TSMC Hits Record Profit: What’s Next for Investors?

Taiwan Semiconductor Manufacturing Company Limited (TSM) has seen its stock price rise after announcing a record-setting net income for the fourth quarter that exceeded analysts’ expectations. This year, TSMC’s net profit jumped 57% to $374.68 billion compared to last year, largely fueled by increased demand for artificial intelligence (AI) chipsets.

While these impressive quarterly results have positively impacted TSMC stock, the company’s overall performance has been strong for the past year, as evidenced by a stock price increase of 91%, particularly driven by advancements in AI technology. The question now is whether TSMC can keep this momentum and prove to be a wise investment choice. Let’s examine the factors at play.

Three Reasons to be Optimistic About TSMC Stock

Even though recent earnings boosted TSMC stock, future growth prospects remain crucial for sustained success. For instance, the company predicts first-quarter revenue between $25 billion and $25.8 billion, which represents a 6% rise over market expectations, indicating a promising short-term outlook. Furthermore, TSMC management anticipates a 20% compound annual growth rate (CAGR) over the next five years, supported by opportunities in AI, 5G smartphones, and high-performance computing.

The demand for TSMC’s customized AI chips from industry players like Broadcom Inc (AVGO) and Marvell Technology, Inc (MRVL) highlights its potential for future growth. Additionally, Apple Inc (AAPL) is experiencing higher demand for its smartphones, which utilize TSMC’s chips, further benefiting the foundry. TSMC’s future also looks bright with the anticipated release of their efficient 2-nanometer (nm) chips later this year; pre-orders are already outperforming previous generations (3nm and 5nm).

TSMC’s leadership in the global semiconductor foundry market places it in a strong position to capitalize on the semiconductor sector’s projected growth. According to SNS Insider, the global semiconductor market is expected to reach $1.47 trillion in revenues by 2030, a significant jump from $729 billion in 2022. Management has deemed the U.S. government’s restrictions on chip sales to China as “manageable.”

Secondly, the new Stargate AI infrastructure initiative is poised to have a transformative impact on TSMC. With President Trump planning to allocate $500 billion to support AI infrastructure, TSMC stands to gain significantly, as its advanced chips are crucial for AI data centers.

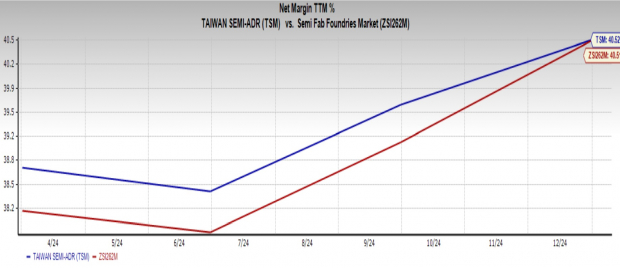

Lastly, TSMC enjoys a robust profit-generating capacity with a net profit margin of 40.52%, slightly above the Semiconductor – Circuit Foundry industry average of 40.51%. This strong margin indicates efficient operations.

Image Source: Zacks Investment Research

Time to Consider TSMC Stock?

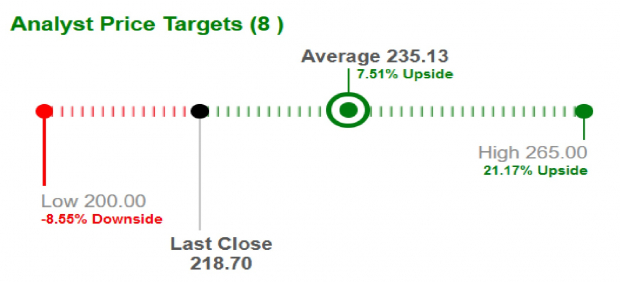

With a host of growth opportunities on the horizon, including the Stargate AI project and solid operational fundamentals, TSMC stock could represent a smart investment choice for the long term. Analysts are optimistic as well, raising the average short-term price target by 7.5% to $235.13 from $218.70, with the highest target set at $265, suggesting a potential upside of 21.2%.

Image Source: Zacks Investment Research

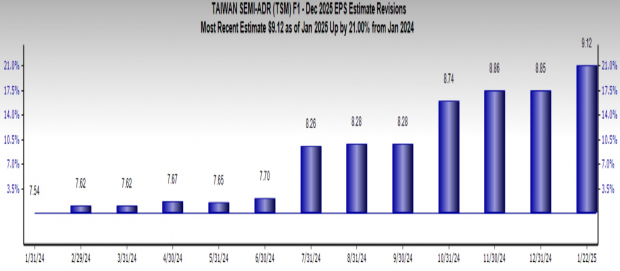

Additionally, TSMC’s earnings per share are expected to grow by 21% year-over-year, with a Zacks Consensus Estimate of $9.12. Thus, TSMC holds a Zacks Rank of #2 (Buy), indicating favorable market sentiment.

Image Source: Zacks Investment Research

7 Stocks to Watch Over the Next 30 Days

Newly released: Experts have identified 7 premium stocks from the current roster of 220 Zacks Rank #1 Strong Buys. These stocks are considered the most likely candidates for early price increases.

Since 1988, this selected list has consistently outperformed the market, achieving an average yearly gain of +24.1%. Investors should pay close attention to these 7 choices.

Want the latest recommendations from Zacks Investment Research? Download the report on the 7 Best Stocks for the Next 30 Days for free.

Apple Inc. (AAPL) : Free Stock Analysis Report

Marvell Technology, Inc. (MRVL) : Free Stock Analysis Report

Broadcom Inc. (AVGO) : Free Stock Analysis Report

Taiwan Semiconductor Manufacturing Company Ltd. (TSM) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are solely those of the author and do not necessarily reflect those of Nasdaq, Inc.