Sprouts Farmers Market: A Resilient Stock with Promising Growth Prospects

Investors searching for stocks that have not only weathered the recent tariff-induced selloff but have also surged in 2025 should consider Sprouts Farmers Market, Inc.SFM.

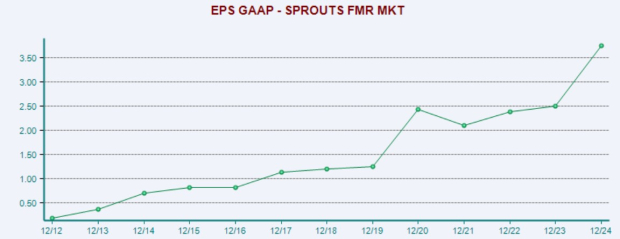

The specialty grocery company has risen 25% in 2025, contributing to a remarkable 370% rally over the past two years, driven by increased earnings revisions.

Despite its strong performance and resilience against tariffs, Sprouts Farmers Market stock remains far from overheated.

Why This Retail Stock Is a Must-Buy

Sprouts Farmers Market is a relatively lesser-known powerhouse in the specialty grocery sector.

Based in Phoenix, the company operates around 440 stores across 24 states, having opened 33 new locations in 2024. Its stores are predominantly situated in California, Texas, Arizona, Florida, and Colorado.

Image Source: Zacks Investment Research

Renowned for its fresh, natural, and organic offerings, Sprouts attracts higher-income customers who are often less affected by economic downturns. During financial uncertainty, grocery shopping typically remains a steadfast expense, reinforcing SFM’s resilience.

The company is focused on product innovation, enhancing its e-commerce operations, and expanding its higher-margin private-label segment while keeping prices competitive. In Q4 2024, the Sprouts brand represented 23% of total sales.

In 2024, Sprouts launched 7,100 new items, including over 300 unique to the Sprouts brand, showcasing its ability to adapt to consumer preferences.

Image Source: Zacks Investment Research

On the digital front, partnerships with Uber Eats, DoorDash, and Instacart have driven a 37% increase in e-commerce revenue in Q4. Management prioritizes efficiency in the competitive grocery landscape, with over 85% of stores located within 250 miles of a distribution center.

Sprouts’ Impressive Growth Outlook

Despite facing competition from Amazon AMZN-owned Whole Foods, Target TGT, and other grocery chains, Sprouts continues to excel.

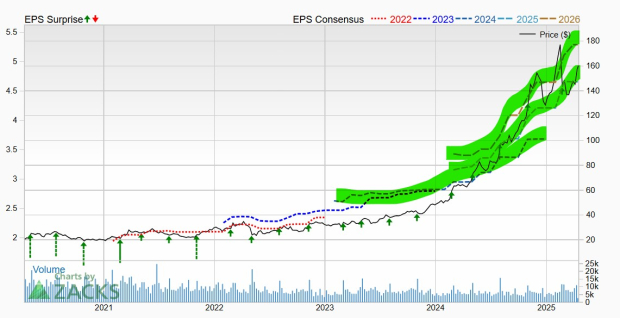

In 2024, the company experienced a 13% increase in sales, while comparable store sales grew by 7.6%, resulting in a 50% rise in adjusted earnings.

Image Source: Zacks Investment Research

SFM is set to achieve a 6% increase in same-store sales in 2025, which would mark its second-best growth year in the last five years. Projections suggest revenue will grow by 12% in 2025 and 11% in 2026, reaching $9.54 billion.

The company anticipates strong earnings per share (EPS) growth of 24% year-over-year in 2025 and 14% in 2026. SFM has consistently exceeded quarterly earnings estimates by around 15% over the past four quarters, with earnings estimates significantly increasing since its Q4 report.

Image Source: Zacks Investment Research

SFM’s fiscal year 2025 consensus earnings estimate increased by 10% in recent months, while estimates for fiscal year 2026 have risen by 13%.

These upward revisions have resulted in a Zacks Rank #1 (Strong Buy) for SFM and reflect a trend of positive earnings revisions that have raised its fiscal year 2026 consensus by 55% over the past year.

