Investor Interest Surges as Amazon Expects Strong Q4 Results

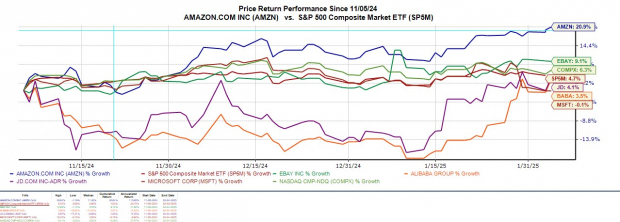

Amazon’s AMZN stock has seen a boost in investor confidence following the company’s announcement of record sales during the holiday season.

As the largest e-commerce firm, Amazon holds a strong lead over eBay EBAY and even global competitors like Alibaba BABA and JD.com JD. Additionally, Amazon Web Services (AWS) continues to dominate the cloud industry ahead of rivals such as Microsoft MSFT Azure.

With momentum building lately, investors are keen to know if now is the right time to purchase Amazon stock as the company prepares to release its Q4 results after-market hours on Thursday, February 6.

Image Source: Zacks Investment Research

What to Expect from Amazon’s Q4 Report

According to Zacks estimates, Amazon’s Q4 sales are projected to rise by 10% to $187.28 billion, up from $169.96 billion a year prior. Notably, AWS sales are expected to jump 19% to $28.83 billion compared to $24.2 billion in the same quarter last year.

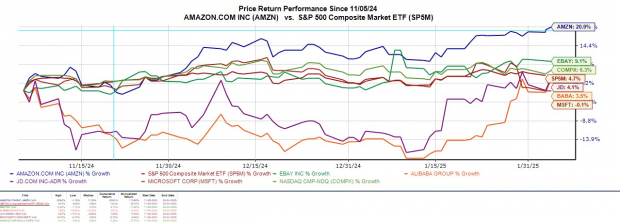

In terms of earnings, Q4 EPS is forecasted to increase by 50% to $1.52 from $1.01 in the previous year. Interestingly, the Zacks ESP (Expected Surprise Prediction) suggests that Amazon might exceed earnings expectations, with the Most Accurate Estimate at $1.59, nearly 5% above the Zacks Consensus.

Image Source: Zacks Investment Research

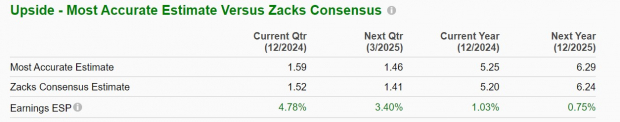

The tech giant has consistently exceeded earnings expectations for eight quarters, showcasing an impressive average EPS surprise of 25.85% over its last four quarterly reports.

Image Source: Zacks Investment Research

Looking Ahead: Full-Year Projections

For fiscal year 2024, Amazon is expected to post total sales growth of 11%, reaching $637.43 billion. Moreover, annual earnings are anticipated to rise by 79%, hitting $5.20 per share compared to $2.90 in 2023.

Analyzing Amazon’s Valuation

Currently trading near $240, AMZN reflects a forward earnings multiple of 38X—not excessively high compared to the S&P 500 benchmark, which is at 31.5X. Furthermore, investors can find positivity in the fact that AMZN is trading significantly below its five-year high of 161.3X and offers a notable discount to the median of 66X during this time frame.

Image Source: Zacks Investment Research

Summarizing the Outlook

As Amazon prepares for its Q4 release, its stock currently has a Zacks Rank #2 (Buy). The Zacks ESP indicates that positive surprises in Q4 results are likely, following an outstanding holiday shopping season.

If favorable guidance follows, AMZN could experience a continued rally, with Zacks projecting another year of double-digit growth for both sales and earnings in FY25.

Research Chief Highlights “Top Pick for Exceptional Growth”

Five Zacks experts have identified their top stock picks that could potentially double in value. Among these, the Director of Research Sheraz Mian has selected one company poised for remarkable growth.

This favorite focuses on millennial and Gen Z markets, achieving nearly $1 billion in revenue last quarter. A recent decline makes it an ideal time to invest now. While not every top pick performs, this one has potential to eclipse Zacks’ previous top selections, such as Nano-X Imaging, which surged +129.6% in just over nine months.

Free: Access Our Top Stock and 4 Alternatives

For the latest recommendations from Zacks Investment Research, download our report on the 7 Best Stocks for the Next 30 Days. Click to get this free report.

Amazon.com, Inc. (AMZN) : Free Stock Analysis Report

Microsoft Corporation (MSFT) : Free Stock Analysis Report

eBay Inc. (EBAY) : Free Stock Analysis Report

JD.com, Inc. (JD) : Free Stock Analysis Report

Alibaba Group Holding Limited (BABA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.