Amazon Web Services (AWS) reported a revenue of $33 billion for Q3 2023, marking a year-over-year growth of 20.2%, the highest rate in 11 quarters. This performance reflects a robust demand, according to CEO Andy Jassy. AWS generated $11.4 billion in operating income, demonstrating continued profitability. Amazon’s forecast for Q4 projects total revenues between $206 billion and $213 billion, with an expected operating income of $21 billion to $26 billion.

The company has invested $34.2 billion in capital expenditures during Q3, totaling $89.9 billion this year, with expectations to reach $125 billion by year-end 2025. Amazon’s cloud backlog has reached $200 billion, indicating strong demand amidst ongoing enterprise shifts to AI and cloud infrastructure.

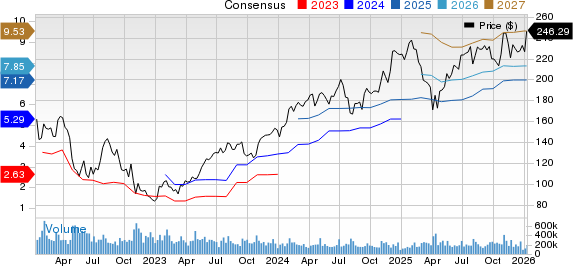

Despite facing competition—Google Cloud growing at 34% and Microsoft Azure at 40%—AWS remains the market leader, significantly surpassing both in revenue. With a P/E ratio of 31.21, Amazon’s stock could present a compelling investment opportunity as the company positions itself for continued growth into 2026.