Why Uber Technologies Outshines Amazon as a Growth Investment

Amazon has seen remarkable success, with its stock soaring approximately 300,000% since going public in 1997. While the next 30 years may not promise the same returns, the company’s expansion into cloud computing keeps it among the top investment options. However, Uber Technologies (NYSE: UBER) may be an even stronger growth stock for your portfolio. Here’s why.

Start Your Mornings Smarter! Wake up with Breakfast news in your inbox every market day. Sign Up For Free »

A Growing Trend in Mobility

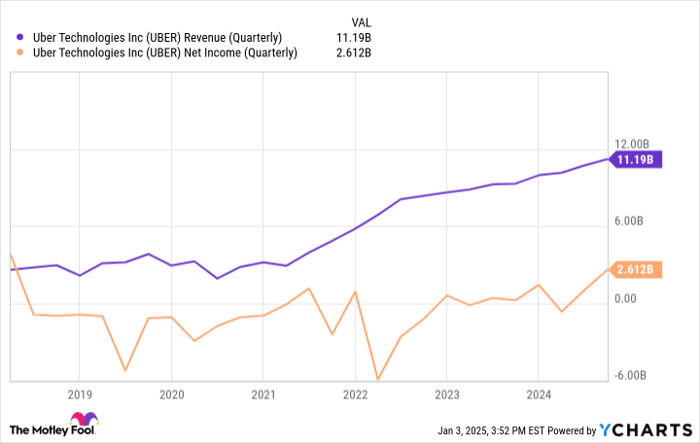

Travis Kalanick and Garrett Camp didn’t invent ride-hailing apps, but they certainly helped popularize them. Uber’s revenue grew by 20% in the third quarter, highlighting the ongoing demand for its services. The company is also becoming increasingly profitable.

UBER Revenue (Quarterly) data by YCharts

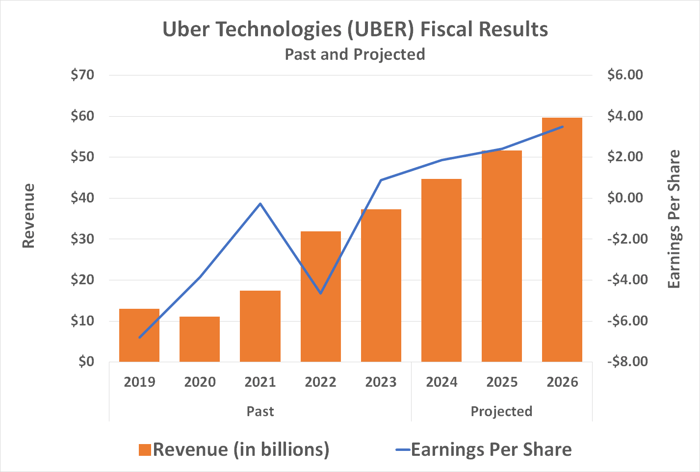

Analysts anticipate continued growth in both revenue and profits into the foreseeable future.

Data source: StockAnalysis.com. Chart by author.

More than just numbers, a significant cultural shift supports Uber’s growth. Car ownership is decreasing, and fewer people are even seeking drivers’ licenses.

According to the U.S. Federal Highway Administration, car registrations in the U.S. have declined from a peak of 138 million in 2001 to just under 100 million in 2022. This decline accelerated during the COVID-19 pandemic but has been a trend for years.

While it may sound contradictory, another statistic shows that there were 283.4 million registered vehicles in the U.S. as of 2022. However, this figure includes buses and heavy trucks mainly owned by companies.

Vehicle ownership rates within households have also plateaued. As of 2022, typical American households owned 1.83 cars, slightly down from the peak of 1.89 in 2001.

Shifting Attitudes Among Young Adults

The trend toward less vehicle ownership appears resilient. A recent Zipcar poll found that over one-third of Americans may not own a vehicle by 2030. Nearly 20% of those surveyed expressed serious intentions to give up their cars in favor of other transport options.

Sales of light vehicles (excluding commercial trucks) are expected to modestly reach 15.9 million units this year, up from 15.5 million in 2023, but still significantly lower than the 17.4 million sold in 2016.

Young people today show a decreasing interest in car ownership compared to older generations. Data from the U.S. Department of Transportation indicates that only 25% of 16-year-olds had a driver’s license in 2022, down from 50% in 1983. The percentage of 18-year-olds with licenses also fell from 80% to 60% over the same period.

Rising costs play a role in this shift. With average car payments exceeding $700 a month, many young adults find Uber a more economical and convenient alternative to owning a vehicle, especially as they rely on technology for socializing and entertainment.

Uber vs. Amazon: A Strong Investment Comparison

Investing in Amazon remains a solid choice; it benefits from consumer shifts similar to Uber’s. Many people prefer online shopping and rely on Amazon to deliver goods. However, when comparing the two, Uber shows greater potential due to its unique cultural momentum.

Market research predicts that the global ride-hailing industry will grow at an average pace of 15.4% each year until 2034, positioning Uber to capture significant market share.

A New Opportunity for Investment

If you’ve ever felt like you missed the opportunity to invest in successful stocks, now may be your chance.

Our analysts occasionally issue a “Double Down” stock recommendation for companies they believe are poised for substantial growth. Here are a few past examples:

- Nvidia: If you had invested $1,000 when we doubled down in 2009, you’d now have $374,613!*

- Apple: A $1,000 investment from 2008 would be worth $46,088!*

- Netflix: $1,000 invested when we doubled down in 2004 would now be $475,143!*

We’re currently issuing “Double Down” alerts for three impressive companies, and the opportunity to invest may not come again soon.

See 3 “Double Down” stocks »

*Stock Advisor returns as of December 30, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is on The Motley Fool’s board of directors. James Brumley has no positions in the stocks mentioned. The Motley Fool has positions in and recommends Amazon and Uber Technologies. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.