Investing in the Future: Taiwan Semiconductor is a Top Choice for Your Portfolio

Finding the best stocks for long-term investment can be challenging. Many trends are unpredictable, causing some stocks to drop after a few years. However, the semiconductor industry shows strong potential for stability, regardless of market fluctuations.

While artificial intelligence (AI) may emerge as a leading trend, pinpointing the winning company for the next decade is complex. The chip companies, which provide the necessary technology to develop and run AI models, will surely thrive.

Where to invest $1,000 right now? Our analyst team has identified the 10 best stocks to purchase currently. See the 10 stocks »

Strong Growth Prospects for Taiwan Semiconductor

Taiwan Semiconductor (NYSE: TSM) is my top recommendation in the chip sector. The company is well-positioned for growth, as management has optimistic projections for its future performance.

As a contract chip manufacturer, Taiwan Semiconductor allows companies to create their own chip designs and outsource the production. This shift has become significant in the semiconductor industry, with notable clients like Advanced Micro Devices, Nvidia, and Apple opting for this model.

TSMC’s neutrality in the competitive AI landscape means it will benefit regardless of which company leads. Notably, AI-related revenue for TSMC tripled last year, and management anticipates this revenue to double again by 2025. Forecasts show a compounded annual growth rate (CAGR) in the mid-40% range for AI revenue over the next five years, signifying robust growth ahead.

This AI revenue represents only a portion of TSMC’s overall business, contributing around a mid-teens percentage of total revenue. In total, TSMC is projecting a revenue growth of around 20% CAGR in U.S. dollars over the next five years. For a company of its size, achieving this level of growth could make it one of the decade’s top performers.

Affordable Stock Valuation

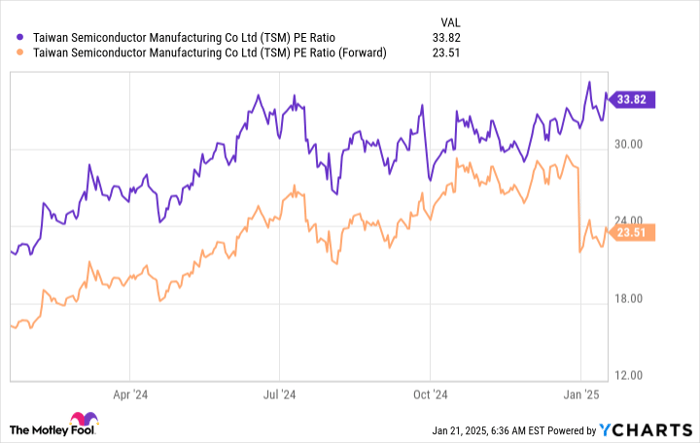

Despite robust growth expectations in a sector poised to gain from AI advancements, TSMC’s stock is priced competitively.

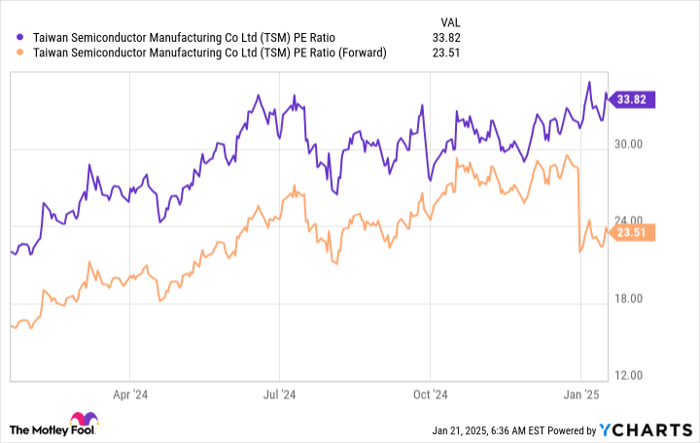

TSM PE Ratio data by YCharts.

Currently trading at 23.5 times forward earnings, TSMC matches the overall market, as measured by the S&P 500, which trades at 23.4 times forward earnings. However, the broader market is not projected to grow at 20%, making TSMC an attractive investment opportunity.

Although the chip market may face downturns, the overall trend is upward. The increasing demand for computing power positions TSMC as a major benefactor of this evolving landscape. Investors who buy now are likely to appreciate their decision in the years to come.

A Second Chance at a Potentially Profitable Investment

Do you feel you missed opportunities with past successful investments? It’s not too late to seize another opportunity.

Our expert analysts occasionally identify stock “Double Down” recommendations for companies they predict will show significant growth. If you feel you’ve missed out before, this might be the right moment to invest. Consider these past successes:

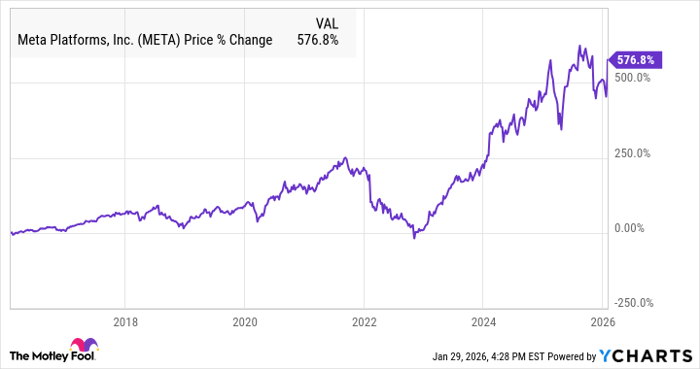

- Nvidia: An investment of $1,000 in 2009 would now be worth $381,744!*

- Apple: If you invested $1,000 in 2008, it would have grown to $42,357!*

- Netflix: An investment of $1,000 in 2004 has turned into $531,127!*

Right now, we’re issuing “Double Down” alerts for three incredible companies and encourage timely investment.

Learn more »

*Stock Advisor returns as of January 21, 2025

Keithen Drury holds positions in Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Advanced Micro Devices, Apple, Nvidia, and Taiwan Semiconductor Manufacturing and has positions in these companies. The Motley Fool has a disclosure policy.

The views expressed in this article are those of the author and do not necessarily represent those of Nasdaq, Inc.