“`html

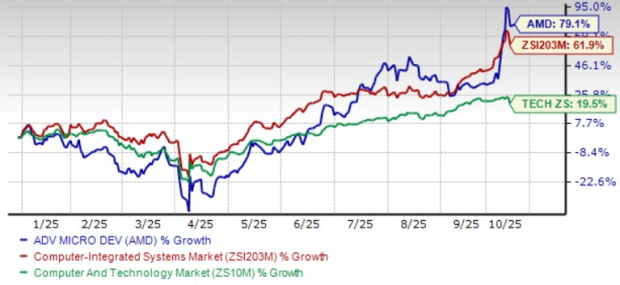

Backblaze (BLZE) has surged 56.8% year-to-date (YTD), significantly outperforming the Zacks Internet-Software industry (16.7%) and Zacks Computer and Technology sector (19.6%). The company is benefitting from increasing demand for its B2 Cloud Storage, driven by enterprise adoption, with expected revenue growth of 28% to 30% for Q3 2025, translating to approximately $20.88 million, a 29% year-over-year increase.

Additionally, Backblaze is integrating artificial intelligence and cybersecurity features into its cloud platform, enhancing its competitive position against larger rivals like Amazon and Dropbox. The Zacks Consensus Estimate indicates a loss of one cent per share for Q3 2025, a 90% improvement year-over-year, as the company aims for positive adjusted free cash flow by Q4 2025.

Despite strong operational performance, Backblaze’s stock is viewed as overvalued with a forward price-to-sales ratio of 3.27X. Investors are advised to hold positions while waiting for more favorable entry points as competition and valuation pressures may limit short-term gains.

“`