UiPath Sees Potential for Stock Reversal Amid Analysts’ Optimism

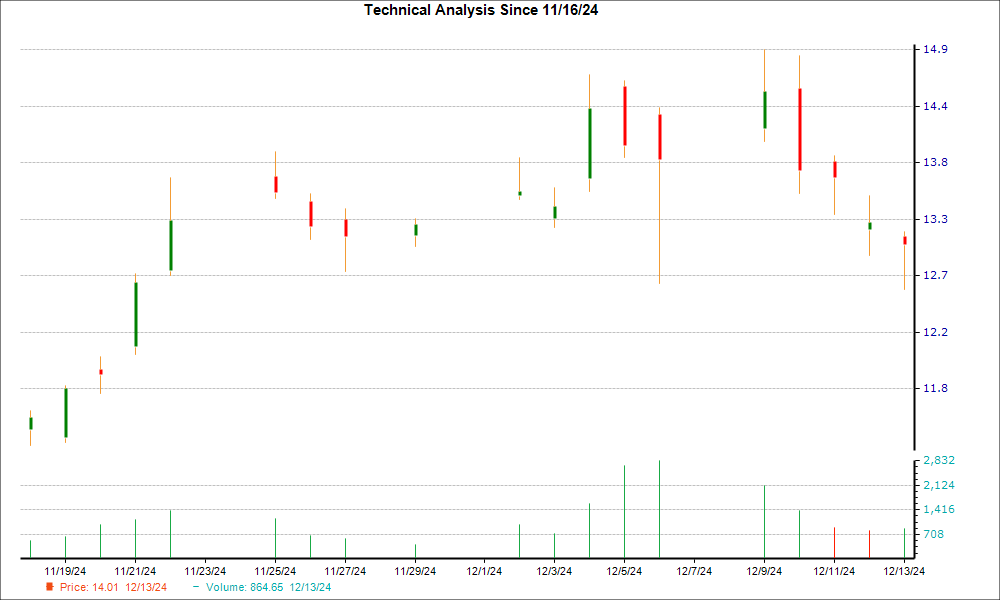

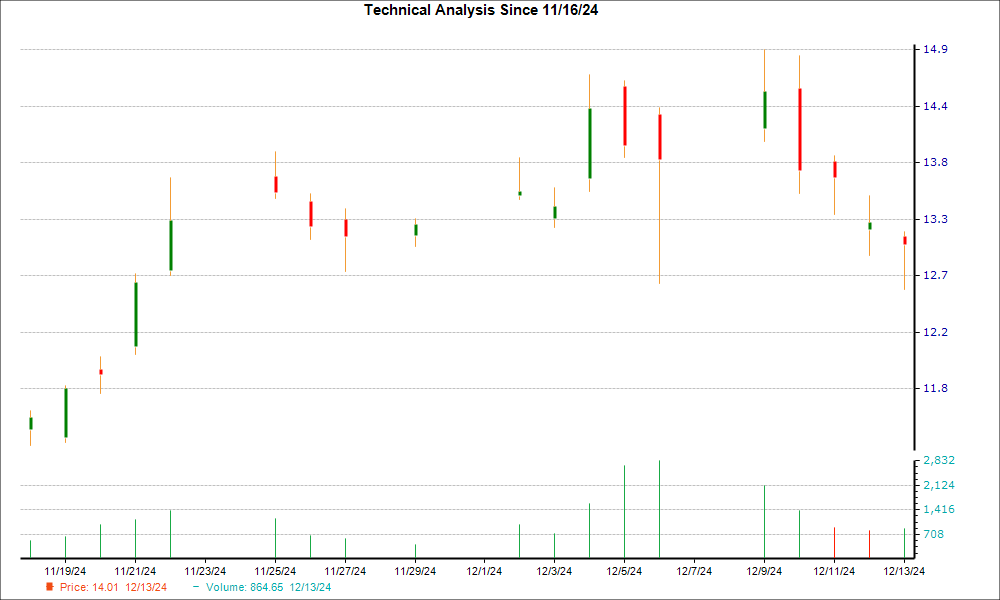

Shares of UiPath (PATH) have been under pressure recently, dropping 8.6% over the last two weeks. However, a hammer chart pattern emerged in the latest trading session, indicating that the stock may have found support as buyers stepped in to counter selling pressure. This development could suggest a possible trend reversal in the near future.

The hammer pattern, a technical signal indicating a potential bottom, coincides with growing optimism among Wall Street analysts regarding UiPath’s future earnings. This combination of technical and fundamental factors enhances the likelihood of a reversal for the stock.

What is a Hammer Chart Pattern?

The hammer pattern is one of the key formations in candlestick charting. It features a small candle body, formed by little difference between the opening and closing prices, alongside a long lower wick—indicating significant downward movement during the day. This lower wick must be at least twice the length of the candle body, giving it a hammer-like appearance.

Essentially, during a downtrend, the stock tends to open lower than the previous day’s close and may initially decline further. On the day the hammer pattern forms, a new low is achieved. However, buyers emerge, pushing the price back up to close near or above the opening price.

When this pattern appears at the end of a downtrend, it suggests that selling pressure may be easing. Successful buyers in halting further declines could indicate an impending trend reversal.

Hammer patterns can appear on various timeframes, appealing to both short-term traders and long-term investors.

Like most technical indicators, the hammer pattern has its limitations. Its effectiveness hinges on where it appears on the chart, so investors should look for confirmation from other bullish signals.

Factors Supporting a Trend Reversal for PATH

Recently, there has been a noticeable positive trend in earnings estimates for UiPath, serving as a bullish signal from a fundamental perspective. Typically, upward revisions suggest that stocks may appreciate in value in the near term.

In the past month, analysts have increased the consensus earnings per share (EPS) estimate for the current year by 24.4%. This widespread agreement indicates that analysts expect better-than-previously forecasted earnings from UiPath.

Additionally, UiPath carries a Zacks Rank of #1 (Strong Buy), placing it in the top 5% of over 4,000 stocks ranked based on earnings estimate revisions and EPS surprises. Historically, stocks with a Zacks Rank of #1 or #2 tend to outperform the market. This indication further strengthens the outlook for Path.

A strong Zacks Rank for UiPath signals a prime opportunity for recognizing when the company’s prospects start to improve, enhancing the potential for a trend reversal.

Expert Picks for Future Growth

Among thousands of stocks, five Zacks analysts have each selected their top pick expected to double in value within months. Director of Research Sheraz Mian has highlighted one company he believes has the most explosive growth potential.

This company focuses on millennial and Gen Z consumers, generating nearly $1 billion in revenue last quarter. Current market volatility may provide a great opportunity to invest. While not every pick will succeed, this one is anticipated to outshine past Zacks winners, such as Nano-X Imaging, which surged +129.6% within nine months.

Want to see more from Zacks Investment Research? Download the report on “5 Stocks Set to Double” for free today.

UiPath, Inc. (PATH): Free Stock Analysis Report

For the original article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect the opinions of Nasdaq, Inc.