Vertiv VRT is a picks-and-shovels AI stock that’s partners with the current king of AI, Nvidia, and will grow no matter who eventually dominates artificial intelligence.

Vertiv stock has soared 700% in the past two years and 90% YTD, yet it trades 15% below its highs.

Vertiv’s AI and Big Data Bull Case

Vertiv’s power, cooling, and IT infrastructure solutions and services operate across data centers, communication networks, and beyond. Vertiv helps the computing power needed to drive the modern economy run as smoothly as possible around the clock.

Vertiv’s product categories include critical power, thermal management, racks & enclosures, and monitoring & management. At the same time, its services range from DC power and electrical reliability to safety and compliance and much more.

Vertiv works with small and medium-sized businesses and enterprises across healthcare, retail, telecom, education, and other critical parts of the economy.

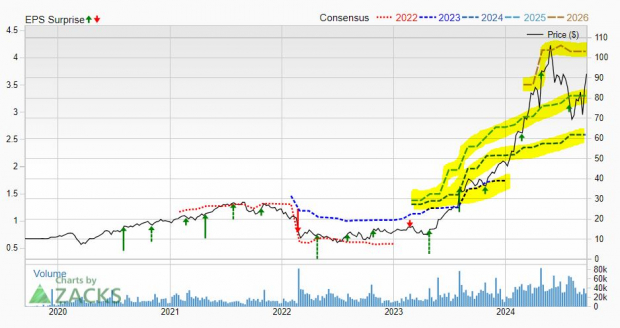

Image Source: Zacks Investment Research

Vertiv is working with the current champion of AI, Nvidia NVDA, to help solve future data center efficiency and cooling challenges.

Vertiv grew its organic orders by 57% in the second quarter. “We continue to see increased scaling of AI deployment and Vertiv has the capacity in place to seize this pivotal moment while continuing to invest in capacity for the future,” Vertiv chief executive Giordano Albertazzi said in prepared Q2 remarks.

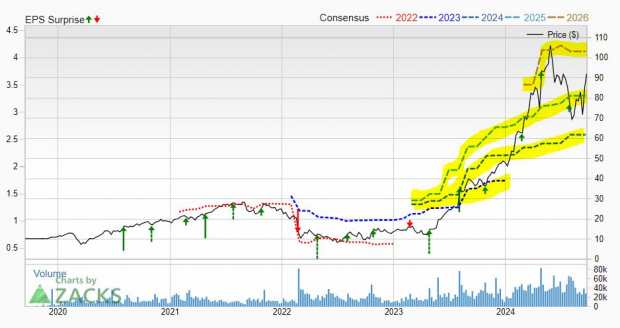

Vertiv’s earnings estimates have jumped since its second quarter release, extending its impressive stretch of upward EPS revisions over the last year and a half. VRT’s improving bottom-line outlook helps it earn a Zacks Rank #1 (Strong Buy), and it has topped our EPS estimates by an average of 13% in the trailing four quarters.

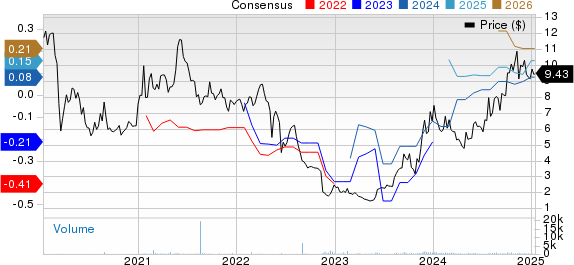

Image Source: Zacks Investment Research

Vertiv is projected to grow its adjusted EPS by 46% in FY24 and 28% in FY25 to reach $3.31 a share next year. This earnings expansion would come after VRT grew its bottom line by 230% in 2023.

Vertiv is projected to increase its revenue by 13% in 2024 and 2025 to pull in nearly $9 billion next year.

Vertiv Stock’s Performance, Technical Levels, and Valuation

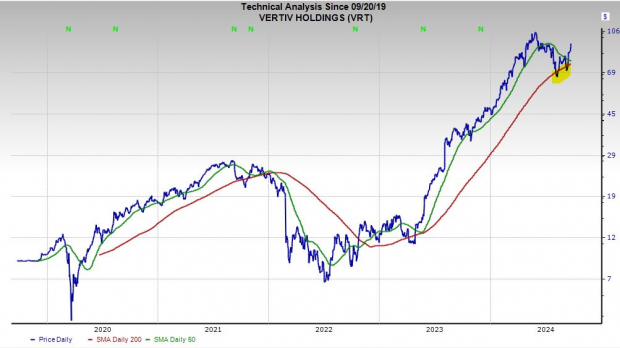

Vertiv stock has soared over 800% in the last five years, roughly 700% in the past two, and 90% YTD. These runs put Vertiv up there with the likes of Nvidia, while blowing away Meta and other tech giants.

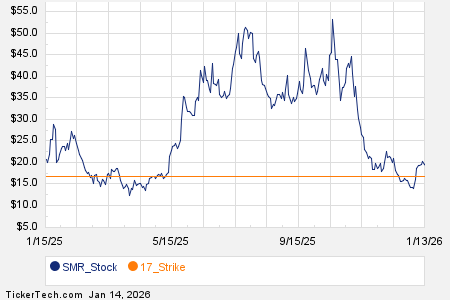

Image Source: Zacks Investment Research

Vertiv recently rebounded above its 21-week moving average. Vertiv also found support at its 200-day moving average earlier this month for the second time since early August.

VRT stock is back above its 50-day and 21-day moving averages. On top of that, Vertiv trades roughly 15% below its May peaks.

On the valuation front, VRT trades at a 24% discount to its highs at 29.7X forward 12-month earnings. Vertiv stock offers 22% value compared to its highly-ranked Computers – IT Services industry.

VRT’s impressive relative value is in place even though Vertiv has climbed 300% in the past three years to blow away its industry’s 4% decline.

Bottom Line on Vertiv Stock

The constant expansion of data centers and the rise of AI systems, cryptocurrencies, and other new technologies provide Vertiv with a massive growth runway for decades. This is why Wall Street loves Vertiv stock, with all 11 brokerage recommendations Zacks has for Vertiv sitting at “Strong Buys.”

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2024. While not all picks can be winners, previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

NVIDIA Corporation (NVDA) : Free Stock Analysis Report

Vertiv Holdings Co. (VRT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.