Medtronic Eyes Growth with Robotic Surgery Device Approval

Medical device specialist Medtronic (NYSE: MDT) has struggled in the past five years, trailing behind broader equity markets. A significant factor contributing to this underperformance is slow revenue growth. Despite considering a spin-off of certain low-growth units to boost performance, Medtronic ultimately decided against this move.

Nevertheless, recent developments indicate that Medtronic may soon capitalize on a promising long-term opportunity. A closer examination reveals what this could mean for investors.

Identifying Potential in Robotic Surgery

Medtronic has been diligently developing its robotic-assisted surgery (RAS) device, the Hugo system, which has gained traction in several countries but has yet to obtain clearance in the U.S. This market represents the most lucrative opportunity for the company, prompting Medtronic to conduct U.S. trials of the Hugo system to facilitate regulatory approval.

Recently, the company announced that it has submitted an application to the U.S. Food and Drug Administration (FDA) for approval of the Hugo system. This application follows successful completion of clinical trials involving 137 patients undergoing urologic procedures, where the device met critical safety and efficacy benchmarks.

If the FDA approves the Hugo system for urologic procedures, it could significantly benefit Medtronic. Historically, only about 5% of surgeries eligible for robotic assistance have been performed using such techniques. This gap is noteworthy, as minimally invasive robotic surgeries offer clear advantages over traditional open surgeries. The use of smaller, more flexible instruments allows for reduced incision sizes, enhancing surgical precision and providing a high-definition view for operators.

Patients enjoy the benefits of quicker recovery times and shorter hospital stays due to these minimally invasive techniques. With an aging global population driving demand, the market remains ripe for growth.

While Medtronic will face competition from Intuitive Surgical, known for its da Vinci system, the potential for multiple players exists in this expanding field. Medtronic’s initial focus on urologic procedures with the Hugo system is just the beginning; plans are in place to target additional therapeutic areas moving forward. This trajectory suggests that the financial performance of Medtronic could eventually improve significantly with more approvals.

Solid Financial Foundation and Future Growth

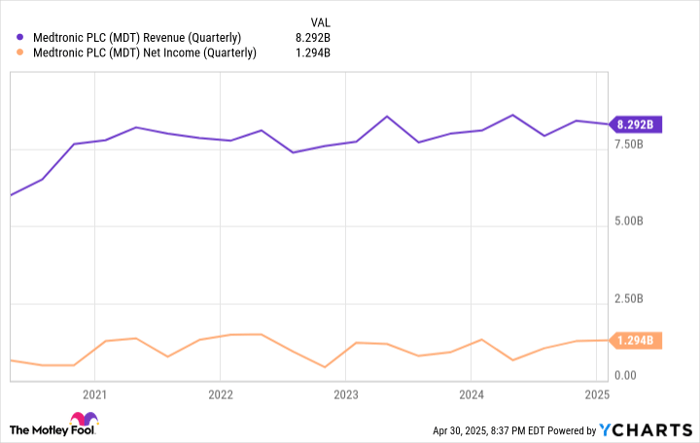

Despite its recent stock struggles, Medtronic maintains solid financial health, underpinned by consistent revenue and earnings, thanks to its diverse product portfolio.

MDT Revenue (Quarterly) data by YCharts.

Medtronic continually secures new product approvals. Although most segments do not exhibit remarkable sales growth, its diabetes care division stands out. The company offers a variety of diabetes-related products, including the innovative MiniMed 780G insulin pump. Plans are underway to broaden the device’s approval to include type 2 diabetes patients, significantly augmenting its market potential.

Even with potential cost pressures from tariffs, Medtronic’s financial performance is expected to remain stable. The anticipated approval of the Hugo system will likely bolster the overall business.

Furthermore, Medtronic has demonstrated a strong commitment to dividends, increasing its payouts for 47 consecutive years. In three years, it could reach the coveted status of Dividend Kings. This reliability adds to Medtronic’s appeal for income-seeking investors, complemented by the promising developments surrounding the Hugo system.

Should You Consider Investing in Medtronic Now?

Before making an investment decision regarding Medtronic, it’s essential to weigh the following:

The analyst team at The Motley Fool recently identified what they believe to be the 10 best stocks for investors, and Medtronic was not among them. The selected stocks have potential for significant returns in the coming years.

For example, consider when Netflix made this list on December 17, 2004. If you had invested $1,000 at that time, your investment would now be worth $623,685!*

Similarly, if you invested $1,000 in Nvidia when it was listed on April 15, 2005, your investment would be valued at $701,781!*

Notably, Stock Advisor‘s total average return stands at 906%, vastly outperforming 164% for the S&P 500. You don’t want to miss the latest top 10 list, accessible upon joining Stock Advisor.

*Stock Advisor returns as of April 28, 2025

Prosper Junior Bakiny holds positions in Intuitive Surgical. The Motley Fool has positions in and recommends Intuitive Surgical. Additionally, it recommends Medtronic and provides options on Medtronic. The Motley Fool has a disclosure policy.

The views expressed here are those of the author and do not necessarily reflect those of Nasdaq, Inc.