Market Predictions: S&P 500 Gains and Bond Investment Opportunities

Let’s start with a prediction: the S&P 500 is expected to rise about 5% this year, which is moderate but certainly acceptable. This estimate is based on annualizing the gains the market has shown so far in 2025.

This year can be described as a transitional phase in the business cycle. Inflation is moderating, the labor market is softening, and consumer spending is beginning to decelerate—emphasis on beginning to. This context suggests that it is crucial to ensure a well-diversified portfolio, which means considering assets beyond just stocks. At the forefront of our focus? Corporate bonds.

Corporate Bonds: A Strategic Mid-Cycle Investment

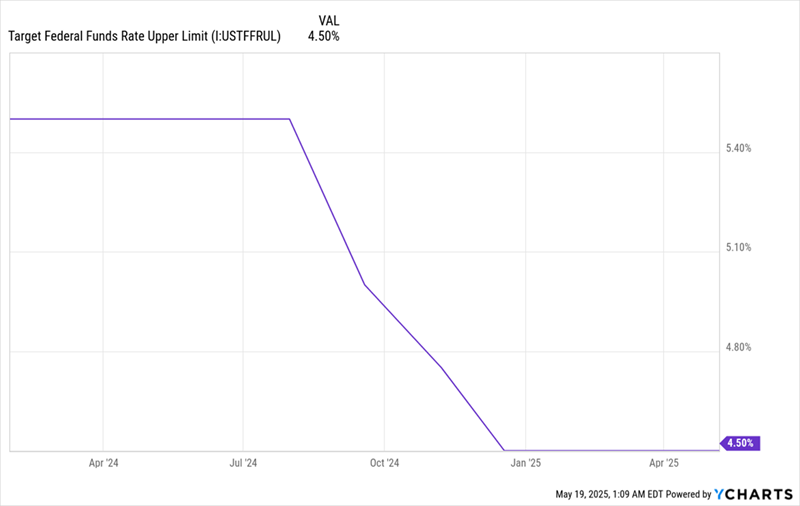

Why are corporate bonds attracting attention now? The answer lies in the Federal Reserve’s stance on interest rates. Although the Fed reduced rates twice in 2024, the cuts were fewer than many had anticipated.

Two Cuts So Far

This year has mirrored that pattern, with the Fed exercising restraint on further rate cuts despite systemic expectations from investors.

In light of the Fed’s cautious approach, we are focusing on closed-end funds (CEFs) that invest primarily in corporate bonds. These bonds were issued during periods of higher yields. The delayed rate cuts provide these funds with additional time to acquire such bonds and continue offering substantial payouts to investors.

The reality is that rates are likely to decline, whether due to shifts in investor sentiment following a recent downgrade of US government debt or the normal progression of the business cycle, where economic activity continues to slow. As interest rates drop and investors seek reliable income, the value of these CEFs’ bonds—and the funds themselves—should increase.

In summary, there’s an opportunity to invest now, while yields are attractive, and to get ahead of the income-seeking investors that will follow.

The Nuveen Core Plus Impact Fund (NPCT)

One standout fund poised to benefit from this setup is the Nuveen Core Plus Impact Fund (NPCT), which offers an impressive 14% income stream, yet remains under the radar for many investors.

Here are key features of this low-profile bond CEF:

- Exceptional 14% payout, which saw an increase in June 2024. This dividend is paid to investors monthly.

- Currently trading at an 8.4% discount to its net asset value (NAV), meaning investors can acquire its bond portfolio for less than 92 cents on the dollar. For reference, this discount is significantly lower than the typical 3.9% discount found in comparable bond CEFs.

- The fund returned a strong 11% in the past year, demonstrating resilience despite its larger discount—highlighting its overlooked status.

It’s important to note that a significant portion of the fund’s gains are delivered as dividends, translating to liquid profits—real income that can be utilized as desired.

The source of the current discount deserves attention, as NPCT focuses on corporate bonds from companies adhering to environmental, social, and governance (ESG) criteria. The ESG focus seems to have diminished appeal among some investors, which has contributed to the fund’s price discount.

However, this perceived drawback presents an opportunity. The fund’s value stems from its robust portfolio, featuring bonds from stable regional banks like PNC and international institutions such as Standard Chartered, which have provided consistent income.

Throughout this mid-cycle phase, NPCT and its investors have been enjoying this substantial income stream. Eventually, either the fund will adjust its ESG approach, or investors will recognize the strength of its bond portfolio, particularly if rate cuts accelerate.

The current discount reflects a misunderstanding of the fund’s reliable dividend. Such misconceptions can create favorable opportunities for savvy investors.

Exploring Additional Investment Options

As we’ve discussed, many investors are overlooking NPCT, which is what makes it attractive. With a significant 14% yield, monthly payouts, and a notable discount, this fund is appealing despite its misunderstood ESG focus.

This fund is part of a larger Monthly Dividend Portfolio that has been designed to provide steady income through any market cycle. I am prepared to share the details of all the investments included in this “battleship” monthly paying portfolio, which collectively offer an average dividend yield of 11.6%. These investments are also currently undervalued.

To discover more about this portfolio and receive a complimentary report listing all the bargain-priced opportunities it includes, please click here.

Also See:

- Warren Buffett Dividend Stocks

- Dividend Growth Stocks: 25 Aristocrats

- Future Dividend Aristocrats: Close Contenders

The views expressed in this article represent the author’s opinions and do not necessarily reflect those of Nasdaq, Inc.