Zoom Transforms Into an AI-First Work Platform Positioned for Growth

Zoom Video Communications (ZM) is evolving from its origins as a video conferencing solution into an AI-driven work platform ready for ongoing growth. Recent announcements indicate a strategic shift that may appeal to investors eager to invest in practical AI applications within the business sector.

Financial Fortitude Supports AI Strategy

Zoom’s financial performance illustrates its ability to support innovation and maintain profitability. For fiscal 2025, the company reported revenues totaling $4.67 billion, reflecting a 3.1% increase year over year. Additionally, enterprise revenues climbed 5.2%, reaching $2.75 billion. Operating cash flow rose significantly by 21.7% to $1.95 billion, resulting in a strong 41.7% margin.

A careful approach to managing expenses has led to an improved GAAP operating margin, which expanded by 580 basis points year over year to 17.4%. With approximately $7.8 billion in cash and marketable securities, Zoom is well-positioned to advance its AI-focused strategy while maintaining its share repurchase program, which included around 15.9 million shares during fiscal 2025.

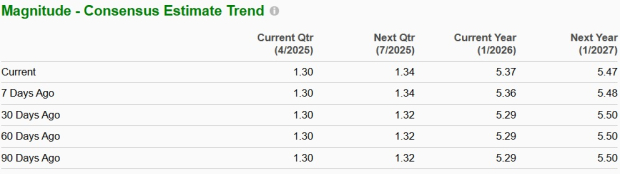

The Zacks Consensus Estimate for fiscal 2026 indicates a revenue growth of 2.68% year over year, projecting revenues to reach $4.79 billion. Furthermore, the consensus earnings estimate has increased by 1.5% to $5.37 per share over the last month.

Image Source: Zacks Investment Research

Find the latest earnings estimates and surprises on Zacks earnings Calendar.

AI Companion 2.0: Zoom’s Key Component

Zoom’s AI Companion is central to the company’s transformation narrative. Monthly active users surged by 68% quarter over quarter, indicating robust customer engagement and validating Zoom’s AI-centric direction.

The newly launched Custom AI Companion add-on, set to be available in April for $12 per user per month, enables organizations to tailor the AI experience with specific company knowledge and industry terminology. This innovation overcomes a significant barrier found in generic AI solutions, potentially enhancing user retention on Zoom’s platform.

Interestingly, Zoom’s federated AI approach combines small and third-party large language models to optimize both performance and cost efficiency. This hybrid model facilitates specialized AI tasks while ensuring adaptability—a critical advantage in a rapidly advancing tech landscape.

Expanding Beyond Meetings: An AI-First Ecosystem

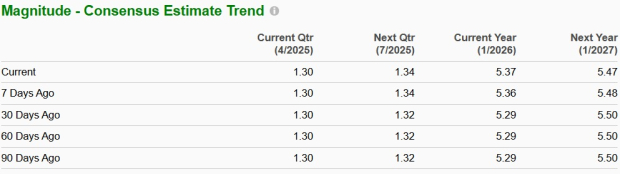

Zoom’s shares have experienced a 10.9% increase over the past six months, contrasting with a 4.5% decline in the overall Zacks Computer and Technology sector. Despite this strong performance, several underlying catalysts and strategic initiatives indicate that the Stock still holds substantial upside potential as the company transitions to an AI-first collaborative platform.

6-Month Performance

Image Source: Zacks Investment Research

Zoom’s strategic appeal stems from its expansion beyond traditional meeting functionalities. The company is embedding AI in its growing product suite, which includes Phone, Team Chat, Events, Docs, and Contact Center. Notably, Zoom Contact Center recently secured its largest contract with a Fortune 100 tech company, encompassing over 15,000 agents, highlighting its competitive edge in adjacent markets.

The introduction of a Virtual Agent with advanced reasoning for voice and chat interactions positions Zoom to capture emerging value in the customer experience automation sector, marking a significant expansion beyond its original focus on collaboration.

Investment Consideration: Why Zoom in 2025?

Currently, Zoom trades at a premium with a trailing 12-month EV/EBITDA ratio of 13.59, compared to the Zacks Internet – Software industry average of 10.78. However, its AI enhancements and strict financial management validate this assessment. Strategic partnerships, including one with Amazon (AMZN), reaffirm its strong market position against competitors like Microsoft (MSFT) Teams and Cisco (CSCO) Webex.

ZM’s EV/EBITDA TTM Ratio Indicates Premium Valuation

Image Source: Zacks Investment Research

Investors should note that Zoom’s shift towards an AI-first framework positions it to harness the productivity gains associated with generative AI. With strong cash flow, prudent expense management, and a focused strategy on practical AI applications, ZM provides an attractive opportunity for those seeking exposure to enterprise AI growth.

Conclusion

In an era where organizations aim to use AI to boost productivity and refine workflows, Zoom’s innovative solutions targeting real business challenges are expected to drive customer adoption and loyalty. For investors looking at a medium to long-term perspective, Zoom’s current valuation presents a favorable entry point to engage with the forthcoming wave of AI-enhanced workplace transformation. Zoom Video currently holds a Zacks Rank #2 (Buy). Investors can see the comprehensive list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks Names #1 Semiconductor Stock

Despite being only 1/9,000th the size of NVIDIA, which soared by over +800% since our recommendation, this new leading chip Stock has significant growth potential ahead.

Fueled by strong earnings growth and an expanding customer base, it’s well-situated to meet the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is expected to surge from $452 billion in 2021 to $803 billion by 2028.

See This Stock Now for Free >>

Want the latest recommendations from Zacks Investment Research? Download 7 Best Stocks for the Next 30 Days today. Click to obtain this free report

Amazon.com, Inc. (AMZN): Free Stock Analysis report

Microsoft Corporation (MSFT): Free Stock Analysis report

Cisco Systems, Inc. (CSCO): Free Stock Analysis report

Zoom Communications, Inc. (ZM): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.