AMD Faces Challenges: Is a Comeback in Sight for 2025?

Advanced Micro Devices (NASDAQ: AMD), commonly referred to as AMD, has struggled as a tech stock over the last year. In 2024, the company saw its stock fall by 18%, despite its strong potential as a leader in artificial intelligence (AI) chip production.

Over the last five years, AMD has shown notable growth, with an increase of about 140%. Historically, the company has often outperformed market averages. As we look to 2025, investors are wondering: Is AMD poised for a recovery, or will it continue to face challenges?

Start Your Mornings Smarter! Get Breakfast news delivered to your inbox every market day. Sign Up For Free »

AMD’s Growth Rate Leaves Much to Be Desired

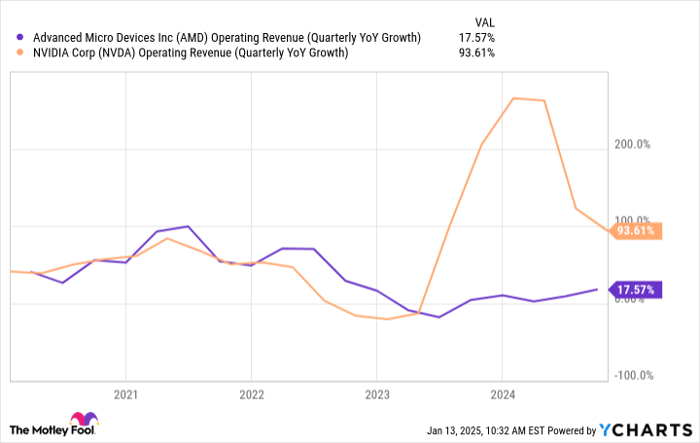

The key focus in the AI sector is growth, an area where AMD has not excelled recently. Despite its involvement in developing AI chips, AMD has fallen behind its primary competitor, Nvidia. Although AMD’s chips are generally priced lower, the key question remains: Will demand for them increase?

AMD Operating Revenue (Quarterly YoY Growth) data by YCharts

There is a clear reason for Nvidia’s strong investment appeal: its growth rates. A comparison of AMD and Nvidia’s growth reveals significant differences. While AMD’s growth rate has shown some recent improvement, it still falls short of Nvidia’s impressive numbers.

For AMD to experience a rebound this year, it must demonstrate that its AI chips can compete with Nvidia’s offerings. Improving its growth rate substantially is essential for this to happen.

AMD’s Stock: Not Necessarily a Bargain

One might think that AMD’s drop in stock price would make it a better investment compared to Nvidia. However, despite AMD’s recent underperformance, it isn’t significantly cheaper than Nvidia right now.

In fact, Nvidia continues to be the healthier option due to its strong growth figures and higher profit margins, making it a more attractive investment based on earnings multiples.

AMD PE Ratio data by YCharts

While AMD’s price-to-earnings ratio has improved recently, there’s still a considerable gap to close when like comparing it to Nvidia’s comparatively lower multiple. Ultimately, AMD’s ability to attract growth investors hinges on its performance in this area.

Is Now the Right Time to Invest in AMD?

Both AMD and Nvidia are promising stocks connected to AI for long-term investors. However, AMD must demonstrate that its chips can compete effectively with Nvidia. If successful, it could lead to accelerated growth and improved earnings, potentially narrowing the gap in valuation.

At this moment, AMD stands out as a somewhat contrarian investment. For risk-tolerant investors, purchasing AMD now could yield significant gains, provided the company shows improved earnings in the forthcoming quarters. Nvidia, being a safer choice, might have limited growth potential since it is already one of the most valued companies globally.

If you prefer a cautious approach, it might be wise to hold off on buying AMD for now. Observing how it performs throughout the year will provide better insights. Should its AI chips contribute to a noticeable increase in growth, it could signal a recovery. Conversely, if the earnings remain disappointing, further declines could be expected.

Your Second Chance for a Lucrative Investment

Ever feel like you’ve missed out on top-performing stocks? Here’s some news that might change that.

Occasionally, our expert analysts issue a “Double Down” stock recommendation for companies expected to soar. If you’re concerned about missing your window, you might want to consider investing now.

- Nvidia: If you invested $1,000 when we doubled down in 2009, you’d have $341,656!*

- Apple: If you invested $1,000 when we doubled down in 2008, you’d have $44,179!*

- Netflix: If you invested $1,000 when we doubled down in 2004, you’d have $446,749!*

Currently, we are issuing “Double Down” alerts for three outstanding companies, and this may be one of the few chances you have.

See 3 “Double Down” stocks »

*Stock Advisor returns as of January 13, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices and Nvidia. The Motley Fool has a disclosure policy.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.