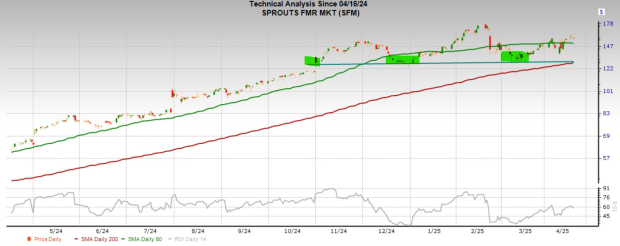

Analyzing This Strong Buy Stock’s Technical Performance

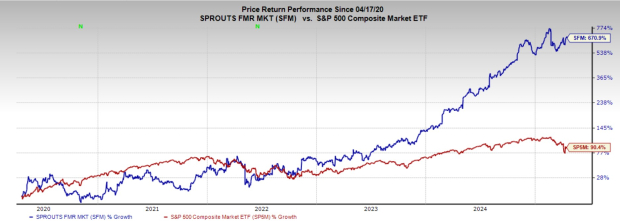

SFM stock remained mostly stagnant from 2015 to 2022. However, it has broken new ground since then, skyrocketing 400% over the last three years, significantly outpacing its industry’s 42% gain.

In the past 12 months, SFM surged 150%, outperforming its industry’s 30% rise and the S&P 500’s 8% gain. In contrast, Target saw a decline of 45%, while Amazon fell 5%.

Image Source: Zacks Investment Research

SFM has gained 25% year-to-date, whereas the S&P 500 has experienced an 8% decline. However, the stock is still trading…

Sprouts Farmers Market: A Strong Buying Opportunity for Investors

Currently trading about 10% below its recent highs, Sprouts Farmers Market, Inc. (SFM) has shown resilience after bouncing back from support levels established following its Q3 earnings report and December lows.

The stock has climbed above its 50-day moving average and is positioned well below overbought Relative Strength Index (RSI) levels. On a long-term scale, SFM is not overheated, providing a favorable outlook for investors.

Image Source: Zacks Investment Research

Valuation and Earnings Growth Potential

Sprouts’ robust earnings growth is underscored by its 2.1 price/earnings-to-growth (PEG) ratio. This figure represents a 50% discount compared to its 10-year highs and a 25% valuation compared to its industry peers.

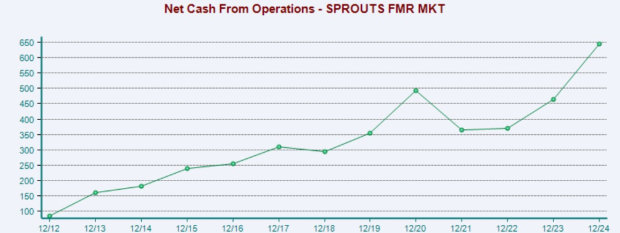

Operational Resilience and Growth Prospects

In the past year, Sprouts generated $645.2 million in operating cash flow, achieving a 38% year-over-year increase, which is 76% higher than its total in 2021. This healthy cash flow has enabled the company to fund $200 million in capital expenditures while returning $238 million to shareholders via buybacks.

Despite general tariff concerns affecting the market, Sprouts Farmers Market appears to present an appealing case for both immediate stability and sustainable long-term growth, making it a key consideration for investors.

Discover All Zacks’ Buys and Sells for Only $1

No gimmicks here.

Years ago, we surprised our members by providing 30-day access to all our recommendations for just $1. There is no further obligation required.

Many have taken advantage of this opportunity, while others hesitated, thinking there was a catch. There’s a reason for our offer: we want you to explore portfolio services such as Surprise Trader, Stocks Under $10, Technology Innovators, and more—services that yielded 256 profitable positions with double- and triple-digit gains in 2024 alone.

Would you like the latest recommendations from Zacks Investment Research? Currently, you can download the report on the 7 Best Stocks for the Next 30 Days for free.

For specific stock analyses, reviews on Amazon.com, Inc. (AMZN) and Target Corporation (TGT) are also available.

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.