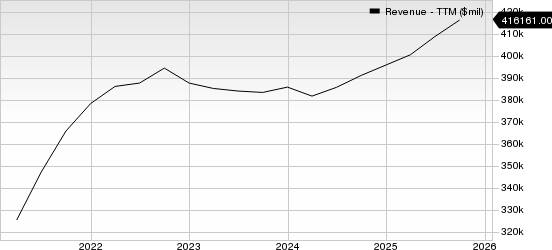

Netflix, Inc. (NFLX) reported impressive fourth-quarter results for 2025, achieving revenues of $12.05 billion, an 18% increase year-over-year, and earnings per share of 56 cents, surpassing analyst expectations. The streaming service surpassed 325 million paid memberships globally, nearing a total audience of 1 billion. Operating income rose 30% to $2.96 billion with an operating margin of 24.5%.

The company anticipates full-year 2026 revenues between $50.7 billion and $51.7 billion, a growth rate of 12% to 14%, bolstered by membership growth and advertising revenues projected to double in 2026. Netflix’s advertising revenue surpassed $1.5 billion in 2025 and is expected to continue growing. Additionally, Netflix is in the process of acquiring Warner Bros. for approximately $82.7 billion, a move that could significantly enhance its content offerings.

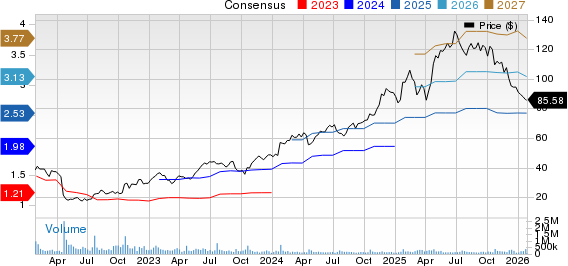

Despite strong performance metrics, NFLX shares have declined by 26.8% over the past six months, lagging behind major streaming competitors. Given its premium valuation and the impending Warner Bros. acquisition’s regulatory scrutiny, investors are advised to assess their entry point for potential investment.