Alphabet’s AI Expansion and Cloud Growth Amid Market Challenges

Alphabet (GOOGL) is significantly integrating artificial intelligence (AI) across its product lines, including Search and Google Cloud, which is aiding revenue growth. GOOGL excels in digital advertising and search markets, achieving impressive advertising revenues of $264.59 billion in 2024. Meanwhile, Google Cloud experienced a notable increase in revenues, rising 30% year over year to reach $12 billion in 2024. This surge is attributed to its core cloud offerings, AI infrastructure, and advanced Generative AI (GenAI) tools such as Vertex AI and Gemini. Furthermore, GOOGL’s plan to acquire Wiz for $32 billion aims to bolster Google Cloud’s security features, thereby fostering additional growth.

Simultaneously, Alphabet is broadening its autonomous driving capabilities with its Waymo platform, which is now launching operations in Japan in partnership with GO, a top Japanese taxi service, and Nihon Kotsu, Tokyo’s largest taxi company. The Waymo service is already operational in Phoenix, San Francisco, and Los Angeles, delivering over four million fully autonomous rides in 2024 alone. This year, GOOGL is also introducing Waymo services to Austin and Atlanta via the Uber app, and in a future collaboration with Moove, it plans to extend its services to Miami in 2026. Additionally, the Waymo One app will be accessible to Washington D.C. riders by 2026.

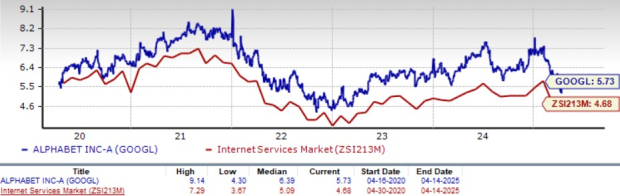

Will these developments positively influence Alphabet’s performance this year? Despite these advancements, Alphabet’s shares have dropped 16% year to date, impacted by adverse macroeconomic factors following former U.S. President Donald Trump’s tariff decisions affecting trade with countries like China, Mexico, and Canada. Sluggish growth in the cloud sector, coupled with rising investments in cloud infrastructure, presents ongoing challenges for Alphabet’s stock.

GOOGL Stock Performance

Image Source: Zacks Investment Research

GOOGL is currently struggling with limited capacity until new expansions are expected to be operational in 2025, leading to increased variability in cloud revenues. The company plans to allocate approximately $75 billion toward capital expenditures in 2025, focusing on enhancing technical infrastructure, particularly for servers, data centers, and networking capabilities.

Given these circumstances, what should investors consider regarding GOOGL stock? Let’s explore.

GOOGL’s Enhanced AI Portfolio and Wiz Acquisition

At the Cloud Next 2025 conference in Las Vegas, GOOGL introduced Ironwood, its seventh-generation Tensor Processing Unit (TPU), expected to launch later this year. Google Cloud also presented its Cloud Wide Area Network (Cloud WAN), allowing enterprises to tap into its private global fiber network. Alphabet revealed its new quantum chip, Willow, alongside the AI model updates with Gemini 2.5 and Gemini 2.5 Flash, which is a low-latency, cost-efficient version aimed at developers.

These AI initiatives, along with a focus on Search, are projected to bolster Alphabet’s revenue growth. Features like Circle to Search are attracting younger users. In 2024, Vertex usage surged by 20 times, with notable engagement from developers using Gemini Flash, Gemini 2.0, Imagen 3, and Veo. Recently, GOOGL also launched Gemma 3, a suite of lightweight, state-of-the-art open models operable on a single GPU or TPU.

The integration of Wiz will enhance Google Cloud’s security framework, enabling robust support across multi-cloud environments. Wiz’s cloud security platform is already utilized by recognizable clients such as Amazon (AMZN), Microsoft (MSFT), and Oracle (ORCL). This acquisition underscores Google Cloud’s critical role in Alphabet’s growth strategy, which contributed to 12.4% of total revenues in 2024, marking a growth of 30.6% compared to 2023, surpassing the previous year’s 26% increase.

In stimulating competition against major players like Amazon Web Services and Microsoft Azure, the Wiz buyout is pivotal. According to Statista, referencing data from Synergy Research Group, Amazon held a 30% share of the global cloud infrastructure market in the fourth quarter of 2024, followed by Microsoft at 21% and Google Cloud with 12%.

