Unveiling the Power of the 200-day Moving Average

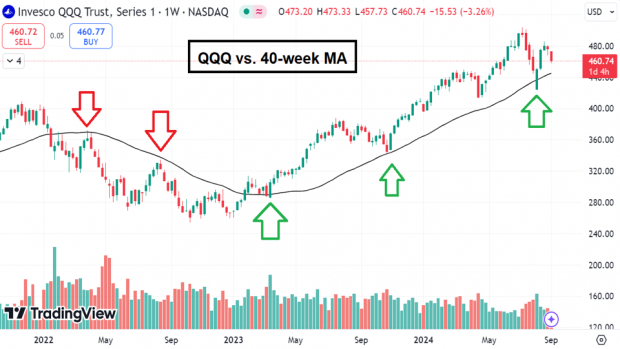

Investors often complicate matters by inundating themselves with an excess of technical indicators and outdated macro data. Through personal experience, I’ve discovered that simplicity triumphs over complexity in the investing realm. The 200-day moving average emerges as a potent tool for identifying trends, managing risk, and optimizing timing. As legendary investor Paul Tudor Jones aptly put it, “We want to be long stocks above the 200-day and cautious below it.”

The Nasdaq 100 ETF (QQQ) exemplifies the efficacy of the 200-day moving average. During the 2022 bear market, adherence to the 200-day MA shielded investors from trouble. Conversely, breaching the line in the subsequent years led to sustained uptrends, demonstrating the indicator’s value in navigating market fluctuations.

Image Source: TradingView

3 Stocks Testing the 200-day Moving Average

MicroStrategy: Pioneering a Return to the 200-day Level

MicroStrategy (MSTR) stands as Wall Street’s premier Bitcoin representative, retracing its steps to the 200-day moving average after a spectacular surge from $25 to $125 per share. Such a significant pullback marks a potentially lucrative phase for astute investors.

Image Source: TradingView

In comparison to other crypto proxies like Coinbase (COIN) and Bitfarms (BITF), MicroStrategy has displayed remarkable robustness, registering a 263% increase while the others linger in double-digit gains. Maintaining its 2024 lows while competitors falter underscores MicroStrategy’s intrinsic strength and resilience.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

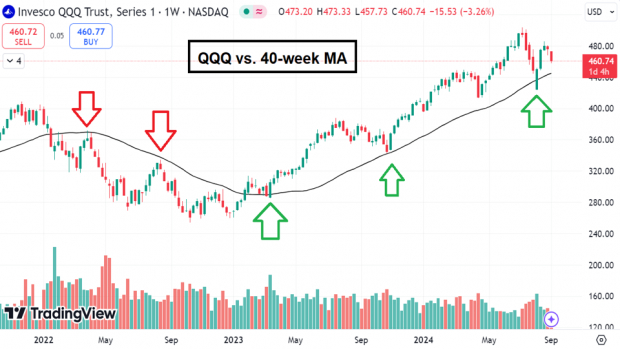

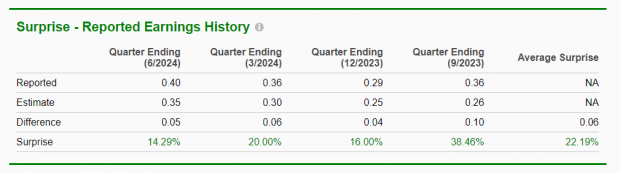

Arm Holdings: Defying IPO Expectations

Arm Holdings (ARM) emerges as a rarity in the current IPO landscape, soaring twofold since its debut in late 2023, reaching a significant pullback towards the 200-day moving average. Despite recent retreats in AI-related stocks, bullish options activity in ARM hints at a transient dip, backed by strong investor confidence through substantial call purchases.

Image Source: TradingView

Furthermore, ARM’s history of consistent positive earnings surprises since going public, averaging an impressive 22.19%, adds another layer of optimism and resilience to the company’s outlook.

Image Source: Zacks Investment Research

Anticipating Obesity Week for Viking Therapeutics

The Rise of Viking Therapeutics: A Weighty Gamble with Promising Fortunes

Viking Therapeutics (VKTX) delivered a seismic jolt to Wall Street this February with the revelation of positive top-line results from its Phase 2 trial for a weight loss medication. The findings revealed that VKTX’s drug exhibited a significant reduction in body weight at all dosage levels compared to a placebo. Following an astonishing more than doubling in a solitary session, VKTX has now settled into a consolidation phase, drawing close to its 200-day moving average.

VKTX: Charting a New Course Towards Sustained Growth

The consolidation of VKTX’s gains over a span of seven months is a customary post-victory digestion period subsequent to a vigorous ascension. Notably, VKTX stands to benefit from the technical impetus of the 200-day moving average and is slated to make a presentation at “Obesity Week” this November, where fresh data will be uncovered. If VKTX can demonstrate its ability to seize a slice of the $150 billion obesity drug market dominated by Novo Nordisk (NVO) and Eli Lilly (LLY), the company could be poised for its next significant upswing.

A Weighty Gamble: VKTX’s Tryst with the $150 Billion Market

The 200-day moving average holds the potential to offer some of the most lucrative long-term entry opportunities. Companies like MicroStrategy, Coinbase, and Viking Therapeutics present enticing risk-reward ratios as they retreat towards a critical technical juncture.

The Road Ahead: VKTX’s Promising Trajectory

Viking Therapeutics now stands at a crossroads, with its Phase 2 triumph setting the stage for a pivotal moment in the company’s narrative. As it treads the path towards “Obesity Week” and further data revelations, VKTX finds itself on the brink of potentially reshaping the landscape of the weight loss medication market. Investors are watching closely as VKTX navigates the competitive terrain against industry giants, with hopes pinned on securing a lucrative foothold in the lucrative obesity drug sector.