Amazon: A Top Investment Choice for the Next Decade

When considering which company might excel in the stock market over the next decade, the sheer number of publicly traded options can be overwhelming. Instead of seeking the best performer, investors should focus on identifying companies that provide significant upside with minimal risk.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy now. Learn More »

The superior investment would ideally be a strong business with promising growth potential. A stock that trades at an appealing price offers investors a safety margin and additional room for profitable returns. One name that stands out is e-commerce leader Amazon (NASDAQ: AMZN), which has created wealth for many over its rise to becoming a multi-trillion-dollar enterprise. Notably, this stock may still hold significant upside, making it an attractive option for the next decade.

Continuous Growth in Core Businesses

Amazon began its journey in the 1990s selling books and has since evolved into the top online retailer in the U.S., commanding approximately 40% of the nation’s online sales. Additionally, two decades ago, it launched Amazon Web Services (AWS), its cloud computing branch, which now serves as an industry leader, holding a 30% share of the global cloud services market.

The scale and market dominance give Amazon competitive advantages in both sectors. The retail side offers consumers a wide range of products with fast delivery and low prices. Similarly, AWS has established itself as a go-to for cloud services. Together, online retail and cloud services accounted for around $152 billion of Amazon’s total $187.8 billion sales for the fourth quarter of 2024, with AWS providing the bulk of the company’s operating profit.

Investors can remain optimistic about the growth prospects in both sectors. Currently, e-commerce only makes up 16.4% of total retail expenditures in the United States, suggesting there’s significant room for growth as online shopping continues to expand into new sectors like groceries and automotive, areas where Amazon is actively engaged.

Furthermore, the rise of artificial intelligence (AI) is expected to boost cloud service utilization over the years. Projections indicate that AI-related cloud revenue could exceed $100 billion this year and escalate to roughly $589 billion by 2032. Amazon’s 30% market share in this arena could potentially translate to an additional $120 billion in cloud revenue—more than AWS’s total cloud earnings in 2024.

Expanding Opportunities for Growth

Known for its proactive corporate culture, Amazon continually ventures into new markets and industries. Among its smaller yet promising segments are:

- Prime: With about 200 million subscribers, Amazon Prime generates consistent revenue while enabling product and service distribution.

- Advertising services: Amazon’s ad revenue grew 18% year-over-year in Q4, approaching $56 billion for the trailing twelve months.

- Media and entertainment: Prime Video, Amazon’s streaming platform, is bundled with Prime subscriptions and has seen considerable investment in content.

- Health care: Amazon is offering telehealth services for a pay-per-visit fee or as part of its Prime offerings.

- Smart devices: The company’s Alexa products dominate the U.S. smart speaker market, which holds a 61% share. Plans are in place to launch a premium Alexa service with AI features.

- AI infrastructure: Amazon is developing proprietary chips for training and operating AI systems, positioning itself for future opportunities, including humanoid robotics.

Any of these emerging sectors could evolve into core revenue sources for Amazon. Moreover, the possibility of spinning off successful subsidiaries adds further value for shareholders.

Amazon’s Current Stock Valuation

Amazon exemplifies a world-class enterprise. While top-performing stocks often have elevated valuations, Amazon currently does not reflect that trend.

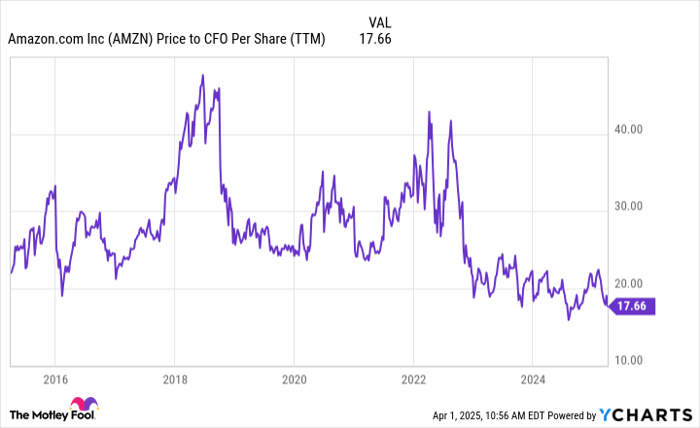

The recent fluctuations in the stock market have impacted Amazon, along with other leading tech stocks, seeing it 20% below its historical peak. Yet, the company continues to advance. Amazon typically reinvests a large portion of its profits to support extensive growth initiatives. Consequently, assessing Amazon based on its cash flow from operations (CFO) is a practical approach.

From this perspective, Amazon’s stock price trades near its lowest valuation in the last decade.

AMZN Price to CFO Per Share (TTM) data by YCharts.

Although Amazon may not maintain its historical growth rate due to its size, the numerous expansion opportunities across various segments, coupled with a favorable valuation, position it well for market outperformance in the coming decade. Owning shares in a stable and recognized leader like Amazon can offer peace of mind.

Seize This Unique Opportunity

Do you ever feel like you missed out on investing in the top-performing stocks? It may be time for a second chance.

Every so often, our analysis team recommends a “Double Down” on specific stocks that they anticipate will surge. If you’re concerned about missing out on this opportunity, now is an advantageous moment to invest before prices soar. Consider these examples:

- Nvidia: If you invested $1,000 when we recommended it in 2009, you’d now have $263,993!*

- Apple: If you invested $1,000 when we recommended it in 2008, you’d have $38,523!*

- Netflix: If you invested $1,000 when we recommended it in 2004, you’d have $494,557!*

Currently, we’re issuing “Double Down” alerts for three stellar companies, and this opportunity may not arise again soon.

Continue »

*Stock Advisor returns as of April 1, 2025

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Justin Pope has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.