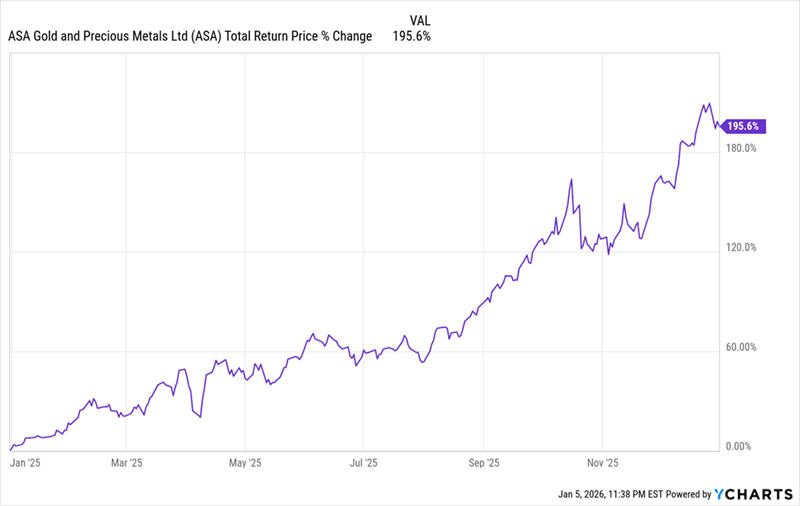

**ASA Gold & Precious Metals Limited (ASA)** was the top-performing closed-end fund in 2025, achieving a near-200% return. However, experts predict the fund could transition from this high to become one of the worst performers in 2026 due to market volatility and its significant exposure to exploration firms, which presents a higher risk.

Currently, ASA trades at a nearly 10% discount to its net asset value (NAV), indicating investor skepticism regarding its sustained performance. The fund’s yield stands at just 0.1%, significantly below the average yield of 8.9% for closed-end funds, suggesting that while it performed well in 2025, it may not be a viable investment for 2026 amid potential declines in gold prices or underperformance in its exploration companies.