Constellation Energy: Navigating Through Recent Setbacks on the Path to AI-Driven Growth

Constellation Energy Corp CEG has shown impressive performance in the energy industry, achieving almost 100% gains in 2024. However, a recent drop of 9.32% in the past month has raised concerns among investors about the sustainability of this rally.

Electricity Demand Surges Amid AI Growth

The rise of artificial intelligence is driving an unprecedented demand for energy. Data centers, essential for AI functionality, are projected to increase electricity consumption by 160% by the decade’s end. This presents not just a challenge, but a significant opportunity for energy companies.

Constellation Energy’s Strategic Position

Constellation Energy, with its robust nuclear capabilities, is particularly well-placed to benefit from this demand surge. Shahriar Pourreza from Guggenheim has indicated that major tech firms may seek partnerships with Constellation, similar to the collaboration established with Microsoft Corp MSFT in September.

Future Predictions for Stock Performance

These strategic partnerships could enhance Constellation’s financial health, potentially driving the stock price to around $328 by 2025, as forecasted by Guggenheim.

Read Also: Bitcoin Up 1% To $94,000: ‘Sweet’ Setup Going Into 2025, But Beware A Drop Below $93,000, Experts Say

Technical Challenges Ahead

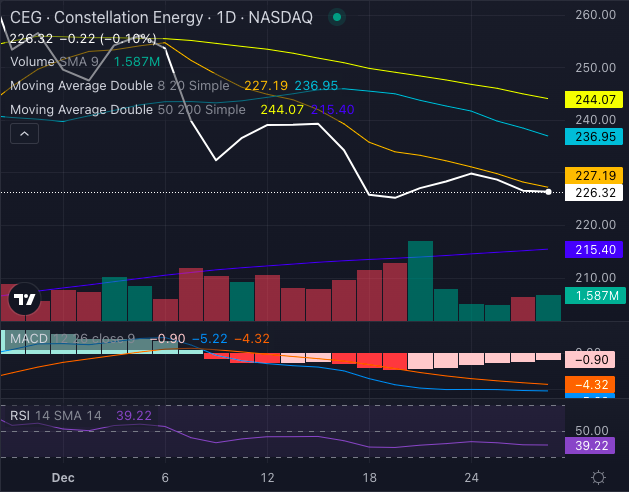

Despite the promising long-term outlook, Constellation Energy’s stock is currently facing technical challenges.

Chart created using Benzinga Pro

The stock is trading below several key moving averages:

- Eight-day SMA: $227.19 (indicates a bearish trend)

- 20-day SMA: $236.95 (indicates a bearish trend)

- 50-day SMA: $244.07 (indicates a bearish trend)

The Moving Average Convergence Divergence (MACD) stands at a negative 5.22, highlighting bearish momentum. In contrast, a Relative Strength Index (RSI) of 39.22 suggests the stock may soon reach oversold conditions, hinting at the potential for a rebound.

What Comes Next for Investors?

Investors now must consider whether Constellation Energy can overcome these short-term difficulties to seize the opportunities presented by the AI energy boom. While the current stock dip might create an appealing entry point for long-term investors, caution is advised given existing technical indicators.

As AI continues to transform the energy sector, Constellation Energy’s nuclear resources may play a critical role in its sustained growth. Observers should keep an eye on the company’s ability to navigate these immediate challenges and unfold its story over time.

Read Next:

Photo: Pitor Swat via Shutterstock

Market News and Data brought to you by Benzinga APIs