Investors Eye Dollar General Amidst Market Turbulence in 2025

As spring begins to unfold, 2025 is shaping up to be a challenging year for investors. As of April 8, the S&P 500 (SNPINDEX: ^GSPC) is down 18%, while the Nasdaq Composite has entered bear market territory. Investors are grappling with President Donald Trump’s proposal to impose the highest tariffs seen in over a century.

This past week, nearly all S&P 500 stocks have declined, with only five stocks in the green. Among them, only one is not in healthcare— a discount retailer known for its resilience during economic downturns. This company has a proven track record of outperforming in recessions and is well-positioned to navigate any challenges associated with tariffs.

Looking to invest $1,000 now? Our analysts have identified the 10 best stocks to consider. Learn More »

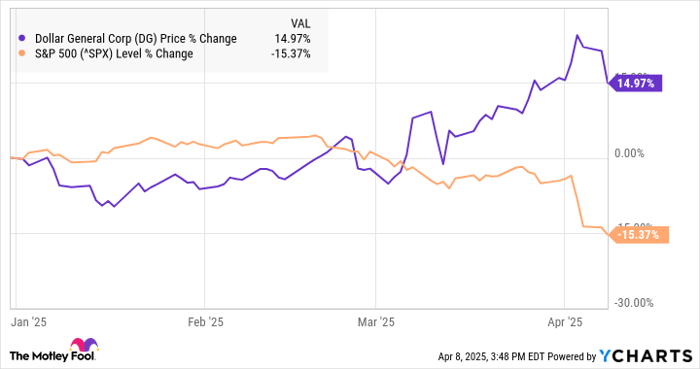

The focus here is on Dollar General (NYSE: DG), a discount retailer that has demonstrated resilience after facing difficulties in 2023 and 2024. As illustrated in the chart below, Dollar General has significantly outperformed the broader market this year:

DG data by YCharts.

Dollar General’s stock has risen during the recent market downturn, demonstrating its countercyclical nature. Notably, the stock jumped 4.7% the day after Trump announced global tariffs, indicating market perception that Dollar General remains resilient to tariff impacts.

Understanding Dollar General’s Resilience Against Tariffs

In today’s unpredictable trade environment and uncertain economic landscape, Dollar General stands out positively compared to other retailers. Its sales composition is primarily consumables—82% of total sales in 2024—which includes essential items such as packaged food, cleaning supplies, and health and beauty products. These are staples consumers continue to purchase regardless of economic conditions.

Due to a substantial amount of its sales coming from domestically produced food, Dollar General faces considerably less tariff exposure than many competitors. Analysts from Citigroup estimate that only about 10% of Dollar General’s inventory is affected by tariffs, a stark contrast to Dollar Tree, which has 50% of its inventory at risk due to a focus on discretionary items.

Additionally, Dollar General has historically excelled during recessions. As consumers tend to opt for cheaper options during tough economic times, Dollar General benefits from its ability to offer smaller package sizes. This allows customers to purchase individually packaged goods, which isn’t available at larger retailers, such as Walmart.

During the financial crisis, for instance, Dollar General reported impressive same-store sales growth of 9% in 2008 and 9.5% in 2009. Following a period of record growth during the pandemic in 2020, it’s worth noting that Dollar General has achieved positive same-store sales growth in virtually every year since 1990, apart from 2021 when it faced a slight decline.

Image source: Getty Images.

Is Dollar General a Smart Investment?

Though Dollar General has faced challenges over the past two years, including market share loss to Walmart and a decline in margins due to inflation’s effect on spending among low-income customers, it is adapting. The company has initiated a “Back to Basics” strategy designed to refine its supply chain by closing temporary storage facilities and enhancing store operations. This entails addressing out-of-stock situations and ensuring staff availability at points of sale. Furthermore, Dollar General is also investing in store remodels while continuing to expand its footprint.

In terms of performance, Dollar General reported a 1.4% growth in same-store sales in 2024, indicating a recovery in demand despite margin pressures. The company has projected same-store sales growth for 2025 in the range of 1.2% to 2.2%. Additionally, an expected modest rebound in earnings per share is forecasted to be between $5.10 to $5.80 this year, compared to $5.11 in 2024.

The current economic climate could potentially favor Dollar General, particularly if recession fears escalate.

With a price-to-earnings (P/E) ratio of 17, the stock appears reasonably priced for potential investors. It also provides a dividend yield of 2.6%, which adds to its attraction.

Given ongoing uncertainty surrounding the Trump tariffs, Dollar General presents itself as a robust option for weathering economic challenges and may outperform broader market trends if the economy continues to soften.

Should You Invest $1,000 in Dollar General Today?

Before making a decision to invest in Dollar General, consider this:

The Motley Fool Stock Advisor analyst team recently highlighted what they believe are the 10 best stocks to buy now, and Dollar General did not make the list. The stocks that were chosen have significant potential for considerable returns in the future.

For instance, consider Netflix — which made this list on December 17, 2004. If you invested $1,000 at that time, you’d have $495,226!*

Similarly, when Nvidia was recommended on April 15, 2005, a $1,000 investment would now be worth $679,900!*

The total average return for Stock Advisor has reached 796%, dwarfing the S&P 500’s 155% return. Don’t miss out on the latest top 10 list, accessible when you joinStock Advisor.

*Stock Advisor returns as of April 10, 2025

Citigroup is an advertising partner of Motley Fool Money. Jeremy Bowman has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Walmart. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.