Adobe Faces Market Struggles Despite Strong Q1 Performance

Adobe Inc. (ADBE), based in San Jose, California, is a major player in software, operating through its segments: Digital Media, Digital Experience, and Publishing and Advertising. With a market capitalization of $163.4 billion, Adobe is among the largest software companies globally.

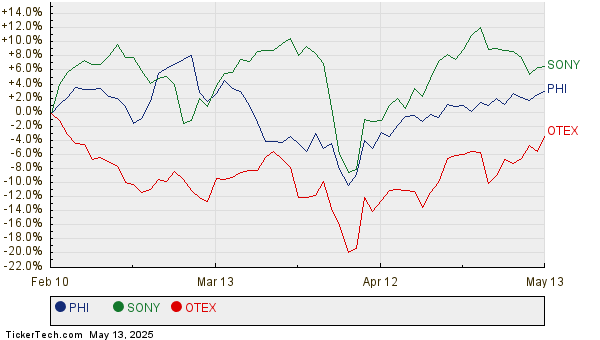

Over the past year, Adobe’s stock performance has been notably weak. The company’s shares have decreased by 17.9% in the last 52 weeks and have dropped approximately 11% year-to-date. This contrasts sharply with the S&P 500 Index’s ($SPX) gains of 11.9% over the same period, along with a modest 64 basis points decline projected for 2025.

Sector Comparison Reveals Struggles

When examining industry comparisons, Adobe also trails the iShares Expanded Tech-Software Sector ETF (IGV), which has seen a 26.3% increase over the past year and a 2.7% rise in 2025.

After releasing a mixed Q1 report on March 12, Adobe’s stock fell by 13.9%. Despite this decline, the company showed solid momentum, with total revenues for the quarter growing 10.3% year-over-year to $5.7 billion—exceeding analyst expectations by 1.1%. Additionally, Adobe’s non-GAAP net income increased 8.7% year-over-year to $2.2 billion, also surpassing projections.

Growth Indicators Show Slowdown

Despite maintaining growth, Adobe has experienced a slowdown in key metrics. The company’s remaining performance obligation (RPO), an important indicator of future revenue, rose 16% year-over-year to $17.6 billion in Q1 2024. However, this growth moderated to 12% year-over-year, reaching $19.7 billion in Q1 2025—this fell short of analyst expectations and impacted investor confidence.

For the fiscal year 2025, which concludes in November, analysts forecast an earnings growth of 11.3% year-over-year to $16.58 per share. Historically, Adobe has a strong track record of surpassing bottom-line estimates, having done so in each of the last four quarters.

Current Analyst Recommendations

Among the 33 analysts covering Adobe’s stock, the consensus rating is a “Moderate Buy,” which includes 21 “Strong Buy,” one “Moderate Buy,” 10 “Hold,” and one “Moderate Sell” rating.

This ranking indicates a slight improvement from two months prior, when one analyst issued a “Strong Sell” recommendation. On April 23, Piper Sandler analyst Brent Bracelin maintained an “Overweight” rating on ADBE but adjusted the price target from $600 to $500.

Currently, ADBE’s average price target of $503.63 signals a 27.2% increase from current price levels, while the highest target of $703 suggests an impressive 77.6% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information, please view the Barchart Disclosure Policy here.

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.