First Solar’s Stock: Is a Rebound on the Horizon?

First Solar FSLR surged up to 6% on Monday but remains 37% below its 52-week peak of over $300 reached last June.

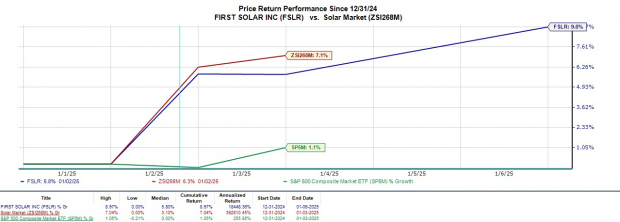

In January alone, shares of the leading solar energy company in the U.S. have climbed by 9%. Investors are now curious whether a prolonged recovery for FSLR is possible.

Image Source: Zacks Investment Research

Investor Sentiment Wanes

Despite being a major player in the solar panel sector, First Solar’s market sentiment has declined following missed Q3 expectations released in October.

In the third quarter, sales reached $887.67 million, a 10% increase year-over-year, but fell short of the forecast of $1.06 billion. Though Q3 earnings per share (EPS) of $2.91 improved by 16%, they did not meet the anticipated $3.10.

Image Source: Zacks Investment Research

Looking ahead, First Solar’s Q4 results, due on February 25, will be pivotal for restoring confidence among investors. Zacks estimates suggest Q4 sales could rise by 27% to $1.47 billion, with EPS potentially climbing 47% to $4.77.

However, the Zacks Expected Surprise Prediction (ESP) indicates the company might once again fall short, with the Most Accurate Estimate for Q4 earnings at $4.57, which is 4% below the Zacks Consensus.

Image Source: Zacks Investment Research

Assessing First Solar’s Growth Potential

First Solar stands out among its competitors, including domestic rival Sunrun RUN, thanks to its impressive growth prospects.

Projected annual earnings for First Solar are expected to surge 69% in fiscal 2024 to $13.13 per share, compared to $7.74 in 2023. Further, FY25 EPS could see an additional 54% rise to $20.14 based on Zacks forecasts.

Sales growth is also projected to remain robust, with expectations of exceeding $5 billion in FY24 and FY25.

Image Source: Zacks Investment Research

Evaluating First Solar’s Valuation

Currently, First Solar trades at a forward earnings multiple of 9.2X, which is considerably lower than the S&P 500’s 22.2X and below the Zacks Solar Industry average of 15.2X, hinting that there may still be potential for a stock rebound.

Image Source: Zacks Investment Research

The Final Takeaway

At present, First Solar holds a Zacks Rank of #3 (Hold). While more attractive buying opportunities may exist, long-term investors might benefit from the average Zacks Price Target of $275.43 per share, indicating a 48% upside from current valuations.

Research Chief Highlights “Top Pick with Doubling Potential”

Out of numerous stocks, five Zacks experts have identified their most promising candidate poised for over 100% growth in the coming months. Among those, Director of Research Sheraz Mian has singled out one with exceptional potential.

This particular firm targets millennial and Gen Z markets, amassing nearly $1 billion in revenue last quarter. The recent decline in stock price signals an opportune moment for investors to consider.

Although not every stock recommendation succeeds, this one could outperform past Zacks selections like Nano-X Imaging, which gained 129.6% in just over nine months.

Free: Discover Our Top Stock and Four Additional Picks

Download the Latest Zacks Recommendations: 5 Stocks Set to Double

First Solar, Inc. (FSLR) : Free Stock Analysis Report

Sunrun Inc. (RUN) : Free Stock Analysis Report

Read the full article on Zacks.com

The views and opinions expressed herein are those of the author and do not reflect those of Nasdaq, Inc.