth, protect against inflation, and leverage emerging technologies, Bitcoin stands out as a prime investment. The real question now is, “Why not Bitcoin?”

For deeper insights and real-time information, visit Bitcoin Magazine Pro for more comprehensive analysis of the Bitcoin market.

Disclaimer: This article is for informational purposes only and should not be regarded as financial advice. Always conduct your own research prior to making investment decisions.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.