Every investor dreams of uncovering hidden gems in the stock market – the proverbial golden goose that consistently outperforms the benchmark indices. Imagine the thrill of stumbling upon a winning formula, the satisfaction of watching your returns leaving the S&P 500 in the dust.

Back in my college days at Cal State Hayward, a mundane assignment led me down a path that would change my investment strategy forever. I crafted a model, a tool, a Portfolio Grader – designed to sift through the noise and pinpoint stocks with the potential to soar.

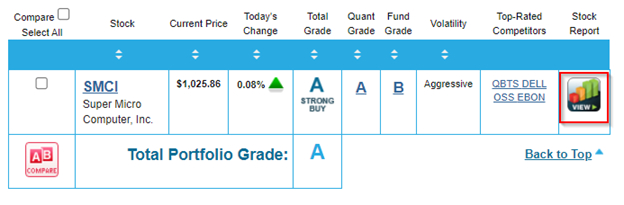

The Portfolio Grader takes a no-nonsense approach, grading stocks on a scale from A to F based on two crucial pillars – fundamental strength and institutional backing. By zeroing in on these key attributes, this tool unveils market darlings with the power to deliver consistent gains, giving investors an edge in navigating the tumultuous waters of the stock market.

The Anatomy of Portfolio Grader

For those unacquainted with the inner workings of the Portfolio Grader, let’s peel back the layers and delve into its core components. It all starts with the Fundamental Grade, where eight critical factors come into play to evaluate a stock’s financial foundation.

From sales growth to earnings surprises, each metric sheds light on the company’s financial health and growth trajectory. A strong Fundamental Grade signifies robust fundamentals, a solid base that can weather market storms and propel the stock to new heights.

But the magic doesn’t stop there. Enter the Quantitative Grade, a measure of institutional support and bullish momentum. This grade gauges where the “smart money” is flowing, providing insights into potential future price movements driven by institutional investors.

Combining the Fundamental and Quantitative Grades yields the Total Grade – a decisive letter grade recommendation that simplifies the stock-selection process:

- A=Strong Buy

- B=Buy

- C=Hold

- D=Sell

- F=Strong Sell

Maximizing Portfolio Grader for Your Investment Strategy

Now, armed with the knowledge of how Portfolio Grader functions, investors can leverage this potent tool to fine-tune their portfolios and unearth market leaders before the crowd catches on. With a few simple clicks, investors can unlock the grades for individual stocks or assess their entire portfolio’s health.

Accessing specific fundamental grades, stock reports, timely news, and expert commentary is just a click away, offering a comprehensive view of your investments at your fingertips. And for the savvy investors looking to save their portfolio for future reference – Portfolio Grader’s got you covered.

Remember, Portfolio Grader undergoes weekly updates, ensuring you stay ahead of any shifts in your stock’s grade. So mark your calendars and kickstart your week with a peek into your portfolio’s performance.

Unearthing Market Gems with Portfolio Grader

Now, the burning question remains – can Portfolio Grader deliver the goods? The answer is a resounding yes.

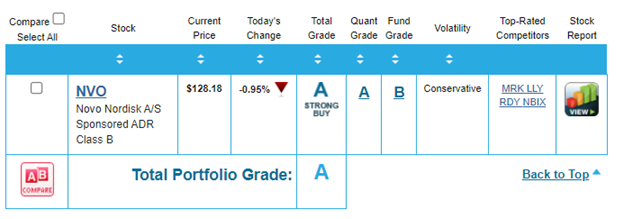

Take, for instance, Novo Nordisk A/S (NVO), a biotech behemoth revolutionizing the healthcare landscape with groundbreaking treatments for diabetes and weight loss. Riding high on the success of products like Ozempic and Wegovy, Novo Nordisk emerged as one of the brightest stars in the High-Growth Buy List.

With the Portfolio Grader guiding the way, investors gained early access to this market leader, showcasing the tool’s prowess in pinpointing future winners. As Novo Nordisk’s stock soared, investors reaped the rewards of staying ahead of the curve, a testament to the Portfolio Grader’s uncanny ability to unveil hidden gems in the stock market.

The Meteoric Rise of Novo Nordisk A/S: A Growth Story Unmatched

A Landmark Performance

Novo Nordisk A/S (NVO) has soared by 18.3% year-over-year to $0.84 per share, surpassing prior estimates of $0.77 per share. This achievement is highlighted by an A-grade in Quantitative analysis and a C-grade in Fundamental evaluation, culminating in a Total Grade of A.

When NVO unveiled its earnings on February 1, 2023, the numbers were nothing short of impressive. Sales in diabetes and obesity care witnessed a remarkable 29% year-over-year surge, while rare disease sales displayed a solid 7% uptick. Notably, Ozempic sales catapulted by a staggering 45% year-over-year.

The Triumph Continues

Throughout 2023, NVO continued to captivate the market with its stellar performance. The pinnacle of their success came when the company released its fiscal year 2023 earnings on January 31 of this year, shattering all expectations. Fourth-quarter sales witnessed a robust 31% year-over-year increase, with obesity care sales leaping by an impressive 38%. NVO reported fourth-quarter earnings of $3.17 billion, equivalent to $0.71 per share, on total sales of $9.51 billion. Analysts predicting earnings of $0.65 per share on $8.81 billion were astounded by a 9.2% earnings beat.

Market Leader Extraordinaire

In the realm of Growth Investor, NVO has been hailed as one of the premier market leaders. This distinction is validated by its exceptional fundamentals and sustained institutional buying fervor. Presently, investors have witnessed a staggering 90% surge in NVO, triumphing over the modest 30% rise of the S&P 500 within that timeframe.

The Path Ahead

What lies on the horizon for NVO? Portfolio Grader suggests that more gains are indeed in store. With a robust A-grade in Quantitative analysis, a B-grade in Fundamental evaluation, and an overarching Total Grade of A, the outlook remains exceedingly bright.

Given NVO’s exceptional recent track record, coupled with its solid fundamentals and noteworthy institutional backing, it unequivocally stands as a must-have addition to any growth-centric portfolio.

It is worth noting that while I could inundate you with countless success stories facilitated by Portfolio Grader, I instead urge you to experience it firsthand. The platform is free to utilize and distills all the critical factors I have previously outlined into an intuitive and easily digestible format.

For those seeking a more hands-on approach and wish to receive my personal recommendations directly, NVO and other fundamentally excellent stocks can be found in my esteemed Growth Investor service.

Our Buy Lists encompass the finest gems from my comprehensive stock database. If your quest is to unearth companies characterized by superior fundamentals and enduring institutional support, I encourage you to explore more about my Growth Investor service today!

(Already part of the Growth Investor subscriber base? Click here to access the exclusive member portal.)

Sincerely,

Louis Navellier

Editor, Market 360

Disclosure:

Novo Nordisk A/S (NVO) and Super Micro Computer, Inc. (SMCI)