After the recent rate cut by the U.S. Federal Reserve, stocks are showing a promising surge to all-time highs. This move has historically proven to be a bullish sign for the stock market, hinting at a potentially abundant year ahead. Let’s delve into past trends and current economic indicators to decipher why stock investors might be on the brink of a prosperous period.

The Bright Path Forward Through Historical Insights

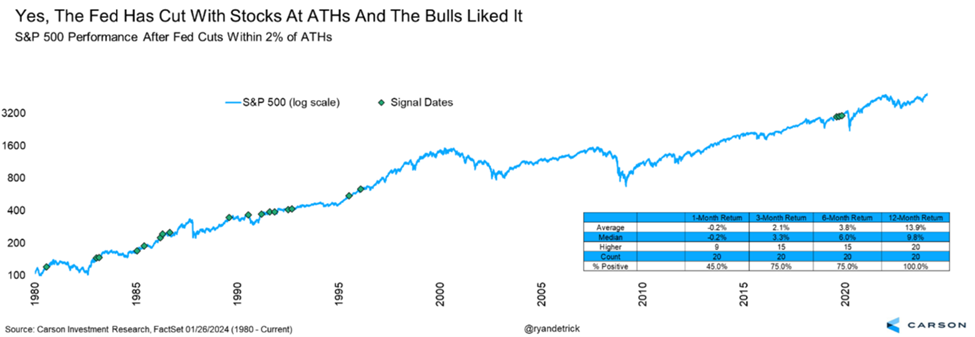

The Federal Reserve’s latest rate cut marks the beginning of a new cycle with stocks resting comfortably at all-time highs. Surprisingly, this scenario isn’t new; history reveals that in approximately 20 instances since 1980, the Fed has initiated rate cuts while stocks were within 2% of record levels. Remarkably, each time this occurred, stocks soared over the following year, delivering an average return of almost 15%.

The Intersection of Economic Growth and Rate Cuts

These rate cuts come at a time when the U.S. economy is exhibiting a robust growth rate of around 3%, coupled with low joblessness figures. This unique blend of economic indicators has been witnessed before in 1987, 1989, 1995, 1998, and 2019, triggering significant stock market rallies in the subsequent year, with an average return of 17%. The historical data provides a solid foundation for the belief that stocks are likely to experience considerable gains in the coming months.

The Dawn of a Potential Stock Market Rally

While nothing in the financial markets is certain, the favorable conjunction of factors – rate cuts, thriving economy, and low unemployment rates – hints at a promising outlook for stock market performance. History suggests a high likelihood of stocks reaping substantial profits over the coming year. However, as with every rally, some sectors may outperform others. In the current landscape, tech stocks, particularly AI-related companies, are poised to lead the charge, drawing parallels to the tech boom of the late 1990s.

Back in the late 1990s, the advent of internet technologies fueled a surge in tech stocks. Similarly, the recent focus on AI technologies has seen a similar surge in AI-related companies. With the economic slowdown prompting Fed rate cuts, the stage is set for AI stocks to embark on a meteoric rise in the years to come. These developments echo the past, underscoring the potential for substantial gains in the AI sector.

Considering these insights, it appears that a wave of opportunity may be on the horizon for stock investors. As we navigate through this period of economic evolution and financial dynamics, keeping a keen eye on AI stocks could prove to be a rewarding strategy.

Regards,

Luke Lango

Editor, Hypergrowth Investing