Wearable Devices Ltd. WLDS is experiencing a surge in stock value, propelled by a groundbreaking report from its extended reality (XR) team examining the advancements in the wearable technology realm.

The Latest Developments:

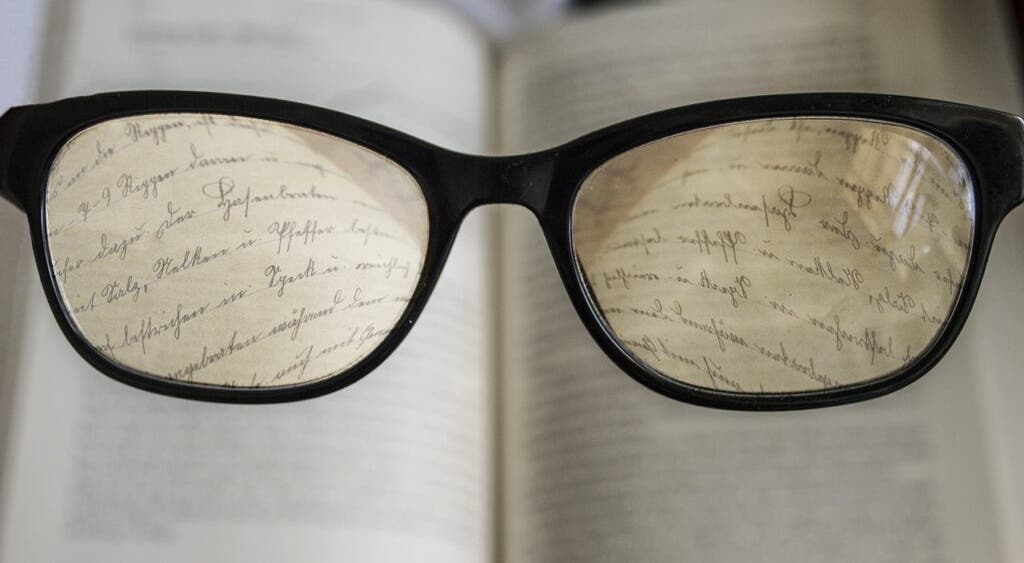

The report shed light on the flourishing smart glasses market, which has been invigorated by the entry of tech behemoths like Meta and Apple. Furthermore, the document delved into Wearable Devices’ Mudra Band’s UX strategy and gesture repertoire, solidifying its position as the gold standard for XR input methods.

Investors are flocking to Wearable Devices as they absorb the report findings. Data from Benzinga Pro reveals a staggering 30 million shares have already swapped hands, dwarfing the stock’s 100-day average of under 692,000 shares.

Related News: What’s Going On With Bitdeer Technologies Stock?

Should Investors Consider WLDS Stock?

When evaluating a potential investment in WLDS stock, various factors come into play. Apart from traditional metrics and price trends available on platforms like Benzinga, savvy investors consider aspects such as dividend policies and stock buyback programs.

While Wearable Devices does not currently offer a dividend, it has several strategies to provide value to shareholders. Monitoring the dividend calendar on Benzinga can help investors track dividend-paying companies and assess potential yields.

Buyback programs, on the other hand, are dynamic and subject to change. A company may implement a buyback initiative to repurchase shares strategically, thereby bolstering share prices. Monitoring Wearable Devices’ news can unveil recent buyback program authorizations, which often act as a safety net for share demand.

Current WLDS Performance: Presently, Wearable Devices stock is soaring by 20.7%, reaching 55 cents per share.

Image: Melissa from Pixabay