Alphabet’s Stock Struggles Despite AI Innovations and Strategic Moves

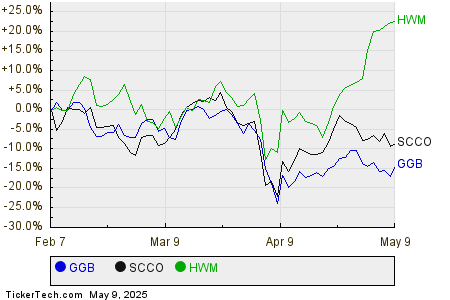

Alphabet (GOOGL) has seen a year-to-date decline of 19.2%, which is worse than the broader Zacks Computer & Technology sector’s drop of 16.4%. This drop stems primarily from challenging macroeconomic factors following U.S. President Donald Trump’s imposition of tariffs affecting trade with partners like China, Mexico, and Canada.

However, the company’s efforts to integrate artificial intelligence (AI) into its offerings are proving to be a significant growth catalyst. During the Cloud Next 2025 conference in Las Vegas, Alphabet made notable announcements aimed at advancing its technology position.

Key Technological Advancements Unveiled

One of the standout announcements was the introduction of Ironwood, the seventh-generation Tensor Processing Unit (TPU). Expected to launch later this year, Ironwood boasts a performance improvement of 3,600 times compared to Alphabet’s first publicly available TPU and demonstrates 29 times better energy efficiency.

In addition, Google Cloud introduced its Cloud Wide Area Network (Cloud WAN), designed to offer enterprises access to the company’s private global fiber network. This service is set to launch later this month, providing over 40% faster performance while significantly reducing ownership costs.

Alphabet also showcased Willow, a groundbreaking quantum chip that addresses crucial error correction challenges. By exponentially lowering errors with each additional qubit, Willow paves the way for scalable quantum computing solutions.

On the AI front, Alphabet launched Gemini 2.5, its latest and most advanced reasoning model, as well as Gemini 2.5 Flash, a cost-effective version meant for developers with low-latency requirements.

Revenue Growth Amid Competition

Alphabet’s extensive portfolio, including Google Cloud, Search, and YouTube, is expected to guide GOOGL through the current challenging market phase. The company’s acquisition plan for Wiz, a cloud security firm priced at $32 billion, is poised to bolster Google Cloud’s security services. Wiz is recognized in the industry, with a client base that includes Amazon (AMZN), Microsoft (MSFT), and Oracle (ORCL).

Furthermore, Alphabet maintains a stronghold in the digital advertising and search market which drives a major portion of its revenue. In the fourth quarter of 2024, Google Search revenues grew 13% year-over-year to $54 billion, supported by strength in the financial services and retail sectors. YouTube advertising similarly increased by 14% year-over-year, reaching $10.5 billion, while Google Cloud revenues surged by 30% year-over-year to $12 billion, driven by its core cloud services and generative AI solutions like Vertex AI and Gemini. Yet, GOOGL contends with fierce competition from Microsoft and Amazon in the cloud space.

Deepening Enterprise Partnerships

Alphabet continues to expand its partnerships with enterprises, fostering growth in AI and cloud technologies. Recently, the company utilized NVIDIA’s (NVDA) H200-based platforms for clients and became the first to announce a customer running on the promising Blackwell platform, reinforcing its strong relationship with NVIDIA.

Moreover, GOOGL has enhanced its cooperation with Oracle, unveiling an industry-first partner program and the imminent launch of the Oracle Base Database Service on Google Cloud, now compatible with Oracle Exadata X11M and providing Oracle Interconnect for U.S. Government Cloud customers. Plans are in place for Oracle and Alphabet to roll out their collaborative service to 11 additional regions over the next year to meet rising demand.

Projected First-Quarter Performance

Looking ahead, Alphabet anticipates that its first-quarter 2025 revenues may be adversely affected by unfavorable foreign exchange rates and one fewer revenue day compared to the previous year.

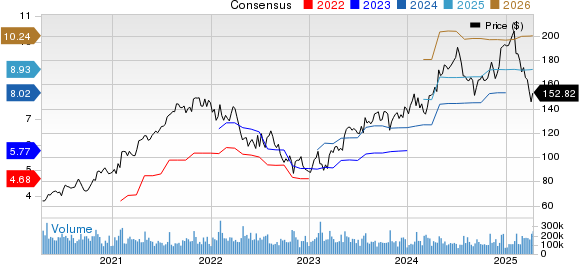

The Zacks Consensus Estimate for first-quarter 2025 revenues stands at $75.63 billion, indicating an 11.87% increase from the equivalent quarter the year before.

Find the latest EPS estimates and surprises on the Zacks earnings Calendar.

For the same quarter, the consensus prediction for earnings is set at $2.02 per share, reflecting no change in estimates over the last 30 days and representing a year-over-year growth of 6.88%.

Zacks Investment Outlook

Currently, Alphabet holds a Zacks Rank of #3 (Hold). For those interested, you can see the comprehensive list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Top Semiconductor Stock Recommended by Zacks

This semiconductor stock, though just 1/9,000th the size of NVIDIA—which has seen an impressive +800% growth since our recommendation—shows great potential for future expansion due to strong earnings growth and a burgeoning customer base. The demand for artificial intelligence, machine learning, and Internet of Things technologies is set to drive the global semiconductor market from $452 billion in 2021 to a staggering $803 billion by 2028.

See this promising Stock Now for Free >>

For latest recommendations from Zacks Investment Research, you can download the report on the 7 Best Stocks for the Next 30 Days. Click to access this free report.

Amazon.com, Inc. (AMZN): Free Stock Analysis report

NVIDIA Corporation (NVDA): Free Stock Analysis report

Oracle Corporation (ORCL): Free Stock Analysis report

Alphabet Inc. (GOOGL): Free Stock Analysis report

This article originally published on Zacks Investment Research (zacks.com).

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.