Take-Two Interactive Software (TTWO) has seen a 32% surge year-to-date but faces significant concerns regarding its financial health, including a GAAP net loss of $4.48 billion for fiscal 2025, up from a $3.74 billion loss in the previous year. This loss was largely due to goodwill impairment charges of $3.55 billion, indicating that past acquisitions failed to meet expectations. Additionally, the company reported negative operational cash flow of $45.2 million for fiscal 2025 and an adjusted EBITDA of only $199.1 million, raising red flags about its overvaluation.

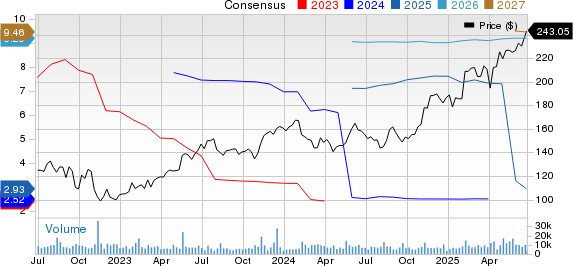

Projected revenues for fiscal 2026 are estimated at $5.99 billion, reflecting a 6.1% year-over-year growth, while earnings are expected to rise 42.93% to $2.93 per share. However, the anticipated release of Grand Theft Auto VI has been delayed to May 26, 2026, significantly impacting short-term revenue outlooks. The company’s reliance on a few blockbuster titles presents a risky business model, exacerbated by mounting operational expenses and declining mobile revenues.

Despite trading at a premium valuation with a P/E ratio of 55.11 compared to the industry average of 34.38, Take-Two’s struggles against intense competition in the gaming industry raise concerns for investors. The combination of excessive valuation, dependency on delayed releases, and a declining growth trajectory creates a risky environment, prompting a Zacks Rank of #4 (Sell) for the stock.