GE Aerospace Set to Report Q3 Earnings: What to Expect

On October 22, before the market opens, GE Aerospace GE will reveal its earnings for the third quarter of 2024. Analysts anticipate a mixed bag of results based on recent trends.

Possible Influences on GE’s Quarterly Results

During the third quarter, GE Aerospace likely saw benefits from a growing number of engines already in use and increased demand across both commercial and defense sectors. The continuing rise in air travel and activities related to fleet upgrades are expected to have bolstered sales of popular engines like LEAP, GEnx, and GE9X.

The company’s propulsion technologies, critical aircraft systems, and aftermarket services are also likely to have played a role, especially as defense budgets rise in the U.S. and abroad. This demand, alongside positive trends in commercial air travel, is expected to enhance GE’s overall performance.

Further supporting its operations, GE has been investing in upgrading its manufacturing facilities both domestically and internationally. Such efforts are likely intended to meet the increased demand from its customers. These strategic decisions, combined with a strong backlog of orders and a focus on generating healthy free cash flow, could provide a beneficial impact on the company’s performance.

GE Aerospace has also been restructuring its portfolio by divesting non-profitable segments to provide greater value to shareholders. In April 2024, the company completed the spin-off of its Vernova business, marking the end of a multi-year restructuring initiative. While this move may impact year-over-year comparisons negatively, it is expected to improve operational focus and financial flexibility within the aerospace division, potentially leading to higher margins in the third quarter.

Despite these positives, challenges remain. High operational costs linked to restructuring and supply-chain disruptions have created hurdles for GE Aerospace. Issues like raw material scarcity and labor shortages in the aerospace and defense sectors may have delayed product deliveries.

The company also faces currency exchange risks due to its global operations, and a stronger U.S. dollar may further add pressure on its international business.

The current Zacks Consensus Estimate suggests that GE’s total revenue for the third quarter will reach $8.97 billion, reflecting a significant decline of 45.7% from the previous year. However, analysts forecast earnings per share at $1.13, which represents an increase of 37.8% from last year’s figures.

Predictions for Earnings Performance

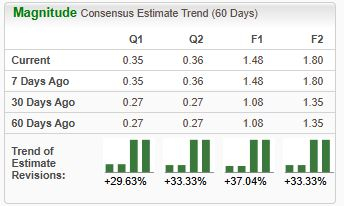

According to our model, there are strong indicators that GE Aerospace will surpass earnings expectations this quarter. A positive Earnings ESP, combined with a Zacks Rank of #1 (Strong Buy), #2 (Buy), or #3 (Hold), enhances the chances of a positive outcome, which is seen in this case.

Earnings ESP: GE Aerospace has an Earnings ESP of +0.57% as the Most Accurate Estimate stands at $1.14 per share, above the Zacks Consensus Estimate of $1.13.

Zacks Rank: Currently, GE holds a Zacks Rank of 3.

Other Market Players to Watch

Several other companies within the aerospace sector are anticipated to perform well this earnings season based on our analysis.

3M Company MMM has an Earnings ESP of +1.81% and currently holds a Zacks Rank of 3. The company is set to release its third-quarter 2024 results on October 22, and it has consistently exceeded earnings expectations in the previous four quarters, boasting an average surprise of 12.6%.

Parker-Hannifin Corporation PH enjoys an Earnings ESP of +2.06% and carries a Zacks Rank of 2. Scheduled for its first-quarter fiscal 2025 earnings announcement on November 7, Parker-Hannifin has achieved earnings surprises in all their last four quarters, averaging an 11.2% surprise.

RBC Bearings RBC boasts an Earnings ESP of +9.57% and has a Zacks Rank of 3. They will report their second-quarter fiscal 2025 earnings on November 1, having beat earnings expectations three times out of the last four quarters, with an average surprise of 4.8%.

Click here to read this article on Zacks.com.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.