Additionally, GOOGL has expanded its partnership with Oracle, announcing an industry-first partner program and the forthcoming availability of the Oracle Base Database Service on Google Cloud. This service now supports Oracle Exadata X11M and provides Oracle Interconnect for government cloud customers, with plans to extend its reach to 11 more regions over the next year in response to increasing customer demand.

Earnings Estimate Revisions Indicate Positive Outlook for GOOGL

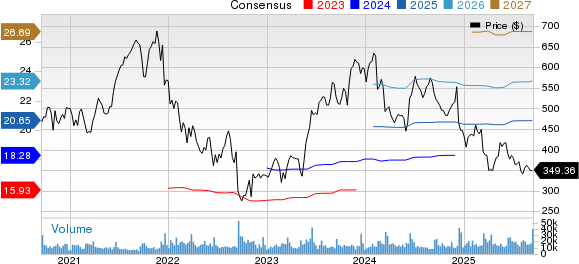

The Zacks Consensus Estimate for first-quarter 2025 earnings is projected at $2.04 per share, reflecting an increase of a couple of cents in the last 30 days, which translates to a 6.88% growth year-over-year.

The consensus forecast for 2025 total earnings stands at $8.93 per share, showing an uptick of 3 cents in the past month and suggesting an 11.07% increase compared to the previous year.

Alphabet Inc. Stock Price and Consensus

Alphabet Inc. price-consensus-chart | Alphabet Inc. Quote

Alphabet’s earnings have consistently surpassed the Zacks Consensus Estimate over the trailing four quarters, averaging an 11.57% surprise. (Get the latest EPS estimates and surprises on Zacks earnings Calendar.)

GOOGL Stock Considerations Point to Overvaluation

Currently, Alphabet’s Value Score sits at C, indicating a potentially stretched valuation at this time.

Presently, GOOGL stock trades at a forward 12-month Price/Sales ratio of 5.73X, compared to the industry’s 4.68X, suggesting it is trading at a premium.

Price/Sales Ratio (Forward 12 Months)

Image Source: Zacks Investment Research

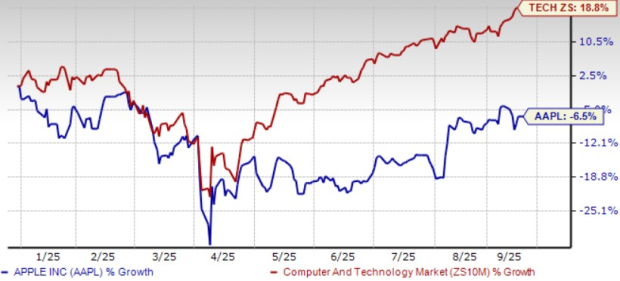

Moreover, GOOGL shares are currently trading below both the 50-day and 200-day moving averages, indicating a bearish market sentiment.

GOOGL Shares Below 50-Day & 200-Day SMAs

Alphabet’s Cloud Investments Set to Drive Future Growth

Overview of Alphabet’s Position

Alphabet is enhancing its capabilities in Generative AI while making substantial investments in cloud computing. These initiatives could serve as future catalysts despite increasing competition and regulatory challenges in the cloud sector. The company’s stronghold in the search engine market, combined with its growing cloud presence, positions GOOGL for long-term success.

Current Stock Status

Alphabet holds a Zacks Rank of #3 (Hold), indicating that investors might consider waiting for a better buying opportunity in the Stock. For a complete list of Zacks #1 Rank (Strong Buy) stocks, you can click here.

Top Stock Picks for the Upcoming Month

Recently released findings highlight seven elite stocks selected from the broader list of 220 Zacks Rank #1 Strong Buys. Experts consider these stocks to be “Most Likely for Early Price Pops.”

Historically, the complete list has outperformed the market more than twice, achieving an average annual gain of +23.9% since 1988. Thus, it is advisable to give these seven stocks your immediate attention.

If you want the latest insights from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click here for your free report.

Stock Analysis Reports

Here are some companies with available free stock analysis reports:

- Amazon.com, Inc. (AMZN): Free Stock Analysis report

- Microsoft Corporation (MSFT): Free Stock Analysis report

- Oracle Corporation (ORCL): Free Stock Analysis report

- Alphabet Inc. (GOOGL): Free Stock Analysis report

This article was initially published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.