Key Points

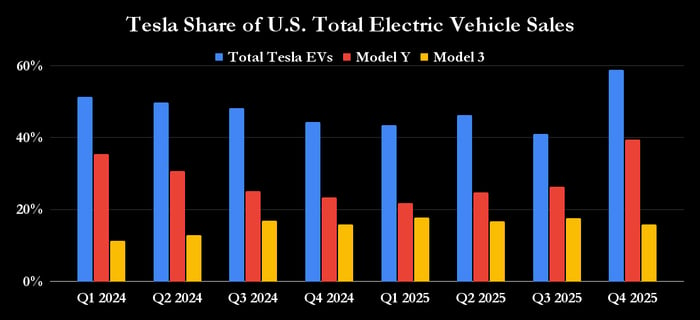

Tesla (NASDAQ: TSLA) saw an 8.6% decline in electric vehicle (EV) deliveries in 2025 compared to 2024, primarily affected by a refresh of the Model Y, the best-selling EV in the U.S. Despite this decline, Tesla’s deliveries are expected to rebound with the new Model Y rollout, as indicated by significant market share increases recorded in the fourth quarter of 2024 after the expiration of EV Federal tax credits.

Financial Performance and Market Position

While Ford’s Model e segment incurred a loss of $3.6 billion in the first nine months of 2025 and announced a $19.5 billion charge for a strategic refocus, Tesla remains profitable and is expanding its production capacity. The company is also enhancing its competitive edge through an extensive supercharger network, critical for supporting sales.

Robotaxi Developments

CEO Elon Musk confirmed the removal of safety drivers from some Tesla robotaxis in Austin, Texas, indicating progress in the company’s autonomous vehicle rollout. The introduction of robotaxis, powered by unsupervised full self-driving (FSD) software, is expected to significantly enhance Tesla’s revenue potential and drive future subscription sales, solidifying Tesla’s position as a leader in the EV market.