Natural Gas: A Potential Goldmine in a New Political Landscape

Hello, Reader.

The recent Election Day has concluded without the expected chaos, leaving us with a clearer picture of the U.S. government for the next two years.

Donald Trump is heading back to the White House, and while control of the House is still uncertain, Republicans have secured the Senate.

This dynamic allows President Trump to advance his economic agenda with minimal resistance.

Such developments could significantly impact the U.S. economy and the stock market.

As a result, many are likely pondering which industries will thrive in this new political climate.

On Wednesday, stocks responded positively, with the market rallying over 2%, led by notable gains in technology, AI, finance, and small-cap sectors.

The market’s upward momentum continued—albeit with less vigor—on Thursday, especially following the Federal Reserve’s verification of an anticipated rate cut.

As we anticipate the future, let’s examine the sectors poised to prosper during a Trump presidency.

In today’s Smart Money, I will highlight an industry I consider a “Buy.” While it might not be lucrative in the coming weeks or months, its potential over the next few years looks promising.

Let’s explore further…

The Transformation of Natural Gas

I firmly believe that natural gas is a “Buy.” However, it’s essential to note that not all natural gas is the same; its value is heavily influenced by location.

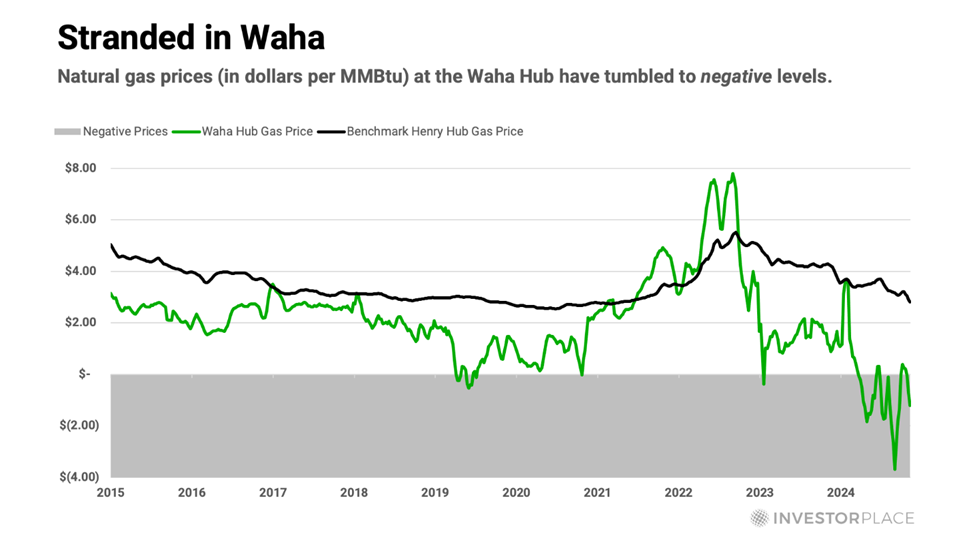

Currently, natural gas trades for $2.75 per million British thermal units (MMBtu) at the Henry Hub in Louisiana. In contrast, at the Waha Hub near the Delaware region of the Permian Basin, gas is priced at a staggering minus $2.46/MMBtu.

In practical terms, this means that producers near the Waha Hub are actually paying companies to take away their natural gas. The Delaware Basin’s gas, like a long-distance relationship, suffers from geographic disadvantages.

Due to these divergent price points, one company might earn an average of only 40 cents per thousand cubic feet (Mcf) of gas, while another company may receive over five times that amount.

Clearly, location is crucial.

Pricing structures, however, are not permanent and can evolve with shifts in supply and demand.

The current low prices for natural gas in the Delaware Basin stem from one fundamental problem: inadequate transportation. The pipelines connecting the upper Permian Basin to hubs near the Gulf of Mexico lack sufficient capacity to manage the surplus gas produced.

This excess, termed “stranded gas,” is so undervalued that producers must dispose of it in less than ideal ways. Those authorized to flare gas burn it off at drilling sites, while others resort to paying companies to truck it away, similar to discarding unwanted furniture.

Yet, a significant change could be on the horizon for natural gas production in the Delaware Basin, with pricing set to become notably more favorable.

How to Position Yourself for the Years Ahead

For members of Fry’s Investment Report, I present a top oil and gas production company well-positioned to take advantage of this anticipated shift. For more details on this recommendation, refer to the November issue of Fry’s Investment Report (subscribers only), released just yesterday. (Click here to discover how to join us at the Investment Report.)

This company may also see a boost from a new and unexpected source of demand: data centers.

As major tech companies expand their data centers, they face challenges in securing the reliable power these facilities require.

In the short term, natural gas will likely fulfill this increasing demand for power. According to Goldman Sachs, natural gas is expected to satisfy 60% of the power demand growth from AI and data centers, while renewables will contribute the remaining 40%.

Consequently, research from Wells Fargo predicts that data centers could increase the demand for natural gas to fuel U.S. power plants by 20% to 45% over the next five years. The median estimate of that growth would essentially double the current natural gas production levels from the Delaware Basin.

The natural gas market possesses three distinct advantages over other technologies:

- It is abundant.

- It is inexpensive, particularly in the Delaware Basin.

- It is a tested technology with relatively quick permitting processes.

In summary, opportunities within the oil and gas sector remain robust. Beyond my recent oil and gas recommendations, my other holdings in the Fry’s Investment Report are also poised for success in this evolving landscape under a Trump presidency.

To learn how to join me at Fry’s Investment Report and gain access to my latest insights and recommendations, click here.

Regards,

Eric Fry