Bank Earnings Preview: JPMorgan, Wells Fargo, and Citigroup Set to Report

JPMorgan’s shares have declined slightly, down just over 3% since their highs in late November, which performs better than the Zacks Finance sector average but lags behind the broader market, which has remained flat during the same period. Since the elections in November, however, JPMorgan’s stock has risen nearly 2%, while the S&P 500 index has shown modest losses.

Wells Fargo (WFC) will also kick off the Q4 earnings season for the Finance sector on Wednesday, January 15th. Since election day, its shares have barely moved into positive territory, while Citigroup (C) has outperformed both of its competitors.

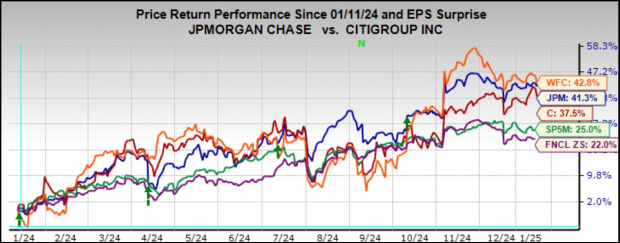

Looking at the bigger picture, these three banks have significantly outperformed the broader market over the past year. The chart below illustrates the performance of JPMorgan, Citigroup, and Wells Fargo compared to the S&P 500 index and the Zacks Finance sector.

Image Source: Zacks Investment Research

Recent expectations regarding Federal Reserve easing had already decreased after the ‘hawkish cut’ in December. This likely moderated further after the impressive jobs report. Nevertheless, the overall environment for these banks has improved recently due to a positive macroeconomic outlook and a more flexible regulatory framework under President Trump.

The rise in long-term treasury yields has been widely discussed in the market, opposing the trend of easing monetary policy. Analysts agree that the strength in these yields primarily indicates optimistic economic growth expectations, along with increased demand for investment capital in sectors like artificial intelligence. Sticky inflation expectations contribute to this situation, but economic growth is the leading factor.

The bond market’s initial response to the significant jobs report was to decrease the steepness of the yield curve slightly, yet it remains much steeper than several months ago. This situation is advantageous for net interest income (NII) for these banks under stable circumstances. Increased estimates for 2025 NII seem possible, especially with a potential rise in deposit and loan growth.

Unfortunately, loan demand has been weak in recent quarters, although December data suggests a +1.8% growth rate—the highest in over a year. This growth is not solely due to credit card activity, as commercial and industrial loans (C&I) are also showing positive trends.

On the topic of credit quality, issues in the commercial real estate (CRE) sector are well recognized and adequately provisioned for by the major banks. Beyond CRE, though, aggregate bankruptcies in the U.S. have risen significantly from the low points during the Covid pandemic in early 2022. However, the growth rate of bankruptcies has been stabilizing in recent months.

With current bankruptcy rates approximately 30% lower than pre-Covid levels, the recent slowdown in the growth of bankruptcies likely reflects healthier household finances. This is further seen in early-stage credit card delinquencies, which have shown flat growth rates year-over-year, signaling favorable results for net charge-off rates this year.

As for investment banking, revenues are expected to rise in the mid-teens percentage range. JPMorgan and other industry leaders could see gains exceeding +20%. The equity capital markets continue to perform well, combined with moderate improvements in debt capital markets and early recovery signs in mergers and acquisitions. Additionally, trading volumes surged in Q4, with notable improvements in fixed income, currencies, and commodities (FICC) after a flat performance in the first three quarters of the year.

Forecasts for JPMorgan, Wells Fargo & Citigroup

JPMorgan anticipates earnings of $4.02 per share, a +1.3% increase compared to the previous year, on revenues of $40.9 billion, up +6.1% year-over-year. The stock price has shown gains since its last earnings report on October 11th, buoyed by positive outlook commentary. Estimates have been on the rise, with the current $4.02 projection up from $3.82 a month ago and $3.79 three months prior.

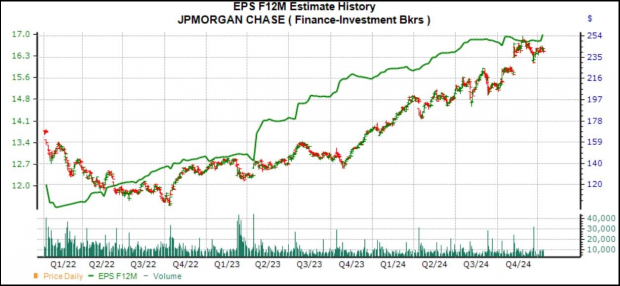

The chart below depicts JPMorgan’s stock price relative to the evolution of the forward 12-month consensus EPS estimate.

Image Source: Zacks Investment Research

Wells Fargo is expected to report EPS of $1.34, reflecting a +3.9% year-over-year increase, on revenues of $20.5 billion (+0.1% YoY). Since the start of the quarter, EPS estimates have gradually increased, rising from $1.32 a month ago and $1.30 three months ago. Following its last quarterly report on October 11th, Wells Fargo shares experienced a rise.

Citigroup anticipates earnings of $1.24 per share, a substantial +47.6% year-over-year increase, on $19.6 billion in revenues (up +12.1%). The trend in analyst revisions has been slightly positive, with estimates being adjusted upward since the quarter began. After the last quarterly report, Citigroup shares fell. However, investor reactions often hinge more on management’s efforts to streamline operations rather than the numbers themselves, and this quarter is unlikely to differ.

