Advanced Micro Devices (AMD) reported significant revenue growth from its data center segment in the first quarter of 2025, with revenues soaring 57.2% year-over-year to $3.674 billion, making up 49.4% of total revenues. This surge is attributed to the adoption of fifth-generation EPYC processors and AI accelerator deployments, with major hyperscalers like AWS, Google, and Oracle launching over 30 new EPYC-powered cloud instances.

AMD continues to expand its footprint in various sectors, including automotive and manufacturing, with all top 10 telecom, aerospace, and semiconductor companies now using EPYC processors. However, it faces strong competition from Intel and NVIDIA. In Q1 2025, Intel’s data center and AI group revenues grew 8% year-over-year to $4.13 billion, while NVIDIA’s data center revenues surged 73.3% year-over-year to $39.1 billion.

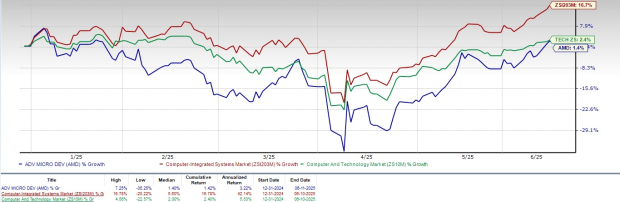

AMD’s shares have gained 1.4% year-to-date, underperforming the Zacks Computer & Technology sector’s return of 2.4%. The consensus estimate for Q2 2025 earnings is set at 56 cents per share, reflecting an 18.84% decline year-over-year.