Shares of Super Micro Computer, Inc. SMCI surged in pre-market trading following the company’s announcement of updated financial guidance for the second quarter, which exceeded previous expectations.

The company projected second-quarter net sales between $3.6 billion and $3.65 billion, a significant increase from the prior guidance of $2.7 billion to $2.9 billion. Additionally, non-GAAP diluted net income per common share is anticipated to be between $5.40 and $5.55, outperforming the previous forecast of $4.40 to $4.88.

As a result, Super Micro Computer shares soared 12.4% to $349.85 in pre-market trading, solidifying its position as a standout performer. This bullish trend sets the stage for a dynamic day of trading, with a number of other stocks also making significant moves before the market opens.

Positive Vibes

- Treasure Global Inc. TGL experienced a remarkable 31.7% surge to $0.1356 in pre-market trading. This surge followed the strategic alliance formed between Treasure Global and AIO Synergy, set to revolutionize the landscape of artificial intelligence.

- Phunware, Inc. PHUN saw a substantial jump of 28.9% to $0.3114 in pre-market trading, building on its 49% rise the previous day. Phunware recently announced a $7 million registered direct offering price at-the-market under Nasdaq rules.

- Cyngn Inc. CYN surged 21.1% to $0.1634 in pre-market trading after a solid 5% gain the day before.

- HNR Acquisition Corp HNRA rose 20% to $2.58 in pre-market trading, adding onto its 13% surge on the preceding day.

- Siyata Mobile Inc. SYTA gained 18% to $4.13 in pre-market trading, rebounding from a 3% decline the day before.

- Future FinTech Group Inc. FTFT witnessed a 16.9% increase to $1.05 in pre-market trading, building on its 7% gain the previous day, following a response to SEC allegations against the company’s CEO.

- Essential Properties Realty Trust, Inc. EPRT gained 11.4% to $27.50 in pre-market trading.

- Mesoblast Limited MESO climbed 10.5% to $1.90 in pre-market trading after the FDA granted a Rare Pediatric Disease Designation to the company’s Revascor® for treating children with congenital heart disease.

- Huadi International Group Co., Ltd. HUDI saw a 9.6% increase to $2.98 in pre-market trading after a 3% decline the day before.

The Other Side

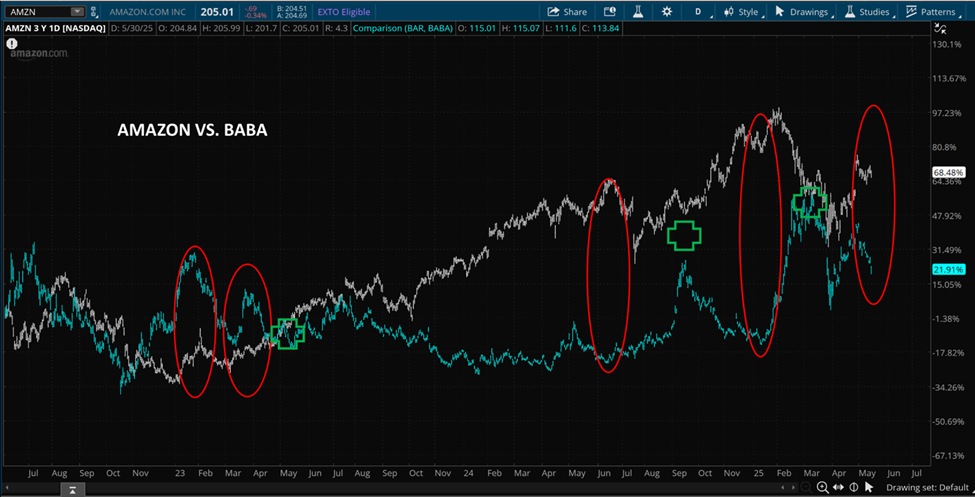

- iRobot Corporation IRBT experienced a significant dip of 35.8% to $15.16 in pre-market trading. This downturn came as the European Union’s competition watchdog is reportedly set to reject Amazon.com Inc’s AMZN ambitious $1.7-billion acquisition of iRobot, as per sources close to the matter cited by The Wall Street Journal.

- Esperion Therapeutics, Inc. ESPR saw a 23.3% decline to $1.65 in pre-market trading as it priced its $85.1 million public offering of 56.7 million common share at $1.50 per share.

- Nuvve Holding Corp. NVVE witnessed a 21.8% decrease to $0.0726 in pre-market trading following the announcement of a 1-for-40 reverse stock split of its common stock, effective from the specified date.

- AST SpaceMobile, Inc. ASTS declined 18.5% to $3.39 in pre-market trading after announcing a $100 million offering of common stock along with a strategic investment from AT&T Inc T, Alphabet Inc GOOG and Vodafone.

- Datasea Inc. DTSS recorded a 17.2% decrease to $0.1131 in pre-market trading after announcing plans for a 1-for-15 reverse stock split to comply with Nasdaq minimum bid requirement.

- Vision Marine Technologies Inc. VMAR saw a drop of 16.4% to $0.6704 in pre-market trading following the close of $3.0 million private placement of convertible preferred shares and warrants with Investissement Québec.

- C3is Inc. CISS experienced a 16.3% decline to $0.3150 in pre-market trading after dipping over 10% the day before.

- SOBR Safe, Inc. SOBR shares went down by 14.3% to $0.3338 in pre-market trading after a 7% decline the previous day.

- ReTo Eco-Solutions, Inc. RETO fell 12.1% to $0.33 in pre-market trading after receiving a Nasdaq notification regarding minimum stockholders’ equity deficiency.

- MorphoSys AG MOR saw a dip of 10.7% to $9.14 after a 6% fall the day before. The decline followed Morgan Stanley analyst James Quigley’s downgrade of MorphoSys from Overweight to Equal-Weight.

Now Read This: SLB, Travelers Companies And 3 Stocks To Watch Heading Into Friday