Halliburton’s Shares Decline Amid Challenging Market Conditions

With a market cap of $16.6 billion, Halliburton Company (HAL) offers products and services to the global energy sector. Founded in 1919 and based in Houston, Texas, the company operates in two segments: Completion and Production and Drilling and Evaluation.

Recent Performance Overview

Over the past year, Halliburton’s stock has underperformed compared to the broader market. HAL shares have declined 45.4% in the last 52 weeks and 25.6% year-to-date. This contrasts with the S&P 500 Index ($SPX), which has returned 9.2% over the past year but has fallen by 3.7% in 2025.

Focusing further, HAL has also lagged behind the iShares U.S. Oil Equipment & Services ETF (IEZ), which saw a 27.6% decline over the same period and a 17.2% drop this year.

Quarterly Earnings Impact

After the release of its Q1 earnings on April 22, HAL shares fell 5.6%. The company reported revenue of $5.4 billion, which represents a 6.9% year-over-year decline and did not meet Wall Street estimates. Adjusted earnings per share (EPS) decreased by 21.1% year-over-year to $0.60, although it matched consensus estimates.

Future Projections

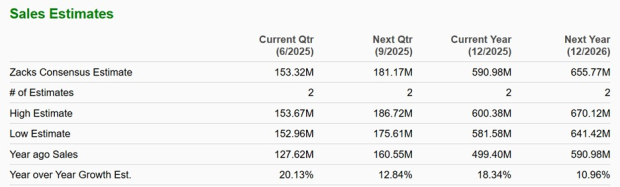

Looking ahead to 2025, analysts forecast an 18.4% year-over-year decline in HAL’s EPS, projecting it to reach $2.44. Notably, the company has exceeded analysts’ consensus estimates in three of the last four quarters, missing only once.

Analyst Recommendations

Among the 25 analysts covering Halliburton stock, the consensus rating is a “Moderate Buy.” This is based on 16 “Strong Buy” ratings, one “Moderate Buy,” and eight “Holds.” The configuration of ratings has remained stable in recent months.

Price Target Adjustments

On May 2, Neil Mehta from Goldman Sachs Group, Inc. (GS) adjusted Halliburton’s price target from $27 to $24 while maintaining a “Buy” rating. The mean price target among analysts is $30.06, suggesting a 48.5% premium from current market prices. The highest target sits at $45, which indicates a potential upside of 122.3% from current levels.

On the date of publication, Kritika Sarmah did not hold positions, either directly or indirectly, in any of the securities mentioned. All information is solely for informational purposes. For more details, see the Barchart Disclosure Policy here.

The views expressed in this article are those of the author and do not necessarily reflect those of Nasdaq, Inc.