Home Improvement Giants: The Home Depot vs. Floor & Decor

Investors reflect on how The Home Depot reshaped home improvement shopping over the past 40 years, but Floor & Decor may be the stock to watch now.

If I had a time machine and could go back 40 years, The Home Depot (NYSE: HD) would be one of my top picks. The company reinvented the concept of a home-improvement store, featuring large spaces that offered a broader selection of products than traditional stores. This innovative approach enabled rapid growth, resulting in over 2,300 locations today.

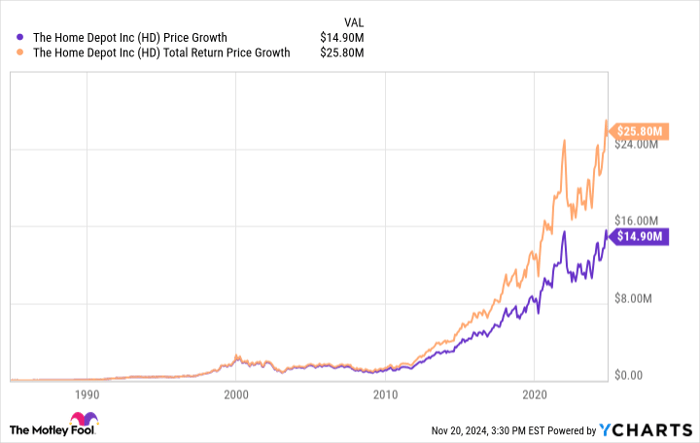

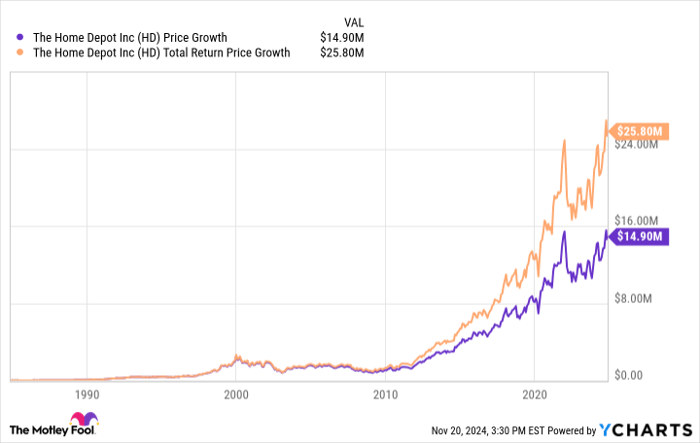

A $10,000 investment in The Home Depot stock 40 years ago would now be worth nearly $15 million. Reinvesting dividends would yield an even more impressive total of over $25 million.

Data by YCharts.

As of now, shares of The Home Depot are trading close to their all-time high of over $415. While the long-term performance has been remarkable, growth has slowed in recent years. The stock has achieved a total return of 112% in the last five years.

However, Floor & Decor (NYSE: FND) is a new stock that’s gaining attention in the home-improvement sector. Its shares have skyrocketed 147% over the last five years, and it could outperform The Home Depot in the next five.

Why Floor & Decor Could Be the Better Investment

An investment thesis explains why a stock might rise (or fall). The Home Depot has opened only 55 new stores in the last five years—a growth rate of just around 2%. This slow growth is understandable given its size, but it limits potential for revenue increases.

For investors, the main reasons to buy Home Depot stock revolve around its strong profit margins and returns to shareholders. With a net margin between 9% and 10%, the company operates at a high efficiency, but there is limited space for further margin growth in such a competitive retail market.

Home Depot creates value by returning cash to shareholders through dividends and share repurchases—a strategy that can be effective in the long term. Many believe in the company’s stability and plan to hold their shares. However, Floor & Decor presents more room for growth, which could provide a better return on investment.

Notably, Floor & Decor has outshined Home Depot in financial performance over the past five years, seeing faster growth in both revenue and operating profits, as illustrated below.

Data by YCharts.

Floor & Decor operates 241 locations today, projected to reach about 250 by year-end. Next year, the company plans to open 25 additional stores, reflecting a growth of 10%. Long-term aspirations aim for a total of 500 stores nationwide.

However, recent same-store sales for Floor & Decor have dipped, with management forecasting an 8% decrease for the year. This decline is unusual and largely attributed to a sluggish housing market, which has affected sales. In 2022, Floor & Decor marked its 14th consecutive year of revenue growth.

Like many retailers, Floor & Decor’s profit margins have taken a hit, now below 5%, after previously being in the 7% to 8% range.

Data by YCharts.

Home sales dropped to their lowest levels since 2010, as reported by the National Association of Realtors. This trend could be contributing to the sluggish sales at Floor & Decor, but it’s a temporary situation that could correct over the next five years, enhancing same-store sales and profit margins.

Considering the store openings, potential growth in same-store sales, and room for margin improvement, I believe Floor & Decor will likely outperform both Home Depot and the S&P 500 over the next five years.

Should You Invest $1,000 in Floor & Decor Now?

Before you invest in Floor & Decor, keep this in mind:

The Motley Fool Stock Advisor analysts recently identified what they believe are the 10 best stocks to purchase now, and Floor & Decor didn’t make the list. The selected stocks may deliver significant returns in the upcoming years.

For perspective, when Nvidia was recommended on April 15, 2005, a $1,000 investment then would have grown to $869,885 today!

Stock Advisor offers a clear guide for investors, including advice on portfolio building, regular analyst updates, and two new stock picks each month. Since its launch in 2002, Stock Advisor has outperformed the S&P 500 four times over.

See the 10 stocks »

*Stock Advisor returns as of November 18, 2024.

Jon Quast has positions in Floor & Decor. The Motley Fool has positions in and recommends Home Depot. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.