Taiwan Semiconductor: A Leading Investment Opportunity for the Decade

For investors, identifying decade-defining investments is the ultimate goal. Historically, certain stocks have performed exceptionally well, rewarding early investors with significant returns.

Taiwan Semiconductor: Positioned as a Top Chip Manufacturer

Taiwan Semiconductor Manufacturing Company (NYSE: TSM), commonly known as TSMC, stands as an industry leader in chip fabrication. With impressive growth projections over the coming years, it is anticipated to emerge as one of the best stock picks of the decade.

TSMC’s dominance in the sector is largely attributed to its extensive client roster, which includes major players like Nvidia and Apple. These companies design chips in-house but rely on TSMC for production. This setup allows TSMC to maintain a competitive edge without directly encroaching on its clients’ business.

Notably, TSMC excels in production capabilities. Currently, the company produces 3 nanometer (nm) chips, and it plans to begin manufacturing 2 nm and 1.6 nm chips in 2025 and 2026, respectively. This technological supremacy is crucial for staying ahead in the rapidly evolving chip market.

While some analysts express concerns regarding TSMC’s manufacturing facilities in Taiwan and potential geopolitical risks, such as a takeover by China or U.S. tariffs, current tariffs do not affect semiconductors. Moreover, a China takeover would likely lead to significant global market volatility.

In response to these risks, TSMC is investing $100 billion in building new facilities in the United States, including three manufacturing plants, two packaging centers, and one research and development center. Although TSMC’s management asserts the expansion is not directly tied to recent U.S. administrations, the decision aligns with ongoing geopolitical dynamics.

TSMC Stock Valuation and Growth Potential

The company’s strong positioning in the chip industry grants it unique insights, particularly as clients place chip orders years in advance. As a result, TSMC’s current U.S. chip production capacity is fully booked through 2027.

TSMC expects its revenue related to artificial intelligence (AI) chips to grow at a compound annual growth rate (CAGR) of 45% over the next five years, alongside an overall revenue growth rate near 20%. If achieved, this growth could signal a near 150% increase in revenue during the period.

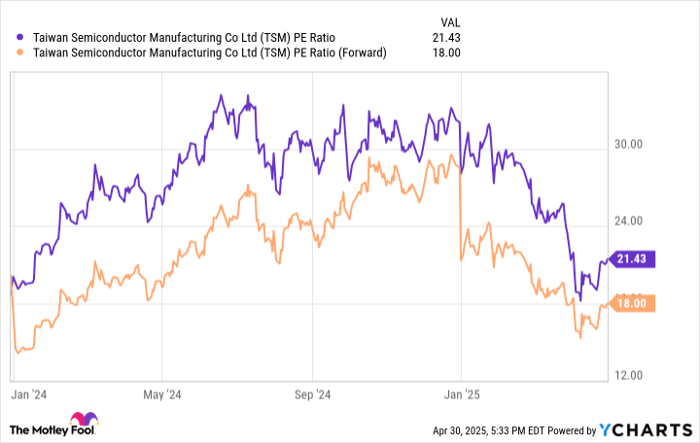

Compared to the broader S&P 500, which trades at 22.1 times trailing earnings and 20.5 times forward earnings, TSMC is currently valued at a discount. Its growth projections suggest it could outperform market averages, indicating that TSMC represents a strong investment opportunity.

TSM PE Ratio data by YCharts

Investment Considerations for Taiwan Semiconductor Manufacturing

Before investing in TSMC, consider this:

The Motley Fool Stock Advisor analyst team recently highlighted the 10 best stocks for purchase; however, TSMC was not included. The stocks chosen could yield substantial returns in the near future.

Consider past performance: when Netflix was recommended on December 17, 2004, an investment of $1,000 would now be worth $611,271!

Similarly, an early investment in Nvidia on April 15, 2005, would have grown to $684,068.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.