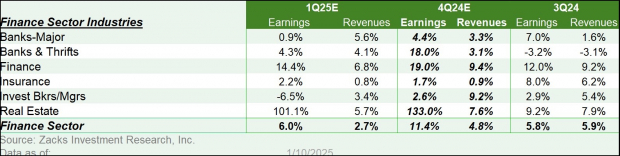

The Zacks Major Banks industry, which includes JPMorgan, Citigroup, and Wells Fargo, is projected to report a +4.4% increase in earnings for Q4 2024 alongside a +3.3% rise in revenues. Notably, this industry represents about 50% of the Zacks Finance sector’s total earnings over the past four quarters.

Image Source: Zacks Investment Research

As demonstrated above, Q4 earnings for the Zacks Finance sector are projected to rise by +11.3% compared to the previous year, with a +4.8% increase in revenues.

Despite the strong performance of major bank stocks over the last year, they remain attractively priced based on traditional valuation benchmarks. The chart below provides a 10-year history of the Zacks Major Banks industry based on forward 12-month P/E ratios.

Image Source: Zacks Investment Research

At first glance, this valuation might seem high or even inflated. However, we must consider the industry’s valuation relative to the broader market.

Currently, the Zacks Major Banks industry trades at just 66% of the forward 12-month P/E multiple of the S&P 500 index. In the past decade, the industry has fluctuated between a high of 78% and a low of 52%, with a median of 62%, as illustrated in the chart below.

Image Source: Zacks Investment Research

Bank Earnings Kick Off Q4 Results

This week, the Q4 earnings season begins in earnest with major results from banks. The cycle has already started, as 22 companies from the S&P 500 index—including industry leaders like FedEx, Nike, and Oracle—reported their earnings for fiscal quarters ending in November. Analysts, including those at Zacks, consider these November results as part of the December quarter’s performance.

Upcoming reports this week will include 18 additional S&P 500 companies, featuring UnitedHealthcare, Schlumberger, and Fastenal along with the significant banking sector results.

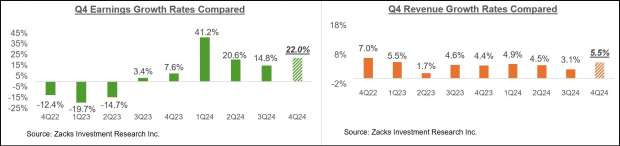

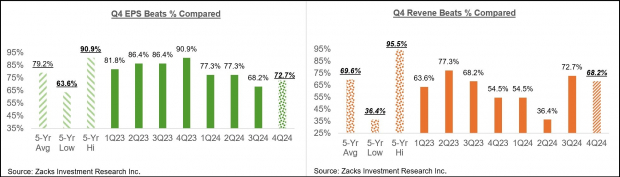

So far, the 22 companies that have reported indicate total earnings growth of +22% compared to last year, along with +5.5% higher revenues. Notably, 72.7% exceeded earnings-per-share (EPS) estimates, while 68.2% surpassed revenue projections.

Comparison charts that follow illustrates how these companies’ growth rates adapt over recent periods.

Image Source: Zacks Investment Research

Charts below reflect the percentages of EPS and revenue beats from this group over recent quarters.

Image Source: Zacks Investment Research

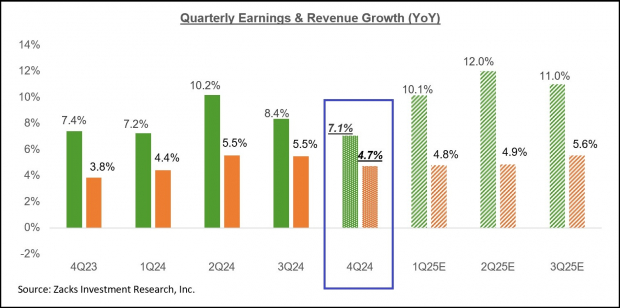

Overall Earnings Outlook

The chart displayed below provides an overview of Q4 earnings and revenue growth expectations, set against the backdrop of the previous four quarters and forecasts for the next three.

Image Source: Zacks Investment Research

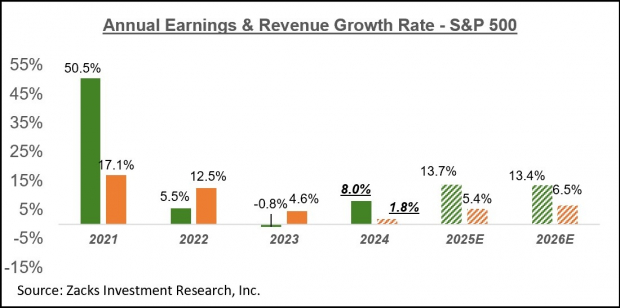

The following chart illustrates the annual earnings trajectory, highlighting anticipated double-digit growth for 2025 and 2026.

Image Source: Zacks Investment Research

For a comprehensive analysis of the earnings outlook, including upcoming expectations, visit our weekly Earnings Trends report >>>> Broad-Based Growth Expected in 2025

Access All Zacks Recommendations for Only $1

We mean it.

Some years back, we surprised our members by offering a 30-day trial to access all our picks for just $1, with no future obligations.

Countless individuals seized this opportunity, while others hesitated, fearing a catch. However, our aim is simple: we want users to explore our services like Surprise Trader, Stocks Under $10, Technology Innovators, and others, which resulted in 228 positions yielding double- and triple-digit gains in 2023 alone.

Wells Fargo & Company (WFC): Free Stock Analysis Report

JPMorgan Chase & Co. (JPM): Free Stock Analysis Report

Citigroup Inc. (C): Free Stock Analysis Report

Click here to read this article on Zacks.com.

The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Nasdaq, Inc.