“`html

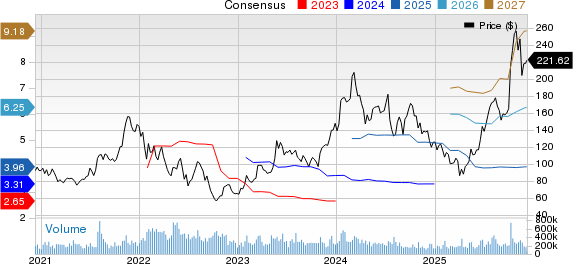

Advanced Micro Devices (AMD) has seen its shares increase by 70.3% over the past year, significantly outpacing the Zacks Computer and Technology sector’s 24.7% return. This growth is driven by strong demand for AMD’s EPYC processors and Instinct MI350 and MI300 series GPUs. AMD anticipates Data Center revenues to grow by double digits year-over-year and sequentially in Q4 2025, with total revenues expected to reach approximately $9.6 billion (+/- $300 million), marking a year-over-year growth of about 25%.

Looking ahead, AMD’s total addressable market for data centers is projected to reach $1 trillion by 2030, with an expected compound annual growth rate (CAGR) exceeding 40% from an estimated $200 billion in 2025. Additionally, AI revenues in the data center sector may see a CAGR of over 80% in the next 3-5 years, benefiting from the growing demand for their GPUs and expanding customer base.

Despite this promising outlook, AMD faces intense competition from NVIDIA, Broadcom, and Intel in the data center and AI chip markets, which poses challenges for maintaining its impressive growth trajectory.

“`