Major Upgrades to Cognizant’s Neuro AI Platform Aim to Drive Growth

Cognizant Technology Solutions (CTSH) has unveiled important upgrades to its Cognizant Neuro AI platform. These changes will assist businesses in quickly identifying and developing AI applications designed to enhance decision-making and create new revenue streams.

Research conducted by Cognizant and Oxford Economics reveals that 76% of enterprises intend to utilize AI for revenue growth, yet they encounter obstacles in scaling these efforts.

The revamped platform includes innovative tools like Opportunity Finder and advanced large language models that facilitate data analysis across multiple sectors, including healthcare, finance, and agriculture. This allows businesses to evaluate and respond to various use cases with greater efficiency.

Strengthening Prospects with a Diverse Portfolio

Cognizant’s commitment to improving enterprise decision-making and exploring new opportunities through cutting-edge AI solutions has contributed significantly to its growth trajectory.

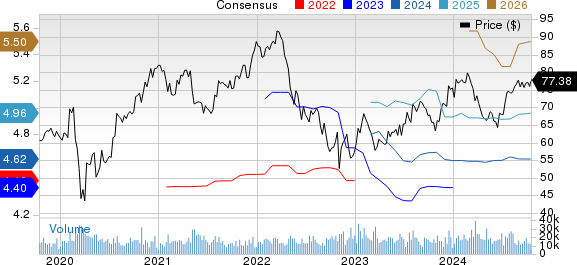

Cognizant Technology Solutions Corporation Price and Consensus

Cognizant’s price and consensus data chart.

The expanded portfolio has been pivotal for growth. In Q2 2024, Cognizant launched Cognizant Neuro Edge, allowing businesses to harness AI and generative AI technologies at the edge. This enhances decision-making and operational stability while lowering data costs and privacy risks.

Cognizant also formed a partnership with Texas Dow Employees Credit Union (“TDECU”) to deploy its AI-driven Neuro IT Operations platform, aiming for improved operational efficiency, resilience, and customer experience during TDECU’s digital transformation.

Growing Client Partnerships Pay Off

Cognizant is bolstered by an expanding client list that features Microsoft (MSFT), Gentherm, Alphabet’s (GOOGL) Google Cloud, and Victory Capital Holdings (VCTR).

In the second quarter of 2024, Cognizant reinforced its momentum by securing robust contracts. It signed five agreements, each valued at $100 million or more. This brings the total to 13 similar deals in the first half of 2024, significantly outpacing 2023 levels.

During the same quarter, Cognizant introduced its first healthcare solutions leveraging large language models on Alphabet’s Google Cloud, targeting costly processes in marketing operations, call centers, and provider management.

The collaboration with Microsoft to utilize generative AI and Copilot has also been significant, focusing on elevating innovation across various industries and enhancing employee experiences.

Additionally, in July, CTSH formed a five-year strategic agreement with Victory Capital Holdings to bolster IT infrastructure, security, and data analytics for its digital transformation journey.

Challenges Loom for Cognizant’s Q3 Outlook

While Cognizant’s diverse portfolio and partner expansion suggest a positive long-term growth outlook, the company anticipates that a challenging macroeconomic environment will impact spending within its Financial Services segment.

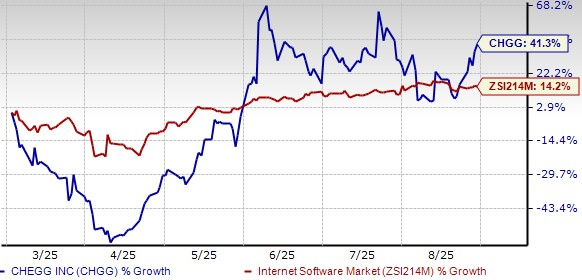

As of this year, CTSH shares have increased by 2.5%, compared to the broader Zacks Computer & Technology sector, which has returned 26.9%.

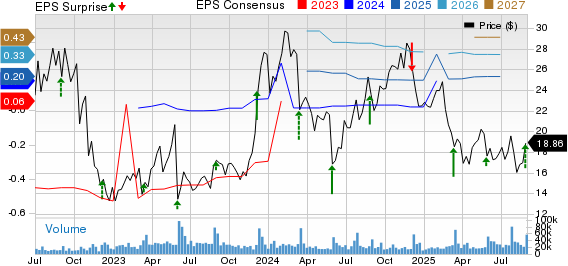

Cognizant expects revenues for Q3 2024 to range between $4.89 billion and $4.96 billion, reflecting a potential decline of 0.2% to an increase of 1.3%. This translates to a 1.5% increase on a constant currency basis. The Zacks Consensus Estimate for Q3 revenues stands at $5 billion, marking a year-over-year growth of 2.17%.

The consensus earnings estimate is $1.15 per share, unchanged in the last month, signaling a nearly 1% year-over-year decline.

Conclusion

Cognizant shares appear undervalued, reflected by a Value Score of B.

The Price/Sales ratio for CTSH is currently at 2, notably lower than the industry average of 11.80.

However, given the uncertain outlook, CTSH presents a higher risk for growth-focused investors, indicated by a Growth Score of F.

Currently, Cognizant holds a Zacks Rank #3 (Hold), suggesting it may be prudent to wait for a more advantageous entry point. For a complete list of today’s Zacks #1 Rank (Strong Buy) stocks, click here.

Top Semiconductor Stock Revealed by Zacks

Though only 1/9,000th the size of NVIDIA, which has surged over +800% since our recommendation, the new leading chip stock presents significant growth potential.

Given its robust earnings growth and increasing customer base, this stock is well-positioned to tap into the soaring demand for Artificial Intelligence, Machine Learning, and the Internet of Things. Global semiconductor manufacturing is anticipated to expand from $452 billion in 2021 to $803 billion by 2028.

see this stock for free >>

Want the latest recommendations from Zacks Investment Research? Click to download 5 Stocks Set to Double for this free report.

Microsoft Corporation (MSFT): Free Stock Analysis Report

Cognizant Technology Solutions Corporation (CTSH): Free Stock Analysis Report

Alphabet Inc. (GOOGL): Free Stock Analysis Report

Victory Capital Holdings, Inc. (VCTR): Free Stock Analysis Report

To read this article on Zacks.com, click here.

Zacks Investment Research

The views and opinions expressed herein are those of the author and do not necessarily reflect those of Nasdaq, Inc.