Cloudflare Exceeds Expectations with Strong Q3 Performance

Cloudflare NET has reported impressive third-quarter 2024 non-GAAP earnings of 20 cents per share, outperforming the Zacks Consensus Estimate by 11.11%. This marks a substantial year-over-year increase of 29.4%.

In fact, NET has topped the Zacks Consensus Estimate for earnings in each of the last four quarters, with an average surprise of 25.5%.

Check out the latest EPS estimates and surprises on Zacks Earnings Calendar.

For the third quarter, NET’s revenues reached $430.1 million, exceeding expectations by 1.52%.

This 28.2% growth in revenues compared to the previous year is largely due to strong new enterprise onboarding, significant advances in the public sector, and heightened customer focus on security, coupled with a zero-trust approach.

NET’s solid third-quarter results, propelled by an influx of large enterprises outside the United States, have led to an increased fourth-quarter outlook. However, the stock experienced a decline of over 6% in pre-market trading.

Year-to-date, NET’s shares have appreciated 14.9%, lagging behind the Zacks Internet – Software industry’s return of 30.1%.

Detailed Q3 Financial Metrics

The success of NET’s top-line performance is attributed to a diverse mix of customer segments, covering both Channel Partners and Direct Customers.

Revenue from Channel Partners, which comprises 20.7% of total revenue, hit $88.9 million, reflecting a remarkable 70% increase from last year.

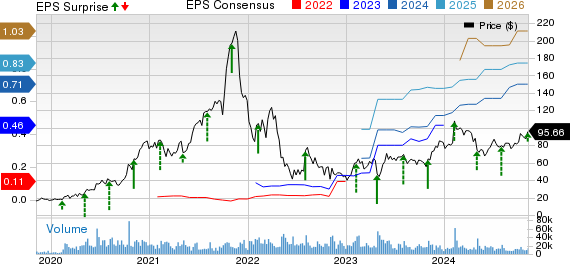

Cloudflare, Inc. Price, Consensus and EPS Surprise

Cloudflare, Inc. price-consensus-eps-surprise-chart | Cloudflare, Inc. Quote

Similarly, revenues from Direct Customers, making up 79.3% of the total, totaled $341.2 million, showing a 20% rise year over year.

The company had 221,540 paying customers in Q3, which is a 22% year-over-year increase. Additionally, NET added 219 new customers with annual revenues exceeding $100,000, bringing the total to 3,265 by the end of the quarter.

NET’s non-GAAP gross profit for the third quarter jumped 28% year over year to $339.1 million, while the non-GAAP gross margin rose by 10 basis points to 78.8%.

Moreover, non-GAAP operating income surged to $63.5 million, up from $42.5 million in the same quarter last year. The non-GAAP operating margin improved by 210 basis points to 14.8%.

Financial Health: Balance Sheet and Cash Flow

As of September 30, 2024, Cloudflare reported cash, cash equivalents, and available-for-sale securities amounting to $1.82 billion, a rise from $1.76 billion as of June 30, 2024.

NET generated an operating cash flow of $104.7 million alongside a free cash flow of $45.3 million.

Updated Guidance for Q4 and FY24

Looking ahead to the fourth quarter, Cloudflare anticipates revenues between $451 million and $452 million.

The current Zacks Consensus Estimate for revenues stands at $455.1 million, representing a year-over-year increase of 25.6%.

For Q4, non-GAAP income from operations is projected between $57 million and $58 million, with expected non-GAAP earnings of 18 cents per share.

The Zacks Consensus Estimate for earnings is currently set at 17 cents per share, signifying a year-over-year growth of 13.3%.

For the entire year of 2024, NET expects revenues to fall between $1.661 billion and $1.662 billion. The consensus estimate for revenues is $1.66 billion, suggesting an increase of 27.9% from the previous year.

Non-GAAP income from operations is forecasted between $220 million and $221 million, while non-GAAP earnings are expected to be 74 cents per share.

The Zacks Consensus Estimate for earnings stands at 71 cents per share, reflecting a year-over-year increase of 44.9%.

Zacks Rank and Alternative Investments

Currently, NET holds a Zacks Rank #3 (Hold).

Shopify SHOP, CyberArk Software CYBR, and Bilibili BILI are among better-ranked stocks worth considering in the broader Zacks Computer & Technology sector.

Both Shopify and CyberArk boast a Zacks Rank #1 (Strong Buy), while Bilibili carries a Zacks Rank #2 (Buy). Explore the complete list of today’s Zacks #1 Rank stocks here.

Year-to-date, SHOP shares have risen 9.8%. Shopify plans to announce its third-quarter 2024 results on November 12.

CYBR shares have surged by 35.2% in the same time frame. CyberArk Software is scheduled to report its third-quarter 2024 results on November 13.

BILI shares have skyrocketed, showing a 98.3% increase year-to-date. Bilibili is set to release its third-quarter results on November 14.

Discover 5 Stocks to Buy As Infrastructure Spending Soars

Trillions of dollars in federal funds have been allocated to repair and upgrade America’s infrastructure. Beyond roads and bridges, this financial influx will also benefit AI data centers, renewable energy projects, and more.

In this report, you’ll uncover 5 surprising stocks that are well-positioned to capitalize on the spending surge that is just beginning.

Download “How to Profit from the Trillion-Dollar Infrastructure Boom” absolutely free today.

Want the latest recommendations from Zacks Investment Research? You can download “5 Stocks Set to Double” free of charge. Click to access this report.

CyberArk Software Ltd. (CYBR): Free Stock Analysis Report

Shopify Inc. (SHOP): Free Stock Analysis Report

Bilibili Inc. Sponsored ADR (BILI): Free Stock Analysis Report

Cloudflare, Inc. (NET): Free Stock Analysis Report

For more insights, visit Zacks.com.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.