“`html

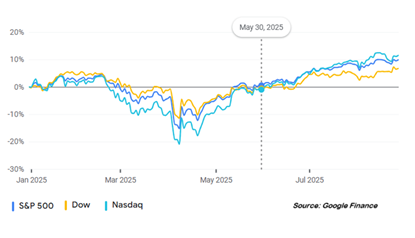

September has historically been the weakest month for the stock market, averaging a 0.9% loss since 1926. In recent years, the S&P 500 has dropped an average of 1.7% in September since 2000. However, as of September 2023, strong corporate earnings, anticipated monetary easing from the Federal Reserve, and gains from AI technology have analysts feeling more optimistic about the market’s trajectory.

Notable statistics include a record 8.8% earnings surprise for the second quarter, with 81% of S&P 500 companies reporting positive earnings surprises. Additionally, the Fed is expected to cut interest rates by 25 basis points on September 17, which could further boost investor confidence.

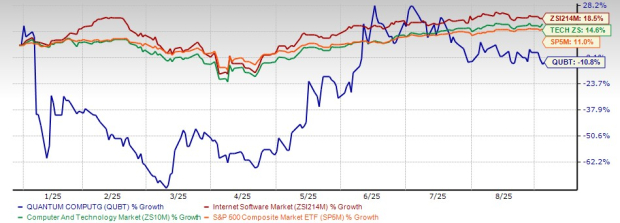

Major AI players like NVIDIA, which has a market capitalization surpassing 3.6% of global GDP, are contributing to overall market growth, indicating potential for a robust year-end rally supported by strong earnings and lower interest rates.

“`